LISTEN TO THIS ARTICLE

Fully depreciated fixed assets that are still in use indicate a potential oversight in reviewing their useful life, leading to accounting errors. According to IFRS (IAS 16), it's mandatory to review the useful life, residual value, and depreciation method of asset items at least at each financial year-end. IFRS for SMEs (Section 17) stipulates such a review when there are indications that the residual value or useful life of tangible assets has changed.

Understanding Useful Life

The useful life of an asset is defined as:

- The period over which an asset is expected to be available for use by an entity, or

- The number of production or similar units expected to be obtained from the asset by an entity.

It is crucial to differentiate between the useful life and the economic life of an asset. For instance, while a motor vehicle may have an economic life exceeding ten years, a company may choose to replace it every three years, making its useful life three years for accounting purposes.

Nil Value Assets

Nil value assets are fully depreciated assets with a carrying amount of zero but are still in use. This typically happens when:

- The annual review of useful life as per IAS 16 was not performed, or the indicators requiring such a review per IFRS for SMEs were not identified.

- Changes in assumptions or circumstances occurred, affecting the initially estimated useful life.

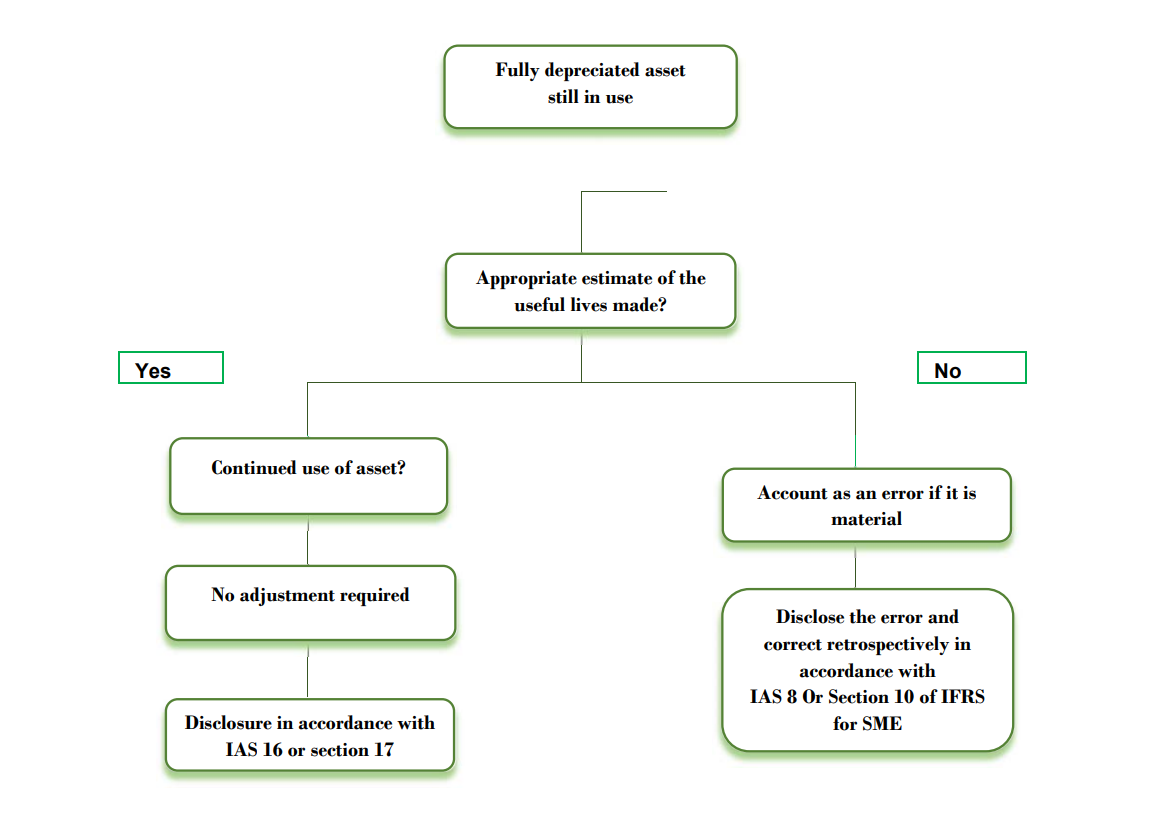

Actions for Fully Depreciated Assets in Use

When fully depreciated assets continue to be used, the approach depends on the reason behind this situation:

1. Regular Review Conducted: If the entity has regularly reviewed useful lives but decided to extend usage beyond the estimated useful life in the current period, no further action is needed. These assets should remain at nil value. However, if this is a common occurrence, it indicates an error in the useful life estimation. Management should ensure regular reviews to avoid such situations in the future.

2. Inadequate Review: If the entity did not appropriately review the useful life as required and the asset is fully depreciated but still in use, this constitutes a prior period error. This error should be corrected and disclosed according to IAS 8 (IFRS) or Section 10 (IFRS for SMEs).

Key Takeaway: Regularly reviewing and updating the useful life of assets is essential to comply with IFRS standards and prevent accounting errors. Fully depreciated assets in use should prompt a review of the estimation processes to ensure accuracy and compliance in future periods. By following these guidelines, companies can ensure proper asset management and adherence to IFRS requirements, maintaining accurate financial records and avoiding potential errors.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

The UAE’s tax and reporting environment is evolving rapidly, especially with the introduction of C...

Read More

Businesses often receive supplier rebates, discounts, or commercial incentives when purchasing fix...

Read More

When a business applies for a VAT refund, most of the focus is usually placed on internal compliance...

Read More