The FTA published comprehensive guide on Taxation of Non-resident Persons under the Corporate Tax Law (CT Law). In this write-up, we have summarised the key provisions and some of its implications for non-residents.

Scope of Taxation

A non-resident person (NR) is subject to tax in the UAE, if:

- NR juridical persons has income is attributable to a permanent establishment (PE) of in the UAE;

- NR natural person conducts business activities in the UAE crossing exceeding turnover of AED 1 million; or

- the source of income is in the UAE (state sourced income).

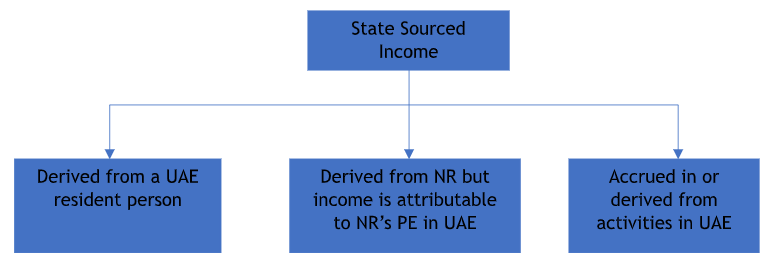

State Sourced Income

Income is said to be state sourced in the following instances:

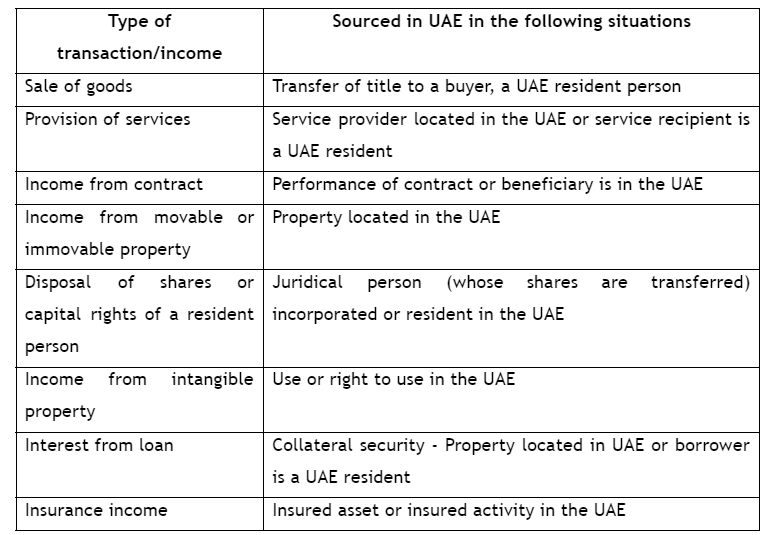

The Guide has provided various examples of state sourced income, tabulated as below

The source of income is distinct from the nature of income which flows to a person. Source is the situs where income originates. It also takes into account where the benefit of transaction lies (e.g. in case of services). The main intention of the CT Law is that if the income of a person, arises or accrues in the UAE or if the benefit is received in UAE, it should be subjected to tax in the UAE. Like many economies of the world, UAE also follows source-based taxation principle for non-residents. It finds support from economic perspective of a country that it seeks share of tax revenue from activity performed in its state. Historically, source-based taxation was practiced in traditional brick and mortar models of business with physical presence in a jurisdiction. However, attributing a source of income qua a specific jurisdiction is posing difficulty in modern day e-commerce transactions and complex transactions involving intellectual property.

Access to Double Tax Avoidance Agreements (DTAA)

The UAE has entered into double taxation agreements with various countries to provide relief to taxpayers from double taxation of same income in two jurisdictions. Non- residents in the UAE can take benefit of such tax treaties if their UAE income is also taxed in the country of their residence.

Withholding Tax

Certain types of UAE sourced income (not attributable to a PE) payable to non-residents may be subject to withholding tax. The current withholding tax rate is 0%.

Tax Registration

The NR juridical person having a PE or nexus in the UAE is required to register for CT. An exception has been provided to NR juridical person, earning only state sourced income and having no PE/nexus in the UAE.

Conclusion

The source-based taxation would necessitate examination by non-residents for business carried on in the UAE or with UAE entities. The double taxation agreements (if accessible) may reduce the net tax impact for non-residents.

Disclaimer: Content posted is for informational & knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

@@PLUGINFILE@@/Tax%20Group%20in%20UAE%20%E2%80%93%20Limitation%20on%20Interest%20Deducti...

Read More

@@PLUGINFILE@@/New%20Pension%20Law%20in%20the%20UAE%20and%20Emiratisation.mp3 LISTEN TO T...

Read More

@@PLUGINFILE@@/Saudi%20Arabia%20%E2%80%93%20Tax%20Measures%20to%20Boost%20Investments%20and%20...

Read More