LISTEN TO THIS ARTICLE

The emergence of cryptocurrencies and blockchain technology has ushered in a new era of financial innovation, presenting unprecedented challenges and opportunities in the realm of international taxation, particularly in transfer pricing. As digital assets permeate the global economy, they're reshaping not just finance, but the very nature of how multinational enterprises (MNEs) structure their operations and manage their resources.

The decentralized nature of cryptocurrencies, combined with their inherent volatility and the rapid pace of innovation in the space, creates a perfect storm for transfer pricing professionals. Traditional models and methodologies, designed for a world of fiat currencies and tangible assets, often fall short when applied to crypto transactions. The arm's length principle, a cornerstone of transfer pricing, takes on new dimensions when dealing with assets that can fluctuate wildly in value over short periods, or with novel concepts like decentralized autonomous organizations (DAOs) that don't fit neatly into existing corporate structures.

In this dynamic environment, transfer pricing for crypto-related transactions becomes not just a compliance exercise, but a strategic imperative. MNEs operating in the crypto space must develop robust yet flexible transfer pricing policies that can adapt to rapid technological changes, regulatory shifts, and market volatility.

Crypto Business Models and Their Transfer Pricing Implications

Understanding key crypto business models is crucial for developing appropriate transfer pricing strategies. Here are some of the most prominent models and their implications:

1. Cryptocurrency Exchanges

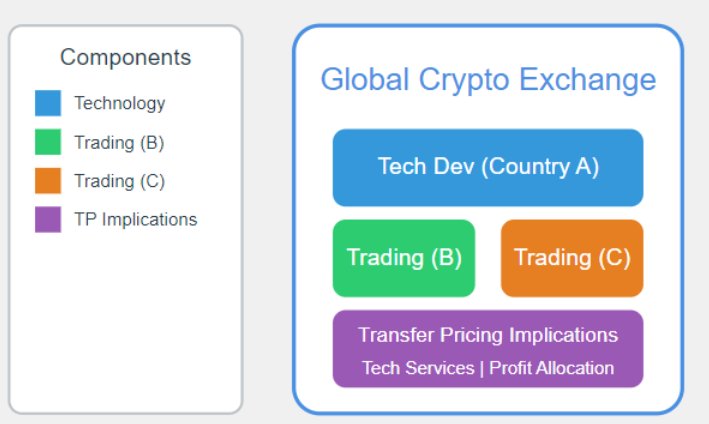

Business Model: Facilitating the trading of cryptocurrencies against fiat or other cryptocurrencies.

TP Implications:

- Pricing of intercompany services for technology platform usage

- Allocation of profits from market making activities across jurisdictions

- Valuation of user data and trading algorithms as intangible assets

Example: A global exchange group might need to determine how to allocate profits between its technology development entity in Country A and its local trading entities in Countries B and C.

2. Mining Operations

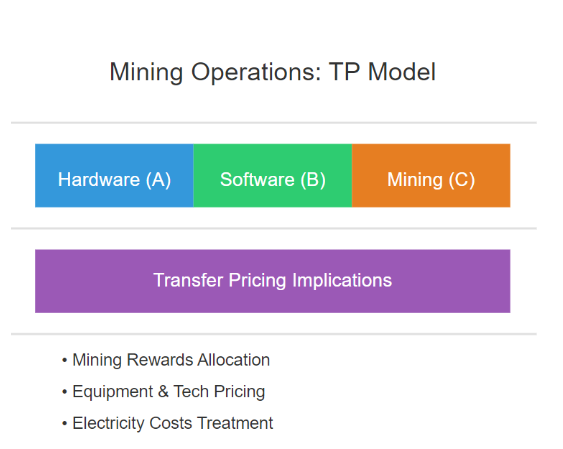

Business Model: Using specialized hardware to validate transactions and secure blockchain networks.

TP Implications:

- Allocation of mining rewards in cross-border mining pools

- Pricing of mining equipment and technology transfers between related entities

- Treatment of electricity costs in jurisdictions with varying energy prices

Example: A mining company with operations in multiple countries needs to determine how to attribute mining rewards when one entity provides the hardware, another the software, and a third the actual mining location and electricity.

3. Decentralized Finance (DeFi) Platforms

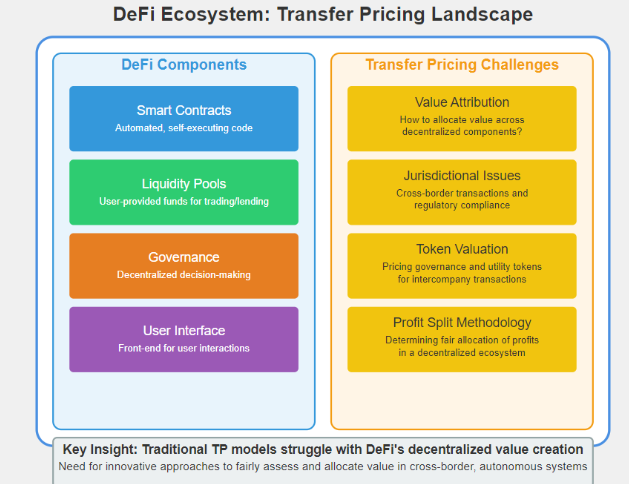

Business Model: Providing financial services like lending and trading without traditional intermediaries.

TP Implications:

- Characterization and pricing of intercompany transactions involving liquidity provision

- Attribution of profits from yield farming across jurisdictions

- Valuation of governance tokens for transfer pricing purposes

Example: A DeFi platform might need to determine how to allocate profits between the entity that developed the smart contracts and the entities providing liquidity or managing user interfaces in different jurisdictions.

This diagram shows how a DeFI platform works without traditional banks, using smart contracts, pooled money, and community governance. The arrows and connections highlight how complex it is to fairly price and tax these new digital financial services across different countries.

4. Non-Fungible Token (NFT) Marketplaces

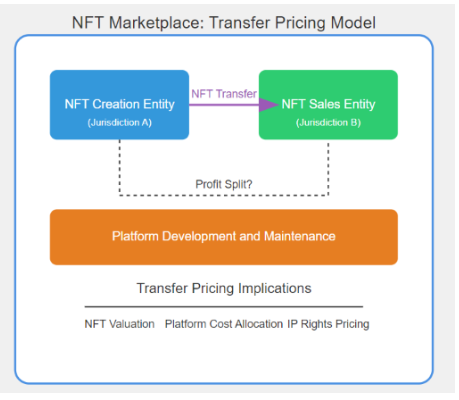

Business Model: Facilitating the creation, sale, and trading of unique digital assets.

TP Implications:

- Valuation of NFTs for intercompany transfers

- Allocation of platform development costs and resulting profits

- Pricing of IP rights for NFT creation between related entities

Example: An NFT marketplace group might need to determine the arm's length price for transferring a collection of valuable NFTs from a creation entity to a sales entity in a different jurisdiction.

Key Transaction Types and Transfer Pricing Considerations

1. Cryptocurrency as an Investment Vehicle

Scenario: A multinational group with a centralized treasury function in Country A decides to allocate a portion of its cash reserves to cryptocurrency investments, managed by its treasury entity.

TP Considerations:

- Functional Analysis: Is the treasury entity acting as an investment manager making strategic decisions, or merely executing trades based on group-level directives?

- Risk Analysis: Who bears the volatility risk associated with cryptocurrency holdings? How is this risk compensated?

- Remuneration Model: Depending on the functional and risk profile, consider cost-plus for low-risk execution services, commission-based structures for more involved management, or profit-split mechanisms for scenarios where multiple entities contribute to investment strategy and bear risks.

Example: Treasury Co in Country A manages a $100 million cryptocurrency portfolio for the group. It employs a team of crypto analysts and uses proprietary trading algorithms. A profit split method might be appropriate, with Treasury Co receiving a share of the gains (or losses) based on its contribution to value creation.

2. Mining Pool Arrangements

Scenario: An MNE sets up mining operations in multiple countries to take advantage of varying electricity costs and regulatory environments. These operations contribute their hash power to a centralized pool managed by a group entity.

TP Considerations:

- Contribution Analysis: Assess the relative contributions of each entity in terms of computational power, electricity costs, and management expertise.

- Profit Attribution: Determine an appropriate mechanism for attributing mining rewards across the contributing entities.

- Comparability Analysis: While traditional comparables may be scarce, principles from other industries involving shared resources (e.g., oil & gas joint ventures) might offer guidance.

Example: Mining Entity A in Country X contributes 30% of the group's total hash power but benefits from significantly lower electricity costs. A profit split method could be employed, with initial allocation based on hash power contribution, followed by adjustments for cost efficiencies and other value drivers.

3. Cryptocurrency as Trading Stock

Scenario: A global financial services group establishes a centralized cryptocurrency trading desk in Country X to manage the group's crypto exposure and provide crypto-fiat exchange services to other group entities.

TP Considerations:

- Functional Analysis: Determine whether the trading desk is operating as a full-fledged trader bearing market risks or as a limited-risk distributor.

- Comparability: Traditional forex or commodities trading operations may provide relevant comparables, adjusted for the unique risks of the crypto market.

- Profit Level Indicators: Consider using return on assets, Berry ratio, or operating margin, depending on the functional profile.

Example: Trading Co in Country X operates as a full-fledged crypto trader, making independent decisions on trading strategies. It charges a spread on all intercompany crypto-fiat exchanges and retains the profit/loss from its trading activities. A Transactional Net Margin Method (TNMM) could be applied, benchmarking Trading Co's return on assets against comparable independent crypto trading firms or adjusted traditional trading operations.

Valuation Challenges and Solutions

The extreme price volatility of cryptocurrencies presents significant challenges in applying traditional transfer pricing methods. To address this:

- Implement real-time pricing mechanisms or agree on specific valuation time points (e.g., daily average prices from multiple exchanges) to mitigate the impact of short-term volatility.

- Develop a classification framework for digital assets based on their economic characteristics, use cases, and risk profiles to facilitate more accurate comparability analyses.

Documentation and Compliance Considerations

The 24/7 nature of cryptocurrency markets necessitates robust real-time data management systems to support transfer pricing positions. Best practices include:

- Implementing blockchain analytics tools that can track and categorize intercompany cryptocurrency transactions in real-time, providing an auditable trail for tax authorities.

- Ensuring that transfer pricing documentation includes detailed explanations of relevant smart contract logic, potentially including code audits to demonstrate the arm's length nature of automated transactions.

Conclusion

The transfer pricing implications of cryptocurrency extend far beyond basic investment scenarios. Whether treated as trading stock, held as assets, or involved in complex mining operations, cryptocurrencies present unique challenges that require careful analysis and innovative approaches. MNEs must be prepared to justify their transfer pricing positions related to crypto losses, intangible valuations, and rapidly evolving business models.

As the regulatory landscape continues to develop, maintaining flexible yet robust transfer pricing policies will be crucial for navigating this dynamic space. By leveraging technological solutions, embracing new valuation methodologies, and maintaining comprehensive documentation, businesses can navigate the complex intersection of cryptocurrency and transfer pricing with confidence.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

@@PLUGINFILE@@/Bahrains%20Domestic%20Minimum%20Top-up%20Tax%20%28DMTT%29%20Regulations%20An%20overvi...

Read More

@@PLUGINFILE@@/Navigating%20the%20Complex%20Web%20of%20Transfer%20Pricing%2C%20Customs%20%20VA...

Read More