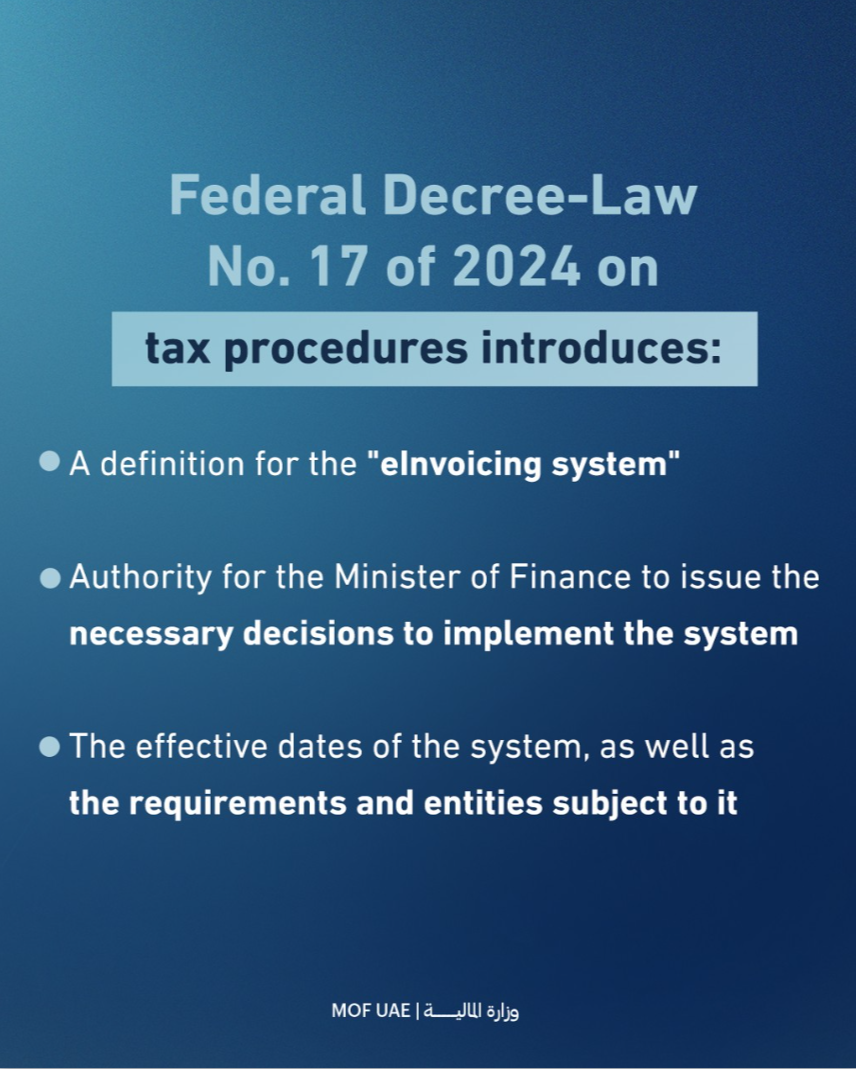

UAE, 29 October, 2024 : The Ministry of Finance, UAE, has announced the first set of VAT legislative amendments to support the upcoming e-invoicing mandate.

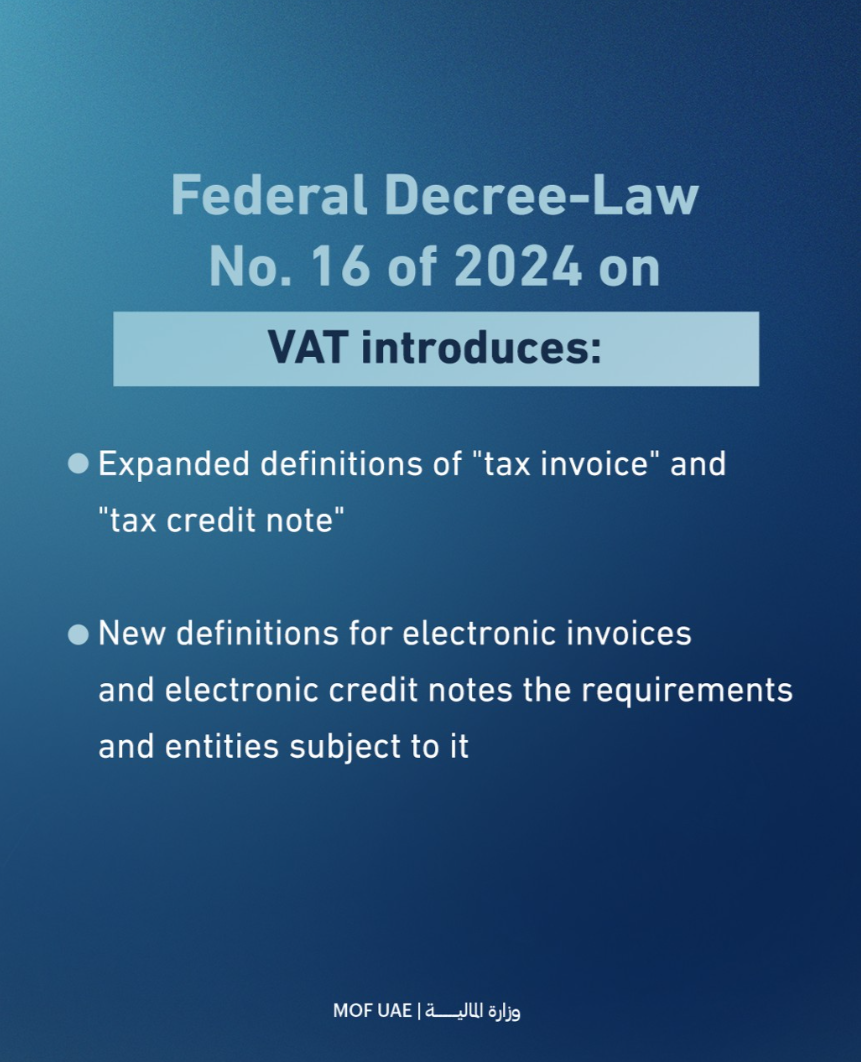

Key Amendments in VAT Decree-Law:

- Article 55 (Input Tax Recovery)

- Article 65 (Tax Invoice)

- Article 70 (Tax Credit Note)

The initial release is available in Arabic, with an English version to follow soon.

Source : www.mof.gov.ae

Related Posts

Anti-Money Laundering (AML) in the UAE is a core component of the country’s financial and economic...

Read More

In an era where financial transactions occur at the speed of light, the role of an Anti-Money Launde...

Read More

@@PLUGINFILE@@/ttsmaker-file-2025-11-13-12-36-37.mp3Listen to this ArticleIn today’s business envi...

Read More