LISTEN TO THIS ARTICLE

The Federal Tax Authority (FTA) recently hosted a workshop to clarify how Corporate Tax applies to different types of real estate income. Here's a concise breakdown of the key takeaways:

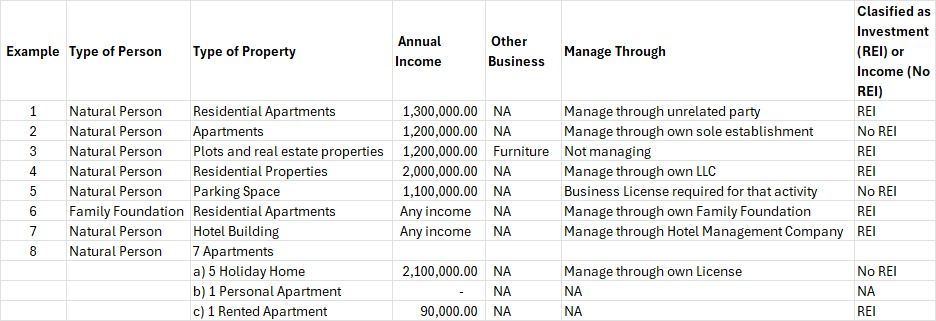

1. The FTA emphasized the importance of classifying properties based on income types, especially distinguishing between properties managed by companies and those managed independently.

2. Properties managed through legal companies typically fall under the category of investment income (REI), whereas properties managed independently i.e. sole establishment may have different income classifications, including rental income and subject to Corporate Tax.

3. It was underscored that obtaining licenses for property-related activities is essential. Non-compliance with licensing requirements may have implications, and businesses should ensure adherence to regulations.

4. Importantly, even if licenses are not obtained, the income generated should still be considered for Corporate Tax (CT) purposes. Businesses need to carefully evaluate their income sources to ensure compliance with tax laws.

Understanding these clarifications is vital for businesses to effectively manage their properties and ensure compliance with tax regulations.

𝐒𝐮𝐦𝐦𝐚𝐫𝐲 𝐨𝐟 𝐞𝐱𝐚𝐦𝐩𝐥𝐞𝐬 𝐠𝐢𝐯𝐞𝐧 𝐛𝐲 𝐅𝐓𝐀

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

@@PLUGINFILE@@/Efficient%20Business%20Transitions%20FTAs%20New%20Rules%20for%20Changing%20Enti...

Read More

In a significant development aimed at streamlining tax compliance, the Ministry of Finance in the Un...

Read More

@@PLUGINFILE@@/FTA%20Introduces%20Backdated%20Exceptions%20Empowering%20Businesses%20with%20En...

Read More