LISTEN TO THIS ARTICLE

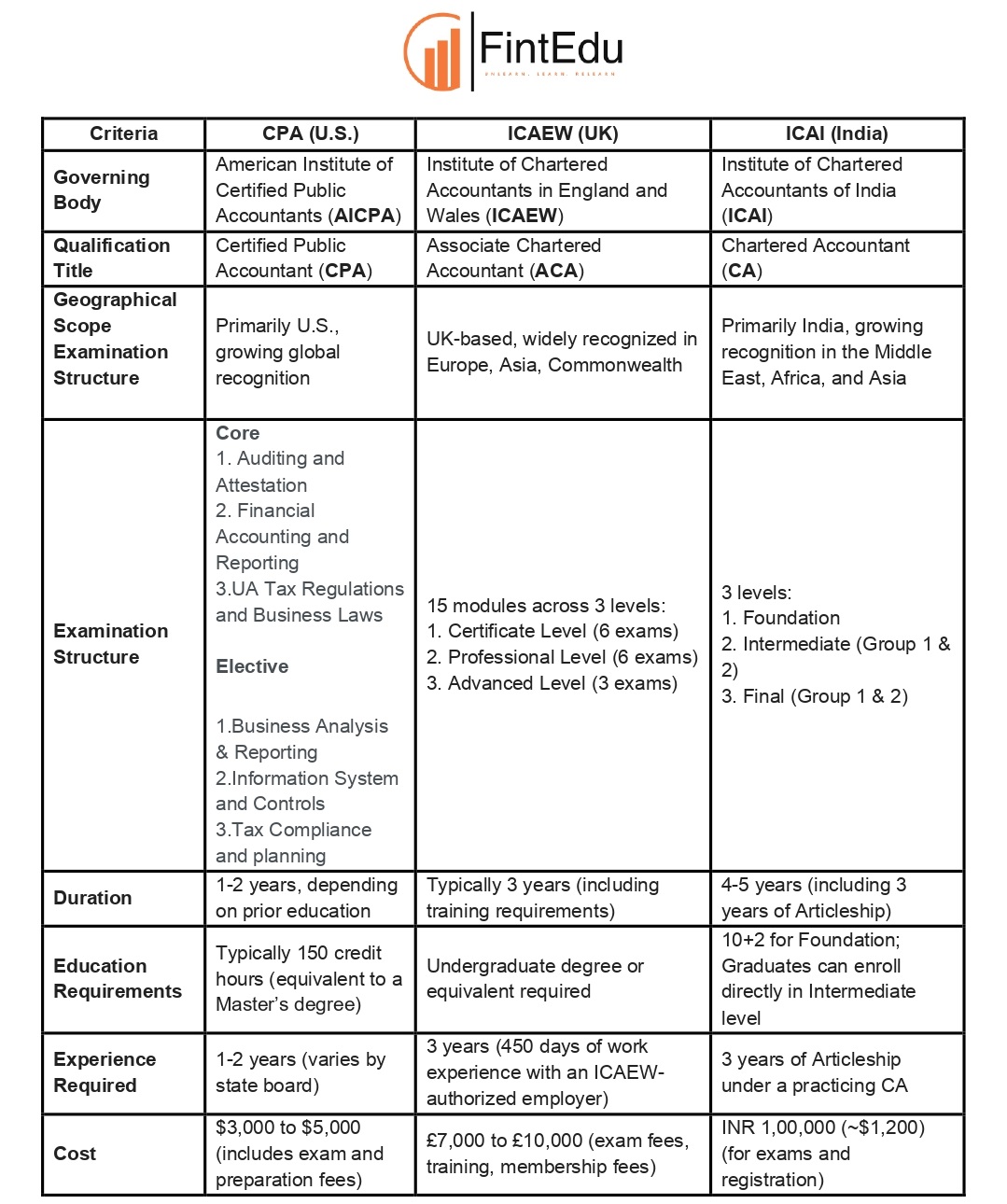

Here’s a detailed comparison between CPA (Certified Public Accountant), ICAEW (Institute of Chartered Accountants in England and Wales), and ICAI (Institute of Chartered Accountants of India), focusing on their geography, qualification structure, and global recognition.

1. Geographical Scope:

- CPA: Primarily recognized in the United States, though CPA bodies exist in Australia, Canada, and a few other countries. However, the U.S. CPA is the most recognized globally.

- ICAEW: Based in the UK, but the ACA qualification from ICAEW is highly respected across Europe, Asia, and Commonwealth nations.

- ICAI: Based in India, ICAI oversees the Chartered Accountancy (CA) qualification. It is widely respected in India and is recognized in countries with significant Indian business communities.

- CPA: American Institute of Certified Public Accountants (AICPA) regulates the CPA in the U.S.

- ICAEW: ICAEW grants the ACA (Associate Chartered Accountant) designation.

- ICAI: Institute of Chartered Accountants of India (ICAI) grants the CA (Chartered Accountant) qualification.

- CPA (U.S.): Requires passing the Uniform CPA Exam, which consists of three core subjects and one elective subject:

- Core

- Auditing and Attestation

- Financial Accounting and Reporting

- UA Tax Regulations and Business Laws

- Elective :

- Business Analysis & Reporting

- Information System and Controls

- Tax Compliance and planning

- Core

- ICAEW (UK): Requires passing 15 modules spread over three levels:

- Certificate Level: 6 exams

- Professional Level: 6 exams

- Advanced Level: 3 exams

- ICAI (India): Requires passing 3 levels:

- Foundation Course

- Intermediate Course (Group 1 and Group 2)

- Final Course (Group 1 and Group 2)

4. Qualification Requirements:

- CPA: Generally requires 150 credit hours of education (equivalent to a Master’s degree), passing the CPA exam, and meeting specific state board experience requirements (usually 1-2 years of relevant work).

- ICAEW: To qualify as an ACA, candidates must hold a degree or equivalent qualification, pass 15 exams, and gain at least 450 days of work experience in an ICAEW-accredited organization (usually takes around 3 years).

- ICAI: To become a CA in India, candidates must clear three levels of exams and complete 3 years of Articleship (internship) under a practicing Chartered Accountant.

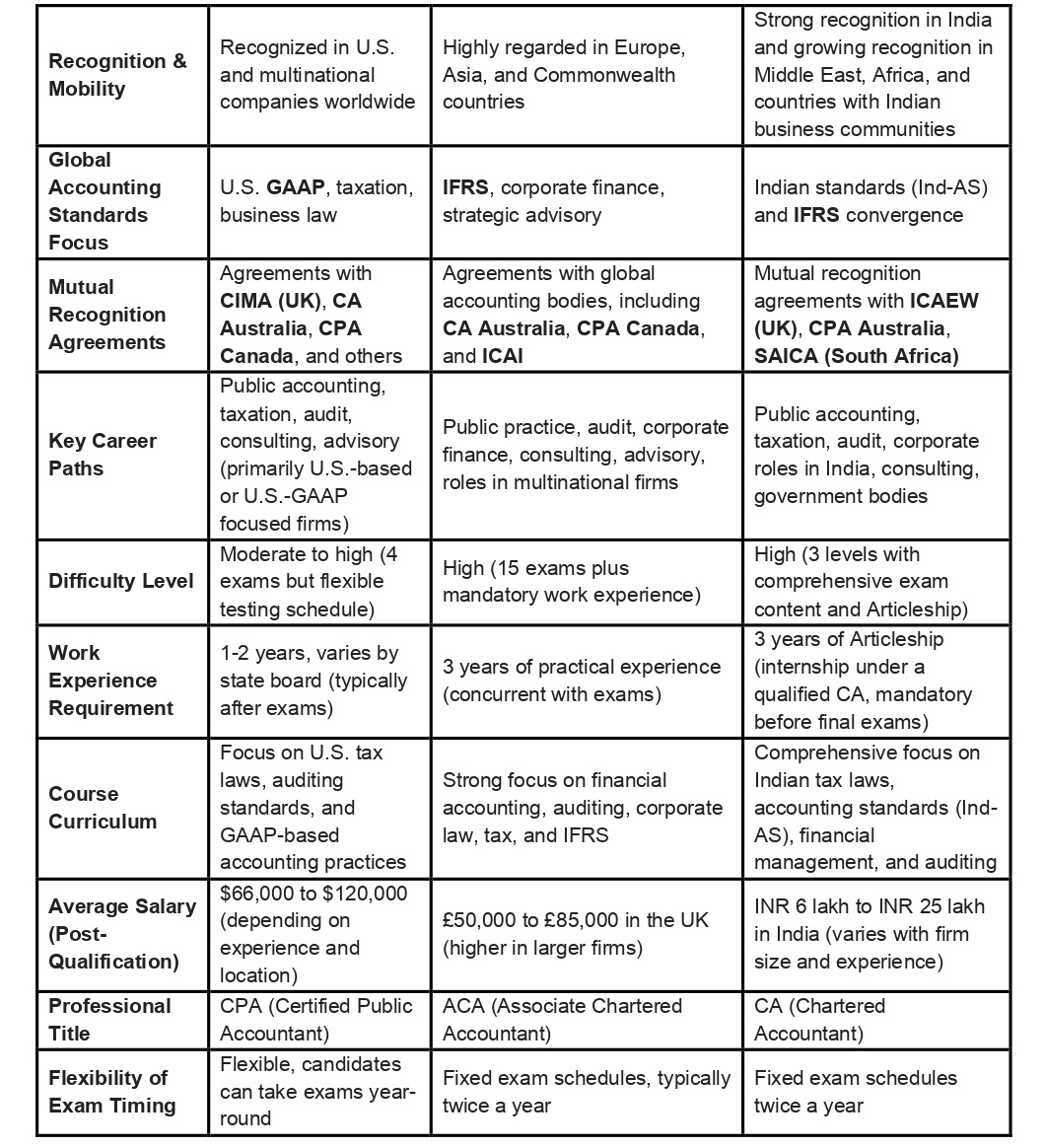

- CPA: Recognized primarily in the U.S., with growing recognition in other regions. CPAs are more commonly employed in companies adhering to U.S. GAAP, particularly multinational corporations.

- ICAEW: ACA is highly respected in Europe, Asia, and across Commonwealth countries. It is seen as one of the most prestigious accounting qualifications worldwide.

- ICAI: Widely recognized in India and several Middle Eastern and African countries with large Indian expatriate populations. However, it may require additional bridging exams or mutual recognition agreements to practice in certain foreign countries.

6. Focus of Study:

- CPA: U.S. GAAP, taxation, audit, and business law with a focus on the American financial and regulatory environment.

- ICAEW: Focuses on IFRS (International Financial Reporting Standards), corporate finance, audit, tax, and advisory services.

- ICAI: Strong emphasis on Indian accounting standards, auditing, taxation (direct and indirect taxes), and financial management. It increasingly incorporates IFRS as India converges with global standards.

7. Career Opportunities:

- CPA: CPAs are in high demand in the U.S., with opportunities in public accounting, auditing, taxation, and consultancy. They are also sought after in multinational corporations and U.S.-based firms globally.

- ICAEW: ACA professionals work in a variety of fields, including public practice, corporate finance, consulting, and auditing, especially in large multinational firms, financial services, and international corporations.

- ICAI: CAs in India have robust career prospects in public accounting, taxation, corporate finance, auditing, and consulting. Many CAs work in the private sector, particularly in Indian firms and government bodies.

8. Duration:

- CPA: Depending on the state and the candidate’s background, it can take between 1 to 2 years to complete the CPA qualification.

- ICAEW: The ACA program typically takes 3 years due to the work experience requirement.

- ICAI: It usually takes between 4 to 5 years to complete the CA course, including the Articleship period.

9. Cost:

- CPA: Total cost can range between $3,000 to $5,000, including exam fees, application fees, and review courses.

- ICAEW: Costs vary but can be around £7,000 to £10,000 for exams, training, and membership fees.

- ICAI: Relatively affordable, the total cost for becoming a CA in India is typically under INR 1,00,000 (around $1,200).

10. Mutual Recognition and Bridging Agreements:

- CPA: Mutual recognition agreements exist between AICPA and other bodies like CIMA (UK), CA Australia, and CPA Canada.

- ICAEW: ICAEW has mutual recognition agreements with various global accounting bodies, making it easier to practice internationally.

- ICAI: ICAI has mutual recognition agreements with accounting bodies like ICAEW (UK), CPA Australia, and SAICA (South Africa), although recognition in countries like the U.S. typically requires passing bridging exams.

Summary of Key Differences:

All three qualifications have strong reputations in their respective regions, and the choice between them largely depends on where you intend to practice and your career goals.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice

Contributor

Related Posts

Qatar, 05 January, 2026: The General Tax Authority (GTA) has announced that the tax return f...

Read More

Bahrain, 05 January, 2026: Bahrain’s government has unveiled a comprehensive fiscal reform ...

Read More

Oman, 05 January, 2026: The Tax Authority has announced the postponement of the Digital Tax Sta...

Read More