LISTEN TO THIS ARTICLE

In any economy, understanding the various forms of revenue collection is essential for both businesses and individuals. Among the primary tools are duties, taxes and tariffs. While they often overlap in purpose - to generate revenue for governments and regulate markets - they have distinct roles and implications.

Let’s break down each term -

1. Taxes

Taxes are mandatory contributions levied by governments on individuals and businesses. They fund essential public services, such as healthcare, infrastructure and education, and are a fundamental part of any economic system. Taxes can be direct or indirect:

Direct Taxes: Income tax is a direct tax applied to an individual’s or a business's earnings. For example, if someone earns AED 50,000 a year, they may need to pay 20% as income tax, which is directly collected from their income (not in UAE)

Indirect Taxes: VAT (Value Added Tax) is added to the price of goods and services. For instance, when you buy a laptop for AED 1,000 with a 5% VAT, the total cost becomes AED 1,050. Here, the tax is indirectly paid by the consumer, as it’s included in the price.

Taxes can be adjusted to promote certain economic goals. For example, governments may reduce corporate taxes to encourage business investment and economic growth.

2. Duties

Duties are a type of tax specifically levied on goods, typically associated with imports and exports. They are applied when products cross borders and serve to either raise revenue or protect local industries. Common types include:

Import Duties: Imagine a country produces leather bags but imports some from abroad. To protect local manufacturers, the government might impose an import duty on these foreign leather bags. If the import duty is 15%, a AED 100 bag from overseas will now cost AED 115, making local bags more competitive.

Excise Duties: These apply to specific products, like tobacco or alcohol, even within the domestic market. For example, if a bottle of wine is sold for AED 20, an excise duty might add AED 5, raising the price to AED 25. Governments often use excise duties to discourage consumption of products with potential health risks.

Duties are generally calculated based on a percentage of the product’s value, though they can also be a fixed amount per unit.

3. Tariffs

Tariffs are specifically taxes on imports, often imposed as part of trade policy. They are used to raise revenue, protect domestic industries or negotiate trade terms. Tariffs can have different purposes:

Revenue Tariffs: For example, if a country imposes a 10% tariff on imported electronics, it generates additional revenue whenever foreign electronics enter the market.

Protective Tariffs: Consider a country that produces steel domestically. To protect its steel industry, the government might impose a 20% tariff on imported steel. This increase in price for foreign steel encourages companies to buy from local producers.

Tariffs are often applied selectively, depending on trade agreements and international relations. For instance, a country might impose higher tariffs on goods from countries it doesn’t have a trade agreement with, while offering tariff-free access to partner nations.

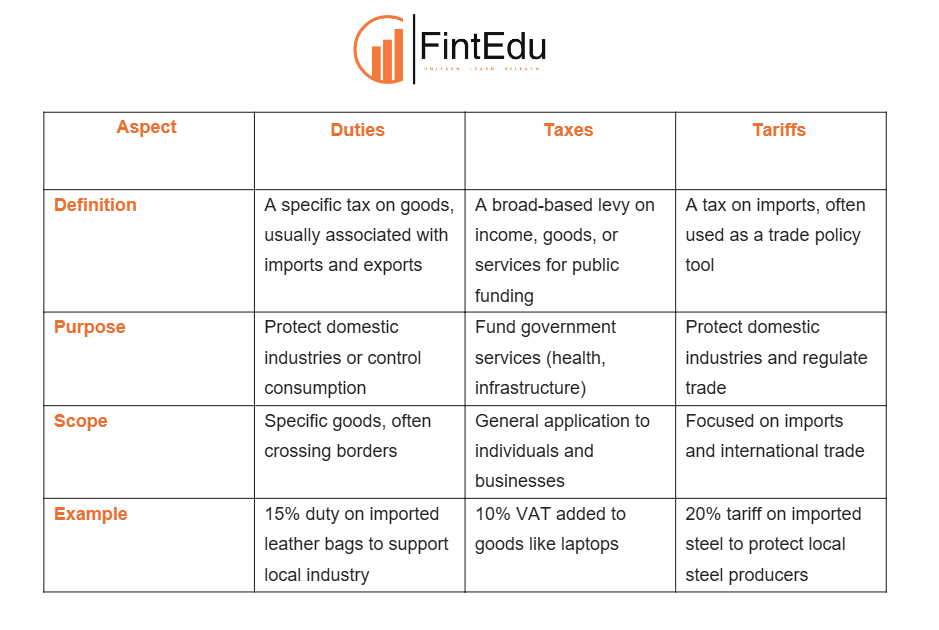

Key Differences Between Duties, Taxes, and Tariffs

Understanding these distinctions is essential, as they influence the prices of goods, consumer choices and international trade. Duties, taxes and tariffs each play a unique role in an economy, illustrating how governments can shape market behavior and revenue generation. Recognizing their impact can help consumers, businesses and policymakers better understand the pricing, policy and trade dynamics.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice