LISTEN TO THE ARTICLE

The facts

Case No. 1: one small but proud tax consulting company in Dubai has been retained by the UK Law Firm Company to work on an international project. The UK Law Firm doesn’t have a client in the UAE. The services include day-to-day all-out support of the project to the extent of the UAE tax issues that have arisen. It includes advising in conference calls and in emails, as well as drafting the relevant part of a consolidated report.

The services are physically performed in the UAE.

The period of the services agreed is:

Variant 1 – 3 weeks,

Variant 2 – 6 months.

An employee of UK law firm (the client) spent 1.5 months of his vacation in the UAE without any involvement in this project.

Case No. 2: The facts are the same as in the previous example except for the nature of the service. Now it is litigation in the UAE court, which lasted 6 months in the court of 1st instance. The contract sets lump sum contingency fees for every stage (instance) of the litigation regardless of how many hearings occurred, the procedural documents produced, etc.

The question

May the UAE consulting company charge the zero rate to its UK client?

The analysis

1. Article 31(1)(a) of the VAT Executive Regulation zero-rates such services if they ‘are supplied to a Recipient of Services who does not have a Place of Residence in an Implementing State and who is outside the State at the time the Services are performed’.

2. Article 31(2) of the VAT Executive Regulation sets forth that ‘for the purpose of paragraph (a) of Clause 1 of this Article, a Person shall be considered as being “outside the State” if they only have a short-term presence in the State of less than a month or and the presence is not effectively connected with the supply’.

The “or” has been replaced with “and” by the Cabinet in Decision No. 46 of 4 June 2021. Both of the conditions previously determined may thus only excuse the temporary presence of the Recipient in the UAE.

3. Under Art. 31(1)(a)(1) of the VAT Executive Regulation the supplier needs to determine whether the Recipient of the Service was inside or ‘outside the State at the time the Services are performed’. Hence, the supplier takes ‘the time the Services are performed’ and checks the presence of the Recipient in the UAE.

‘For [this] purpose’, Article 31(2) determines that a person ‘shall be considered as being “outside the State” if they only have a short-term presence in the State of less than a month and the presence is not effectively connected with the supply’. Article 31(2) doesn’t specify a period within which one month shall be tested. However, it applies “for the purpose” of Article 31(1)(a)(1) which specifies that presence shall be assessed ‘at the time the Services are performed’. Hence, the relevant presence of the person is that, which falls in the period when the Services are performed.

4. Such interpretation is in concert with the Public Clarification VATP019 given by the FTA on 19 March 2022.

The FTA elucidates that ‘in order to determine whether this condition is satisfied, it is necessary to consider whether the recipient has any physical presence in the UAE at the time the services are performed. The requirement that the location of the recipient should be determined “at the time when the services are performed” requires consideration of the nature of the services supplied, and the period or duration during which the services are performed by the supplier and consumed by the recipient. Only the physical presence of the recipient during the period or periods in which the supplier performs services and the recipient consumes them needs to be taken into account; the location of the recipient before or after the services are performed and consumed should not be taken into account for the purposes of this condition’.

5. In Variant 1 the whole period of the services doesn’t exceed 1 month. Therefore, the 1 month threshold may not be exceeded regardless of the duration of the employee’s stay. The whole three weeks may fall during the presence on vacation.

So the threshold of 1 month may never be exceeded if the period of the services doesn’t exceed one month.

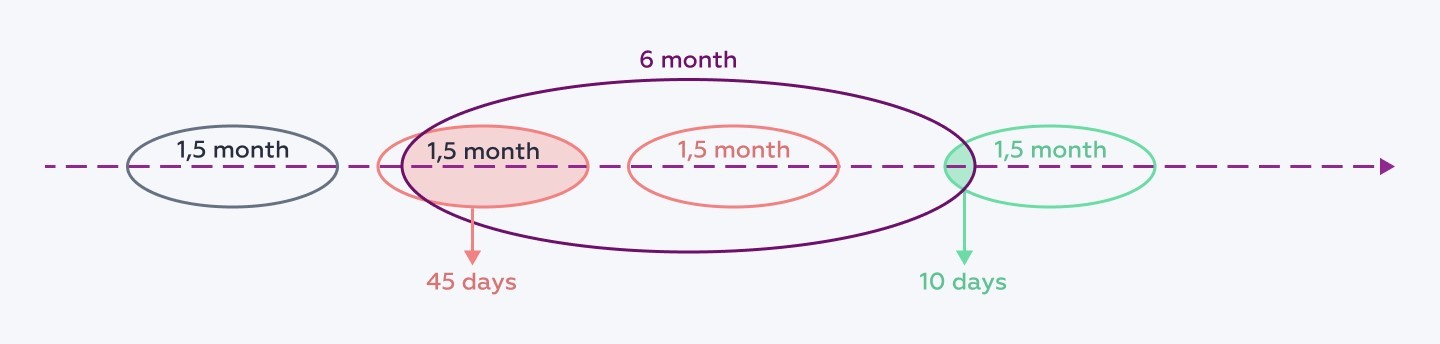

In Variant 2, the period of the service is 6 months and the period of presence is more than 1 month. Hence, theoretically the threshold may be exceeded. Therefore, the period of the employee’s presence shall be juxtaposed with the period when the services were provided:

6. In the black oval, the whole vacation falls within the period when the services hadn’t yet been provided. It may be moved forward to the period which starts after the services have been provided. The result is the same: this presence is irrelevant.

In contrast, the red oval presents a case where the whole period of vacation falls within the period when the services have been provided. This case is perfect to demonstrate that the short-term threshold of 1 month was exceeded.

In the brown and green ovals, part of the presence coincides with the period when the services have been performed. In the brown oval, 45 days of the vacation stay fell within this period. Hence, the threshold of 1 month is exceeded. In the green oval, this threshold was not exceeded since only 10 days of the stay coincide with the period when the services have been provided.

Case No. 2. Analysis.

7. In VATP019, the FTA clarifies:

- ‘… where services are such that they are continuously performed and consumed for a duration of time, then any presence of the recipient during commencement, throughout, or during completion of the service in the UAE would result in the recipient being treated as being within the UAE “at the time the services are performed’.

- ‘… if the services are of a nature that they are performed and consumed at the time that they are completed, then the location of the recipient at the time of completion of the services will determine whether the recipient is outside or inside the UAE at the time the services are performed’.

In Case No.2, it is reasonable to infer that:

- the nature of the services is such that the client consumes them after the final hearing – where the judgment is rendered – is over;

- this moment represents the moment given in VATP019, i.e. ‘the time of completion of the services’.

This moment is a clincher to test the location of the Recipient at the time when the services were performed, for ‘the services are of a nature that they are performed and consumed at the time that they are completed’.

Therefore, only one date (one day) is relevant in Case 2, as on this date the client’s employee was located in the State. One day may not exceed the 1-month threshold. Therefore, we believe that in this scenario the Company may apply the 0% VAT rate.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

@@PLUGINFILE@@/RD%20Principles%20in%20Identifying%20Core%20Attributes%20in%20Innovation.mp3&nb...

Read More

@@PLUGINFILE@@/Overview%20of%20the%20Corporate%20Tax%20Returns%20Guide%20No.%20CTGTXR1.mp3 ...

Read More

A company established and residing in the UAE (referred to as UAE Co.) is planning to distribute app...

Read More