LISTEN TO THE ARTICLE

The Federal Tax Authority (FTA) recently published guide on Taxation of Natural Persons under the UAE Corporate Tax Law marks a significant development for individuals conducting business in the region. While the basic framework may seem straightforward, navigating the nuanced details can be challenging. This article dives deeper into the technical aspects of the law, providing crucial insights for natural persons seeking clarity on their tax obligations.

Applicability

The UAE Corporate Tax (CT) Law applies to natural persons (living human) only if they are engaged in business activity (series of transactions or activities in the course of business (conducted regularly on ongoing basis)) in the UAE or have a permanent establishment (PE) in the UAE or derive income that accrues or arises in the UAE (state sourced income).

Exclusions

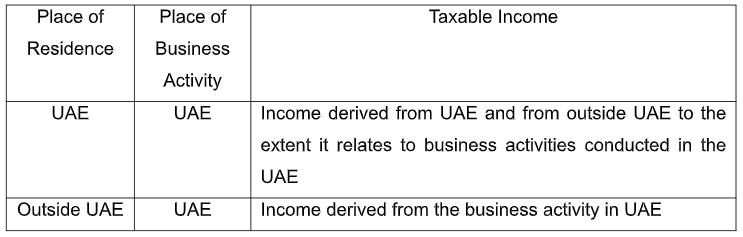

Wages (employment income), personal investment income (Where investment or real estate activity does not require a license from authority ) and real estate investment income are not considered for levy of CT. Interplay of residential status and scope of taxable income Unlike other jurisdictions, physical presence in the UAE is not determinative of residential status for the purposes of UAE tax law. If a natural person conducts business activity in the UAE, he is considered to be a resident, irrespective of whether he resides in UAE or not.

The following table summarises the scope of taxable income of a natural person:

Nexus with UAE

Since only the income that relates to business activities in the UAE is subject to CT, it is critical to determine the nexus of business activities with the UAE. The Guide lays emphasis on the following elements to determine such nexus –

- Persons contributing to producing/selling goods or services are working from or are managed from the UAE;

- Contracting or business development activities for sale of goods/services are performed in the UAE;

- Assets contributing to production/sale of goods are located in the UAE.

Determining nexus, i.e., whether the business activity is conducted in the UAE, is often a factual exercise. It becomes all the more challenging for businesses engaged in online/digital activity or where key managerial personnel work from different countries. For instance, the Guide specifically provides that “Creation, sale, lease and management of electronic platforms, websites, smart applications, data, artificial intelligence and other digital transformation works” is considered as business activity if it is carried out as an occupation. However, establishing the situs or nexus of a digital activity to a particular geography is often debatable.

State sourced income

The state sourced income is defined as income:

- derived from a UAE resident person;

- derived from a UAE PE; or

- accrued in or derived from activities performed, assets located, capital invested,

rights used or services performed or benefitted from UAE.

Certain state sourced income may be subject to withholding tax (WHT) at 0%, while the rest may be subject to CT at the tax rates discussed below.

Taxation

Where the turnover from business activities in the UAE exceeds AED 1 million within a calendar year, the income from such business activities is subject to CT as follows:

- Where taxable income is up to AED 375,000 – 0%; and

- Where taxable income exceeds AED 375,000 – 9%.

For calculating turnover, gross income from all categories of business activities conducted by such natural person, whether as sole proprietorship or share of income from partnership, are combined.

Small Business Relief

To support the small businesses, a relief is accorded where revenue from business activity in relevant tax period and previous tax periods is less than AED 3 million per tax period. Natural persons who elect for this relief do not pay any CT if all conditions are met.

Conclusion

The UAE CT Law provides quite a few benefits to natural persons, viz. basic revenue and income thresholds, small business relief as well tax treaty benefits. It is imperative, especially for individuals who are not residents in the UAE but have business presence therein, to examine whether they are covered within the ambit of CT Law and the benefits they are entitled to.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

@@PLUGINFILE@@/Tax%20Group%20in%20UAE%20%E2%80%93%20Limitation%20on%20Interest%20Deducti...

Read More

@@PLUGINFILE@@/New%20Pension%20Law%20in%20the%20UAE%20and%20Emiratisation.mp3 LISTEN TO T...

Read More

@@PLUGINFILE@@/Saudi%20Arabia%20%E2%80%93%20Tax%20Measures%20to%20Boost%20Investments%20and%20...

Read More