LISTEN TO THIS ARTICLE

The Gulf Cooperation Council (GCC) countries, which include Saudi Arabia, the United Arab Emirates (UAE), Bahrain, Kuwait, Oman, and Qatar, have increasingly modernized their tax systems over the past decade. One significant reform is the introduction of Value Added Tax (VAT) across several countries, and along with it, the implementation of tax refund schemes, primarily for tourists and businesses. These schemes aim to incentivize travel and investment, as well as ensure compliance with tax regulations.

This article delves into the current tax refund schemes across all GCC countries, focusing on how each country approaches tax refunds for tourists, businesses, and expatriates.

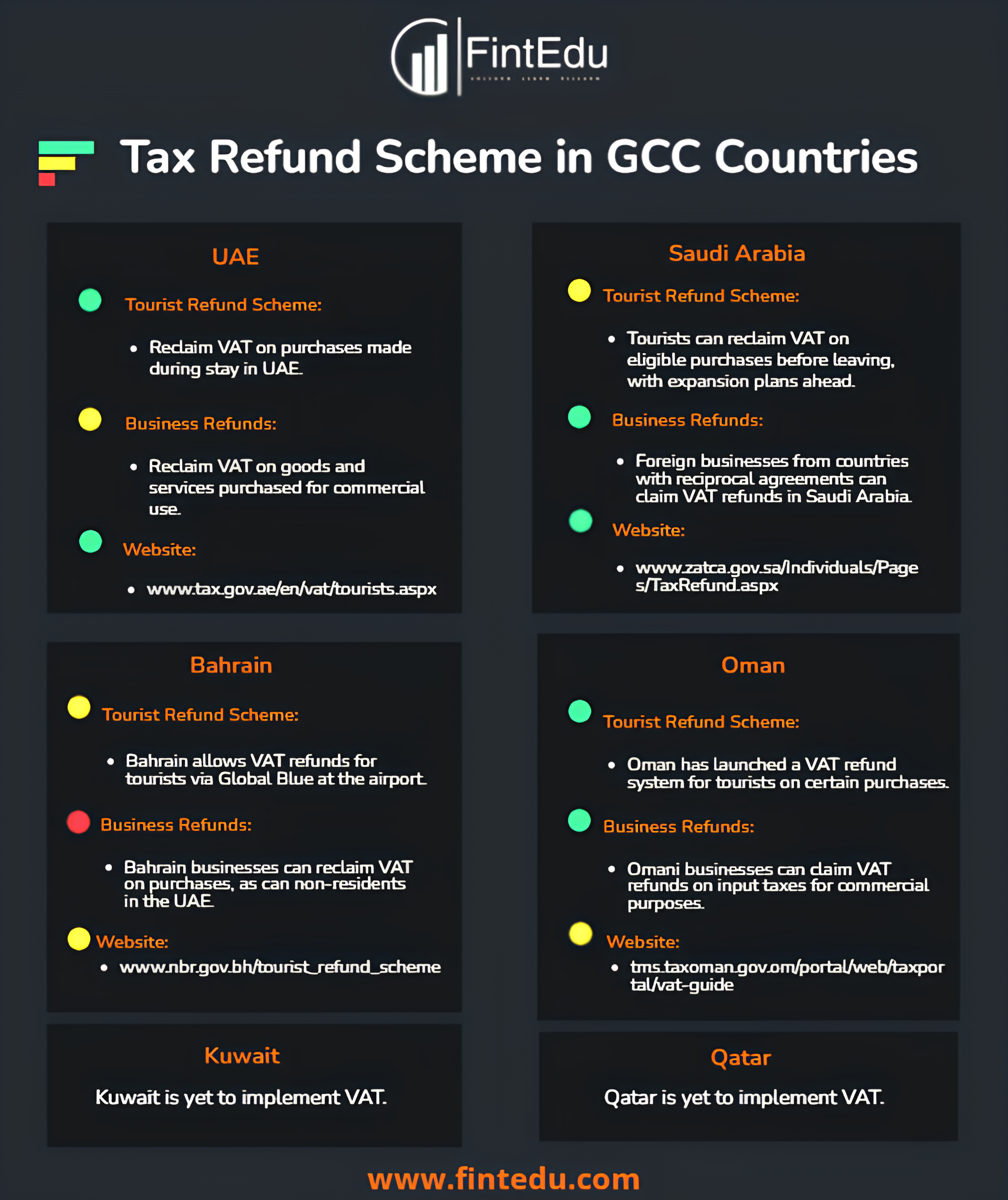

1. United Arab Emirates (UAE)

VAT Introduction: The UAE introduced VAT at a rate of 5% on January 1, 2018, making it one of the first GCC countries to do so.

Tourist Refund Scheme:

- Tourists can reclaim VAT on purchases made during their stay in the UAE.

- The Federal Tax Authority (FTA) has partnered with Global Blue, a tax refund service provider, to facilitate this process.

- Refunds can be processed through kiosks available at major airports, seaports, and border points.

Business Refunds:

- Businesses can reclaim VAT on goods and services they purchase for commercial use.

- Non-resident businesses are also eligible to apply for a VAT refund if they are not registered for VAT in the UAE but have incurred VAT on purchases.

Process for Tourists:

- Tourists need to request a tax invoice from participating retailers.

- The minimum purchase amount to qualify for a refund is AED 250.

- Refunds can be received in cash or credited back to a credit card.

For more detailed information, visit the official Federal Tax Authority (FTA) website.

Direct link : https://www.tax.gov.ae/en/vat/tourists.aspx

2. Saudi Arabia

VAT Introduction: Saudi Arabia implemented a 5% VAT on January 1, 2018, which later increased to 15% in July 2020 in response to economic pressures caused by the COVID-19 pandemic.

Tourist Refund Scheme:

- In Saudi Arabia, tourists can reclaim VAT on eligible purchases before leaving the country. However, the system is still evolving, and tourist tax refunds are expected to expand significantly in the near future.

Business Refunds:

- Foreign businesses from countries that offer reciprocal tax refund arrangements can claim VAT refunds on purchases made in Saudi Arabia.

Process:

- For both businesses and tourists, VAT refund claims must be submitted through the designated online portals or in collaboration with VAT agents.

You can find the full details on the General Authority of Zakat and Tax (GAZT) website.

Direct link : https://www.zatca.gov.sa/en/Individuals/Pages/TaxRefund.aspx

3. Bahrain

VAT Introduction: Bahrain implemented VAT on January 1, 2019, initially at 5%, but this was increased to 10% in January 2022.

Tourist Refund Scheme:

- Bahrain allows tourists to reclaim VAT on eligible purchases made during their stay. The refund can be processed through Global Blue at designated points, such as the Bahrain International Airport.

Business Refunds:

- Businesses are allowed to reclaim VAT on input purchases made within the country. Bahrain’s system mirrors that of the UAE, where non-resident businesses can also apply for VAT refunds on business-related expenses.

Process:

- Tourists must ensure they shop at outlets registered under the VAT refund scheme.

- Refund claims can be made at the airport or seaport when departing.

For more details, visit the National Bureau for Revenue (NBR) website.

Direct link : https://www.nbr.gov.bh/tourist_refund_scheme

4. Oman

VAT Introduction: Oman introduced VAT at a rate of 5% on April 16, 2021, the latest among GCC nations to do so.

Tourist Refund Scheme:

- Oman has recently implemented its VAT refund system for tourists, allowing visitors to reclaim VAT on certain purchases.

- The refund can be claimed at designated airports and border crossings.

Business Refunds:

- Like other GCC countries, businesses in Oman can claim VAT refunds on input taxes incurred for commercial purposes.

Process:

- Eligible retailers provide tax invoices with details of VAT charged.

- Tourists can reclaim their VAT at airport kiosks upon departure.

Visit Oman’s official Tax Authority website for detailed guidance.

Direct link : https://tms.taxoman.gov.om/portal/web/taxportal/vat-guide

5. Kuwait

VAT Status: As of the latest updates, Kuwait has yet to implement VAT, although discussions on the introduction of VAT have been ongoing.

Current Tax Framework:

- Since VAT is not yet in place, there are no tax refund schemes for tourists or businesses in Kuwait.

Future Prospects:

- Kuwait is expected to follow the rest of the GCC in implementing VAT in the near future, likely accompanied by tourist and business refund schemes.

Keep an eye on updates via the Kuwait Ministry of Finance.

6. Qatar

VAT Status: Qatar has delayed the introduction of VAT, but there are ongoing discussions on its potential implementation.

Tourist Refund Scheme:

- Since VAT is not yet implemented, Qatar currently has no VAT refund scheme for tourists.

Business Refunds:

- Similarly, there are no VAT refund mechanisms for businesses until VAT is formally introduced.

Stay informed about Qatar’s VAT developments on the Qatar General Tax Authority (GTA) website.

Conclusion

The tax refund schemes in the GCC have become an essential part of the region's economic strategy, helping to attract tourists and promote a more business-friendly environment. While the UAE, Saudi Arabia, Bahrain, and Oman are fully operational with their VAT systems and refund schemes, Kuwait and Qatar have yet to implement VAT. These tax refund schemes provide significant relief to tourists and non-resident businesses, making the region an attractive hub for both tourism and investment.

For further updates, stay connected with the respective tax authorities of each GCC country to learn about the latest developments in VAT policies and refund systems.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

The UAE’s tax framework is set for further evolution in 2026, with new VAT amendments, excise tax ...

Read More

Accountants in the UAE are deeply involved in the financial lifecycle of businesses. From structurin...

Read MoreRTC Suite offers a comprehensive e-Invoicing solution designed to streamline tax compliance and inv...

Read More