LISTEN TO THIS ARTICLE

Facts - A company registered in a qualified Free Zone (“Original Seller) sold its goods to another company located in another Qualified Free Zone (“Reseller”). The latter company then resold the goods to a third party located in non-qualified free zone (“Ultimate Buyer”).

The question = Does the original sale qualify for the 0% Corporate Tax rate?

Summary

After analysis below, we conclude:

1) We believe that a 0% Corporate Tax rate can be applied to original sale.

2) The FTA may disagree. The risk is higher in scenarios where the goods shipped by the Original Seller to the Ultimate Buyer.

3) To mitigate this risk, we recommend:

- including special warranty provisions into the contract of original sale, and

- obtaining explicit clarification from the FTA.

The analysis

1. Article 3(1)(a) of the Cabinet Decision No. 100 of 25 October 2023 qualifies for the 0% Corporate Tax rate ‘income derived from transactions with a Free Zone Person, except for income derived from Excluded Activities’.

2. Article 3(2) of this Decision specifies that ‘income will be considered as derived from transactions with a Free Zone Person where that Free Zone Person is the Beneficial Recipient of the relevant services or Goods’. Article 3(3) thereof defines the Beneficial Recipient as ‘a Person who has the right to use and enjoy the service or the Good and does not have a contractual or legal obligation to supply such service or Good to another person...’

3. This definition refers to a Person who has obtained the right to use and

enjoy rather than a Person who exercises this right. Therefore, in our

opinion, Beneficial Recipient status should apply equally to the person

who eventually uses and enjoys the goods and the person who obtains

title to the goods and corresponding rights and subsequently disposes of them. Conversely, the Beneficial Recipient status is not obtained if a reseller from the very beginning had no option but to transfer the title to

another person.

4. However, the FTA clarifies: ‘When a Free Zone Person sells services or

Goods to another Free Zone Person, it is required, in order to determine its

own status as a QFZP, to consider if the purchaser is the Beneficial Recipient

of such services or Goods. The seller or service provider may rely on a written statement or undertaking from the purchaser (for example, a contractual

stipulation) confirming that the purchaser is the Beneficial Recipient and will

use the services or Goods for its Free Zone Business, unless the seller has

reason to believe that such representation may be incorrect (for example, because the Goods are to be delivered to a third party)’.1

Moreover, Example 33 in the Guide No. CTGFZP1 resolve a case where

good has been sold to another Free Zone Person and then ‘its outputs

to its Domestic Permanent Establishment’. In this scenario, the Free Zone

parent shall be deemed to be the Beneficial Recipient of the services. It

is remarkable that this Example is illustrated by the output of the goods

passed rather than the goods themselves. Therefore, even if the goods

are shipped from the Original Seller to the Ultimate Buyer but the latter

resells them (rather than their “output”) to a foreign or mainland entity,

the Reseller’s status as the Beneficial Recipient is compromised. At least,

this conclusion could be deduced from the FTA’s example.

5. In our opinion, this conclusion is controversial and should be assessed

with legislation requirements, as follows from the FTA’s description of the

status of the Guide (Sec. 2.6): ‘This guidance is not a legally binding

document, but is intended to provide assistance in understanding the tax

implications of the Corporate Tax regime for Free Zone Persons. The information provided in this guide should not be interpreted as legal or tax

advice. It is not meant to be comprehensive and does not provide a definitive answer in every case. … Each Person’s own specific circumstances

should be considered’.

6. In our view, the subsequent sale to third parties does not automatically mean that a Free Zone buyer (Reseller) ‘has a contractual or legal obligation to supply such service or Good to another person...’.

The UAE legislation does not define this term. However, a technically coincident term is used in the Comments to the OECD Model Convention in relation to the beneficial owner of income.

Paragraph 4.3 of the Commentary to Article 12 of the Model Convention clarifies: ‘In these various examples (agent, nominee, conduit company acting as a fiduciary or administrator), the direct recipient of the royalties is not the “beneficial owner” because that recipient’s right to use and enjoy the royalties is constrained by a contractual or legal obligation to pass on the payment received to another person’. It is easy to see that the bold characteristic completely coincides with the characteristic given in Article 3(3) of Cabinet Decision No. 100/2023: ‘A person who has the right to use and enjoy the service or the Good and does not have a contractual or legal obligation to supply such a service or Good to another person ...’. Therefore, the OECD comments revealing this characteristic are appropriate for applying in relation to the term “beneficial recipient” used by the Cabinet.

The same para in the Comments defines: ‘Such an obligation will normally

derive from relevant legal documents but may also be found to exist on

the basis of facts and circumstances showing that, in substance, the recipient clearly does not have the right to use and enjoy the royalties unconstrained by a contractual or legal obligation to pass on the payment

received to another person. This type of obligation would not include

contractual or legal obligations that are not dependent on the receipt of the payment by the direct recipient such as an obligation

that is not dependent on the receipt of the payment and which

the direct recipient has as a debtor or as a party to financial transactions, or typical distribution obligations of pension schemes and of

collective investment vehicles entitled to treaty benefits under the principles of paragraphs 22 to 48 of the Commentary on Article 1. Where

the recipient of royalties does have the right to use and enjoy the

royalties unconstrained by a contractual or legal obligation to

pass on the payment received to another person, the recipient is

the “beneficial owner” of these royalties.

The teхt in bold underline fits the situation at hand. Being extrapolated to

a transaction with goods, it reads: a contractual or legal obligation to

supply purchased goods to a third party would not include a contractual

or legal obligations that are not dependent on the receipt of the

goods by the direct recipient (the reseller) and which the direct recipient (reseller) has as a debtor or as a party to transactions with the

same goods. Indeed, the Reseller is obligated to supply the goods to the

Ultimate Buyer. However, he is not obligated to supply the goods purchased under specific transaction. Instead, the Reseller can use the

same goods obtained from any other transactions. Therefore, in our view

the Reseller may be treated as a Person who is not bound by an obligation

to supply these particular goods, purchased under this particular transaction, to the third party.

7. Examples given in the cited OECD Comments comprise agent, nominee,

conduit company acting as a fiduciary or administrator. Considering the

above, we believe that the Reseller can be considered as a Beneficial

Recipient of the Goods if:

- 1) it is not an agent of a third party in an acquisition transaction,

- 2) it acquires the goods in its own interest (here – its own interest in earning profits from the resale) rather than in the interests of a third party,

- 3) it has no contractual or other legal obligations to supply these particular goods under this specific purchase to the Ultimate Buyer.

8. To facilitate arguments for the qualification of the income from this contract for the 0% Corporate Tax rate, would be useful to include in the

contract warranties from the Reseller certifying that:

- It is a Free Zone Person.

- It has the rights to use and enjoy the goods acquired under the contract

- It is not bound by a contractual or legal obligation to supply such goods to any other person.

- It acts in its own interest and on its own behalf, and

- Does not act as an agent, nominee, conduit company, fiduciary or administrator of any other person in respect of the goods acquired under the contract.

9. The ‘use and enjoy’ concept applies in the UAE VAT Law. The place of use

and enjoyment predetermines Place of Supply of Telecommunication and

Electronic Services.

2 As per the Law, ‘the actual use and enjoyment of

telecommunications and electronic Services shall be where the Services

were actually used regardless of the place of contract or payment’.

The FTA instructs that ‘in the case of an electronic service which is delivered to a physical place, the place of use and enjoyment of that

service is that physical place. For example, where electronic services

content can be only accessed from a particular physical location, that

location will be the place of use and enjoyment’.3

In our view, these rules don’t hinder from qualifying the reseller as the beneficial recipient of the goods resold. As earlier said, for the purpose of the zero-rating, the Beneficial Recipient is ‘a Person who has the right to use and enjoy the goods’, rather than a person who exercised this right. With the title the reseller receives, he receives the right to use and enjoy the goods along with a right to pass this right to a third party. Unless these rights are not obstructed by the contractual or legal obligation to pass these particular goods to a third party, the reseller ‘has the right to use and enjoy the goods’. The fact that after resale the right will pass to a subsequent buyer, doesn’t diminish the fact, that beneficial recipient of the sale is the reseller. The subsequent byer is the beneficial recipient of the goods for the purpose of the transaction of subsequent sale.

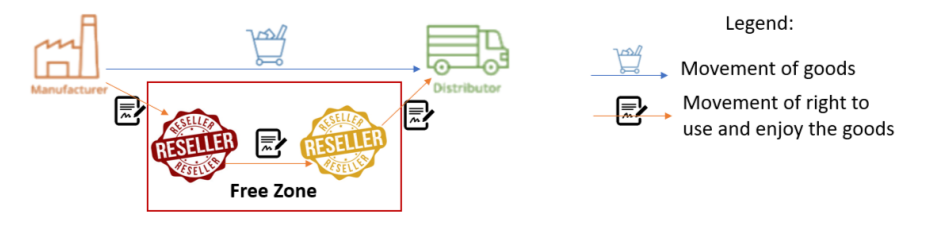

The distinction between the movement of goods and the movement of

rights to use and enjoy them is illustrated in the following figure:

As you may see, in one transaction in the chain, the right to use and enjoy the goods is passed from one Free Zone Person to another. The latter had obligation to sell the similar goods to the distributor but not these specific goods. Only if the second reseller is bound to sell these specific goods, the beneficial recipient of these goods is not the second reseller but the distributor.

The actual place of use and enjoyment is not presented in the figure. It

belongs to the territory where the goods will eventually be consumed.

This place has no relevance to the 0% Corporate Tax rate, as its application is tied up with the location of the beneficial recipient rather than with

the place where the goods are used and enjoyed.

10. Such warranties may mitigate the risk of tax dispute but they do not

eliminate it. To turn the case into risk-free status, it makes sense to obtain a private clarification from the FTA. According to para 8 of the FTA

Private Clarifications Guide TPGPC1: ‘the FTA considers itself administratively bound to follow the position set out in the Clarification

where the factual circumstances are materially the same as set

out in the clarification form. Please note that Clarifications are not

considered to be a decision by the FTA, but rather the FTA’s view on the

application of the applicable legislation based on a specific set of facts.

Consequently, Clarifications are not subject to the dispute resolution process...’.

On 12 of June 2024, the FTA issued Decision No. 4 where it confirmed that ‘the Authority shall be administratively obligated to follow this position in circumstances where such clarification is relied upon and where the factual circumstances are the same as contained in the clarification form provided in the clarification Request’.

Thus, the FTA cannot impose sanctions and collect taxes to taxpayer who obtained the clarification if doing so contradicts the position expressed in the clarification.

1 The Corporate Tax Guide for Free Zone Persons CTGFZP1, Sec. 4.3.1.

2 VAT Law, Art. 31.

3 VAT E-Commerce Guide No. VATGEC1, Sec. 4.2

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice

Contributor

Related Posts

@@PLUGINFILE@@/RD%20Principles%20in%20Identifying%20Core%20Attributes%20in%20Innovation.mp3&nb...

Read More

@@PLUGINFILE@@/Overview%20of%20the%20Corporate%20Tax%20Returns%20Guide%20No.%20CTGTXR1.mp3 ...

Read More

A company established and residing in the UAE (referred to as UAE Co.) is planning to distribute app...

Read More