LISTEN TO THIS ARTICLE

Global leaders have long discussed taxing high-revenue multinationals. Many countries offer tax exemptions to attract investments, leading to profit shifting and erosion of base income among large groups. To address this, the OECD/G20 Inclusive Framework (IF) on Base Erosion and Profit Shifting (BEPS) released the Pillar Two Model Rules on December 20, 2021. They are also called Anti Global Base Erosion or in short, “GloBE” Rules.

Is it Mandatory for All and What is the Tax Impact?

These rules apply to multinationals with consolidated revenue of EUR 750 million or more in at least two of the four preceding fiscal years. Excluded entities include government bodies, international organizations, non-profits, pension funds, and investment/real estate funds that are the ultimate parent of the MNE group. International shipping income is also excluded.

Affected groups will face a minimum 15% tax on their income at the jurisdiction level.

What’s the Mechanism?

In case where jurisdictional effective rate of tax of an MNE falls below 15%, the difference will be charged as “Top-up Tax”. Calculation of this tax liability is slightly complex and involves multiple steps.

1. Identify location of each constituent entity on a jurisdictional basis.

MNEs must identify Constituent Entities (CE) in each jurisdiction based on tax residency or incorporation. Special rules apply to tax-transparent entities and permanent establishments.

2. Calculate GloBE Income for each Constituent Entity

GloBE Income starts with financial accounting income/loss, adjusted for book-to-tax differences, such as excluded dividends, disallowed expenses, and asymmetric FOREX gains/losses.

3. Calculate Adjusted Covered Taxes

Start with current tax expense in the accounts, adjusted for tax credits, deferred taxes, uncertain tax positions, and post-filing adjustments.

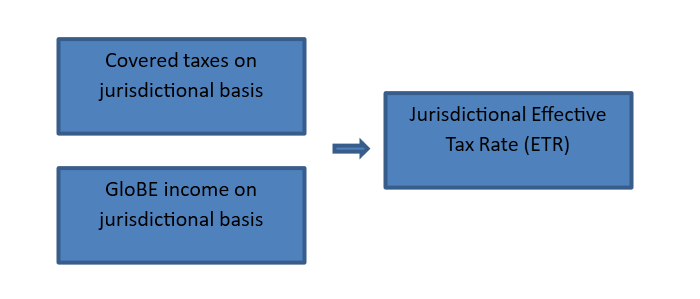

4. Calculate Effective Tax Rate and Top-up Tax

Effective tax rate will be calculated at jurisdiction level using the following formula:

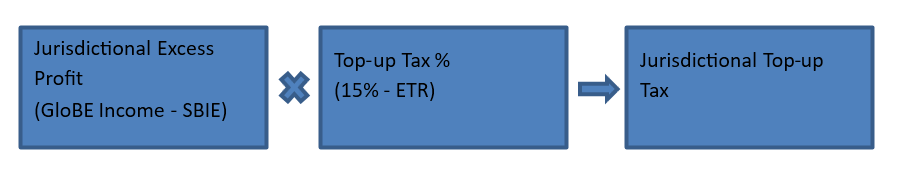

The Top-up Tax rate is the 15% minimum minus the Jurisdictional ETR. This differential rate will then be applied to jurisdictional Excess Profits determined by reducing Substance Based Income Exclusion (SBIE) from the GloBE income.

SBIE is calculated as a percentage of carrying value of tangible assets and payroll costs. These percentages are set at:

- 10% for payroll and

- 8% for tangible assets, but will reduce to 5% for both over 10 year transition period.

This allowance is towards tangible return on income which is in the normal course of business, as it is relatively fixed and less prone to distortions.

5. Impose Top-up Tax under charging mechanisms

Top-up Tax is charged primarily under the Income Inclusion Rule (IIR), and as a backstop, the Undertaxed Profits Rule (UTPR).

Application of IIR will see a top-down approach, with the Top-up Tax being charged to Ultimate Parent Entity (UPE) assuming it falls under an IIR jurisdiction. If UPE does not fall under IIR, Top-up Tax will be imposed on the next intermediate parent entity which is subject to IIR. The share of parent in Top-up Tax will be determined by its share of profit in the low-taxed entity.

Where several parent entities are liable under IIR, the parent that is higher in the chain will reduce its Top-up Tax by amounts payable by parents that are lower in the chain.

Under Taxed Payment Rules (UTPR) applies if IIR is insufficient, disallowing corporate deductions or introducing a new charge.

Some jurisdictions might impose their own Domestic Minimum Top-up Tax (QDMTT) to protect their tax revenue. Such QDMTT will reduce the Top-up Tax under GloBE rules.

Are There Any Relaxations?

To reduce administrative burden, certain relaxations are in place:

- De Minimis Exclusion: Jurisdictions with average GloBE revenue under EUR 10 million or average GloBE Income/Loss below EUR 1 million over three years are excluded.

- Simplified ETR: If an MNE’s ETR is ≥ 15% (16% for 2025, 17% for 2026), Top-up Tax is zero.

- Routine profits test: No Top-up Tax if an MNE’s profit before tax is ≤ SBIE for that jurisdiction.

- Safe Harbors: Reduce compliance for MNEs likely to pay > 15% tax.

What is Impact in the UAE?

Currently, GloBE rules are not applicable in the UAE, but are expected to be implemented in the coming years. The UAE Ministry of Finance issued a public consultation in March 2024 on potential Pillar 2 Framework, indicating its commitment to Pillar 2 regime.

With UAE’s corporate tax rate of 9%, many MNEs with presence in the UAE may be liable for Top-up Tax once these rules are implemented. MNEs will need to adjust their accounting and tax systems to ensure compliance with GloBE requirements and plan for complex Pillar 2 calculations.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Related Articles

UAE’s Domestic Minimum Top-up Tax (DMTT): Addressing Key FAQs

Why Saudi Arabia Has Yet to Commit to Pillar 2 Rules

Qatar’s Implementation of Pillar 2 Global Minimum Tax

Oman Introduces the Supplementary Tax Law Implementing Pillar Two

Exploring the Fate of Pillar 2 in the Gulf

Contributor

Related Posts

Qatar, 05 January, 2026: The General Tax Authority (GTA) has announced that the tax return f...

Read More

Bahrain, 05 January, 2026: Bahrain’s government has unveiled a comprehensive fiscal reform ...

Read More

Oman, 05 January, 2026: The Tax Authority has announced the postponement of the Digital Tax Sta...

Read More