LISTEN TO THIS ARTICLE

The FTA has published a comprehensive guide on Tax Groups under the Corporate Tax (CT) Law in January 2024. In this write-up, we have summarised the provisions relating to limitation on interest deduction as applicable to Tax Groups.

Background

Under the CT Law, a specific provision, viz. the General Interest Deduction Limitation Rule is applicable when the net interest expenditure (after netting off interest income) exceeds AED 12 million for the relevant tax period. In such a case, while computing the taxable income, deduction of net interest expenditure is allowed at higher of the following:

- 30% of earnings before interest, tax, depreciation and amortisation (EBITDA); and

- AED 12 million.

The excessive net interest expenditure, which is not permissible as deduction, must be carried forward and deducted in subsequent ten tax periods.

The provision is similar to the thin capitalisation rules operational in many jurisdictions. These rules are aimed at curbing the tax planning by entities opting for relatively high level of debt financing as compared to equity funding as interest is fully tax deductible. This rule does not apply to specific entities like banks and insurance providers, i.e., any income or expenditure of such member is disregarded for the calculation of total net interest expenditure and EBITDA of the Tax Group.

How Limitation Rule applies to Tax Group

The CT Law provides an option of formation of a Tax Group, wherein two or more taxable persons are treated as single taxable person, subject to fulfilment of conditions. Since a Tax Group is a single taxable person, the restriction on interest deduction is computed at the Tax Group level. The EBITDA of Tax Group, and not of individual member entities, is to be taken into account to compute the interest allowable as deduction as per threshold given above.

Carried Forward Interest Expenditure

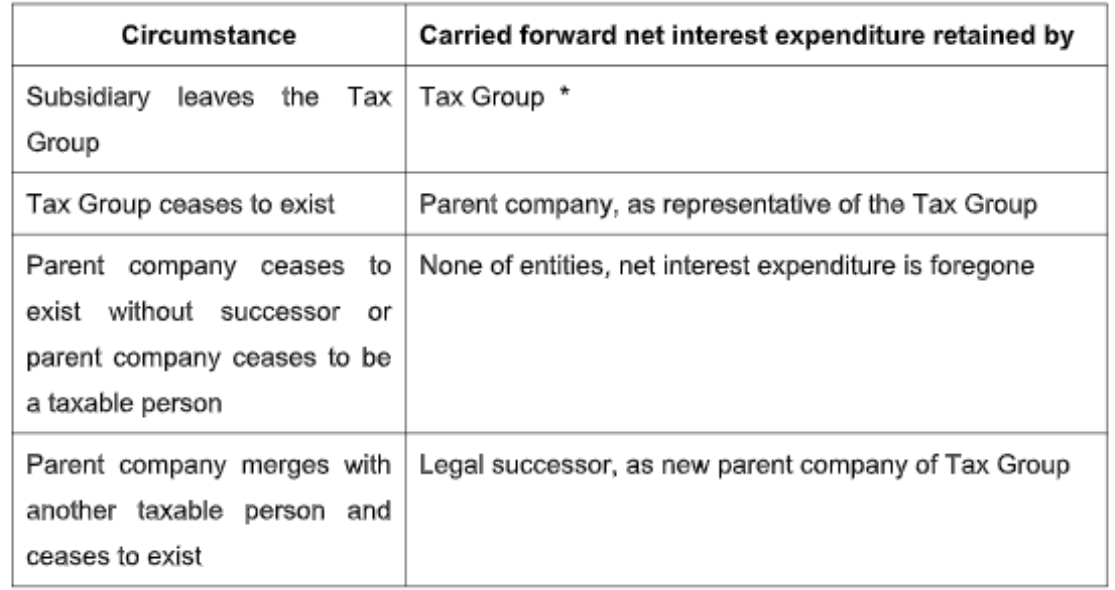

The carried forward interest expenditure is attributable to the Tax Group, as represented by the parent company and not to any individual member entity. The table below captures different circumstances when the composition of the Tax Group may change and the consequent treatment of the carried forward net interest expenditure:

Except pre-grouping net interest expenditure of the subsidiary

Order of utilisation

If the Tax Group has net tax expense for the current tax period and it also has carried forward net interest expense, in such a case, the Tax Group has to first claim deduction of current tax period interest expense and subsequently, utilise carried forward net interest expense.

Interplay with Business Restructuring Relief

A taxpayer may elect for Business Restructuring Relief in respect of gains/losses arising on transfer of business. This may not generally impact the carried forward net interest expenditure except that certain expenditure may be forgone (eg. if the parent company ceases to exist).

Conclusion

The capital intensive sectors like infrastructure having long gestation period, will be impacted by the above limitation rules. Further, if the Tax Group consists entities that are in initial stages of their operations or those incurring huge losses due to varied reasons may adversely affect the EBITDA at Tax Group level.

Disclaimer: Content posted is for informational & knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

@@PLUGINFILE@@/New%20Pension%20Law%20in%20the%20UAE%20and%20Emiratisation.mp3 LISTEN TO T...

Read More

@@PLUGINFILE@@/Saudi%20Arabia%20%E2%80%93%20Tax%20Measures%20to%20Boost%20Investments%20and%20...

Read More

@@PLUGINFILE@@/UAE%20Corporate%20Tax%20for%20Natural%20Persons%20A%20Comprehensive%20Guide.mp3...

Read More