LISTEN TO THIS ARTICLE

The FTA has been working tirelessly this year to produce voluminous guidance on the newly imposed UAE corporate tax regime. It comes as over 500,000 businesses domiciled in the UAE are preparing to file their inaugural corporate tax return. These efforts have been welcomed by companies and their advisors. However, guidance released too frequently can be as confusing as too little.

UAE corporations are contending with many novelties this year, including complying with transfer pricing rules. Purely domestic UAE corporate groups may have had limited experience with meeting the requirements of the newly minted transfer pricing rules that are standard fare in the rest of the world, including in the GCC – with KSA and Qatar being early adopters.

This article is aimed at helping CFOs and their tax advisors develop a more focused approach in meeting their transfer pricing requirements for FY2024 based on legislative guidance released to date (see Exhibit 2).

Unfamiliar Terrain

Many UAE tax advisors (aside from global advisory firms) have not dealt with transfer pricing legislation in practice to sufficiently appreciate the bends, traps and opportunities which are not always apparent in the legislation or guidance. The FTA Transfer Pricing Guidelines is a good starting point as it provides ample amounts of theoretical and practical guidance on meeting the transfer pricing requirements.1 But developing a transfer pricing strategy requires an understanding of the legal requirements but also practical judgement about risk and reward.

Your transfer pricing plan should ideally reflect your overall transfer pricing exposure. All transactions (and companies) do not carry the same degree of risk. Spending money on your advisors to develop comprehensive transfer pricing documentation is not always the best strategy.

A better strategy is to first understand your corporation’s specific risk profile, in the context of the group’s size, its global footprint, industry and the nature of the UAE activities. Resources should be targeted at related party transactions that pose the greatest risk of challenge by the financial auditors and the tax authorities.

But which factors inform your company’s transfer pricing risk profile?

- Global Footprint: The transfer pricing exposure of a domestic UAE group with all related party transactions involving UAE affiliates is significantly lower than that of a UAE subsidiary of a larger MNE group (ceteris paribus).

- Financial Profile: Companies with UAE revenues more than AED 100 million invite greater scrutiny by the tax authorities, as would companies with recurring tax losses and large volume of intercompany transactions.

- Industry: Businesses that involve significant R&D activities related to intellectual property (e.g. patents, software) require a more careful analysis, particularly around first establishing the rightful economic ownership of critical intangibles before the transfer pricing policies can be correctly established.

For instance, a transfer pricing challenge may center on whether a UAE subsidiary of a software developer which provides design and development services on behalf of a US parent but enjoys some level of autonomy in developing the product features should be considered to have “economic ownership” or “co-ownership” of the software it develops. The transfer pricing policy may be to reward the UAE subsidiary with cost plus a markup as a provider of software development services to the US parent. A tax authority could challenge this narrative, arguing that the transfer pricing policy should instead be to reward the UAE subsidiary on a percentage of the global revenues attached to software sales. Such a policy would typically yield a higher reward for the UAE subsidiary compared to a cost-plus model.

In less intangible-oriented industry sectors, for example manufacturing of fabricated steel products, the value-generating activities are conjoined to the location of manufacturing capabilities, limiting (but not eliminating) the risk of a significant transfer pricing challenge. A potential challenge may be more narrowly focused on the mark-up that the UAE manufacturer earns on its manufacturing but not around the very nature of the services that the UAE subsidiary provides to its related parties.

Sending the Right Signals

Before we get into the transfer pricing planning checklist, it is important to understand the frame of reference of the key stakeholder involved – the tax authority – and the very peculiar characteristic of the transfer pricing documentation exercise.

Transfer pricing is neither science, nor art (or artifice). Practically speaking, transfer pricing policy and accompanying documentation is a signaling tool used by the companies to communicate to the tax administrator that they are not engaging in tax avoidance (i.e. artificially reducing taxable income in the UAE by shifting it overseas or paying excessive salaries to owners).

Some common fact patterns that may signal concern for the tax authorities:

- Consistent losses generated by the UAE company with a growing number of registered employees and no growth in revenues

- Inconsistencies between the narrative of the local business activities presented in the transfer pricing report and other compliance filings e.g. Economic Substance Reports (ESRs)

- No registered employees but substantial revenues

- Substantial employees but no revenue

- Significant increases in salaries paid to shareholders

- Significant volume of transactions with offshore subsidiaries in favorable tax jurisdictions such as Cayman Islands, British Virgin Islands, Bermuda, Jersey and Guernsey where transfer pricing laws do not exist.

Why Are the Right Signals Especially Important for Transfer Pricing?

Sending the right signals on transfer pricing compliance is important because of the costs involved – for both the company and the tax authorities.

If we were to simplistically reduce tax laws into two very broad categories, they could be classified as “binary” or “grey”.

The first category (binary) involves an investigation of facts with a limited scope for subjective narration of those facts to inform a yes/no conclusion vis-à-vis compliance. Are we selling a physical product or a service? Did you renew your trade license? How many employees are on your company register?

The second (grey), where transfer pricing falls, involves an investigation of the facts as well as a subjective interpretation of those facts in the context of somewhat “abstract” legislative requirements. Such questions often have no “right” or “wrong” answers. As the great poet Rumi once said: “Out beyond ideas of wrongdoing and right doing, there is a field. I'll meet you there.”

When the question is posed–what is the arm’s length price? The answer may well be $5 million. But it could also be $9 million. Both could be correct or both could be wrong because of the protean nature of the transfer pricing rules which accommodate a range of correct outcomes instead of a single correct transfer price.

Hence for a tax authority challenge to be successful, the case needs to be made that the transfer pricing policies are outside of the entire range of plausible arm’s length prices.

Transfer Pricing Audits Are Costly

The implication here is that transfer pricing audits can be costly for both taxpayers and auditors. Tax administrators have limited resources to accomplish their objective: Identify companies shifting otherwise UAE taxable income to free zones or foreign jurisdictions or paying out excessive salaries to shareholders.

Even successful transfer pricing adjustments by the FTA will not automatically lead to fiscal gains for the government. Gains are only made when transfer pricing adjustments create additional taxable income in the UAE. Any transfer pricing adjustments between two related parties paying corporate income tax at the same rate within the UAE does not create any meaningful gain for the tax authority. Tax auditors would be expected to behave as utility maximizing agents, homing in on the likely suspects. 2 If your signals are positive, there is no perceived benefit for the tax authority from engaging in a lengthy transfer pricing audit.

With this context, let’s first look at the specific requirements of the UAE transfer pricing laws released to date and how to approach the legislated requirements based on a company-specific risk profile.

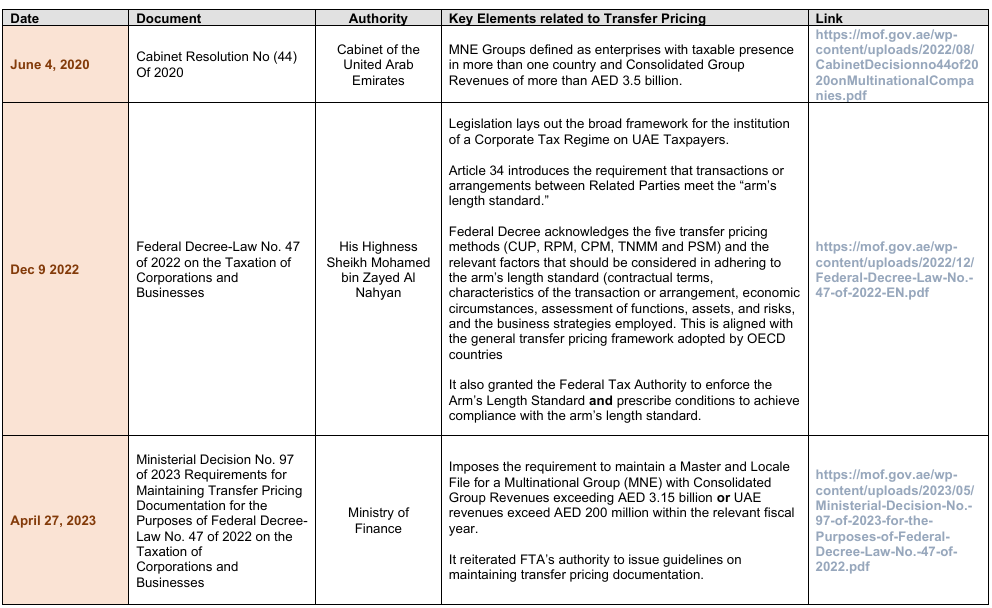

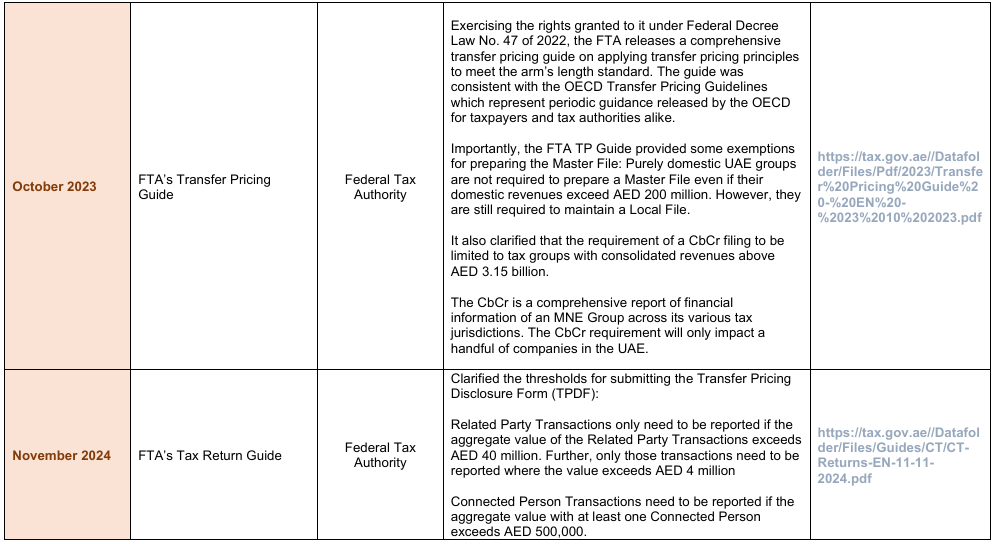

Since Dec 2022, with the release of the Federal Decree Law No 47 for UAE companies to comply with the arm’s-length standard, there have been periodic releases from the Ministry of Finance and the FTA to enhance the body of transfer pricing legislation and guidance which are summarized in Exhibit 2.

Exhibit 2 – Timeline of Legislation and Guidance

Requirements

Broadly, the transfer pricing requirements center around:

- Having arm’s length transfer prices,

- Having supporting documentation for those transfer prices and

- Disclosing the amount of those transfer prices to the tax authority via the Transfer Pricing Disclosure Form.

Large Multinational Groups with global revenues exceeding €750 million also need to prepare and file a Country-by-Country Report (CbCr). The CbCr will not be discussed in this article.

Transfer Pricing Policy vs Documentation

There is a distinction between transfer pricing policy and transfer pricing documentation. A company could have a transfer pricing policy that complies with the arm’s length requirements but still not comply with the transfer pricing documentation requirements.

For example, Company A provides services to its affiliate Company B based on a transfer pricing policy of cost-plus 15 percent. Company A has determined this policy to be arm’s length because it provides similar services to an arm’s length company (Company X) using the same pricing of cost-plus 15 percent.

Company A has concluded that its transfer price to Company B is arm’s length. However, to fulfill its transfer pricing documentation requirements, it needs to prepare an analysis that describes the nature of the transaction/arrangement between Company A and Company B, and then prepare a functional analysis which confirms the nature of the transaction as being consistent with its purported form (services) and then undertaking a benchmarking exercise using the CPM as the most appropriate method and identifying and making adjustments for any differences between the transactions between Company A and Company B and between Company A and Company X.

Transfer pricing documentation can be understood as your argument of why you believe your transfer pricing is arm’s length for a specific tax year, invoking and applying the transfer pricing laws and frameworks endorsed by the relevant tax authority and providing the relevant financial information that was available at the time.

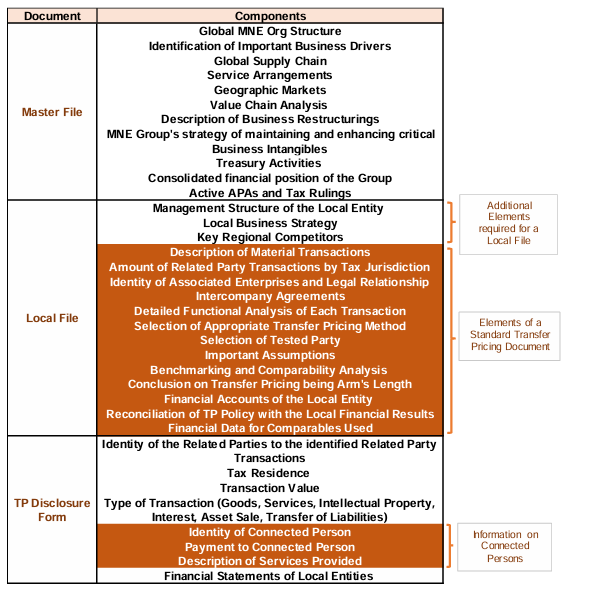

Master File vs Local Files vs Standard Transfer Pricing Documentation

A specific type of transfer pricing documentation is referred to as the Master File and another as the Local File, but not all transfer pricing documentation are a Master File or Local Files. The differences between these documentation forms are provided in Exhibit 2.

Exhibit 3 – Documentation Components

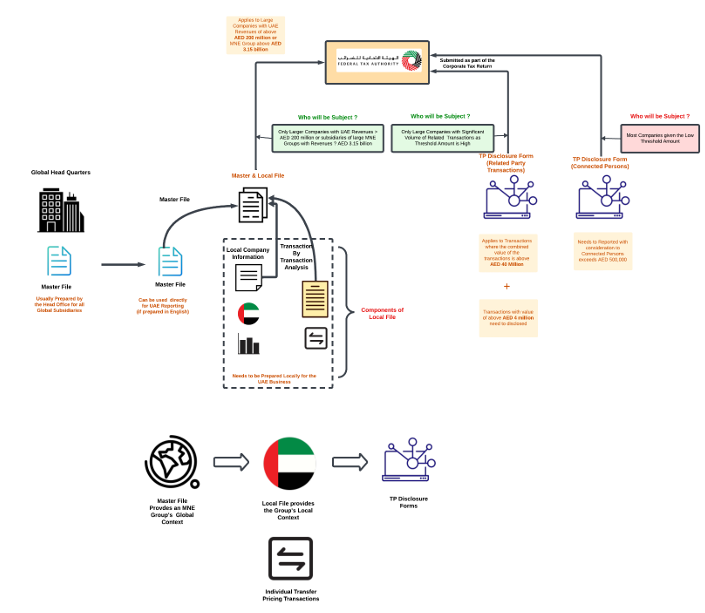

Each large MNE group typically has one global Master File and Local Files for each country in which it has legal presence.

The Master File is usually prepared by the country where the MNE Group is head quartered and supplied to the finance department of all regional subsidiaries.

Both Master and Local Files are exhaustive documents that can require hundreds of hours to develop. It’s not uncommon for large public companies to have a dedicated team assigned to them by their transfer pricing advisors throughout the year to maintain and continuously update the Master and Local Files.

Given the high investment needed to maintain these documents, they are only required for large MNE Groups with domestic revenues of more than AED 200 million or global revenues of more than AED 3.15 billion.

What is in the Master and Local Files?

The Master File is a comprehensive map of an MNE group, its various activities globally, its international supply chain, and an outline of its transfer pricing policies in its various jurisdictions of presence. It is meant to provide the reader with a macro-level view of the MNE group. The Local File(s), on the other hand, provides a hyper-local picture of the activities within a particular country or jurisdiction, including financial results, and local reporting structures.

Exhibit 4 – Global vs Local Context

Together, the Master and Local File are meant to provide the tax authorities with a narrative of how value is created across the global supply chain of an MNE group and then narrow down to the local business activities: how do the activities of the local group fit into the overall supply chain of the MNE group – and whether the relative profit share of the UAE entities seem reasonable?

For example, a UAE subsidiary may be a local distributor of very sophisticated semiconductor chips that are manufactured by its Taiwanese parent which owns all product patents and undertakes very complex manufacturing requiring billions of dollars of investment in fabrication facilities.

The Master File and Local File will aid the tax authorities in understanding the “value created” by the UAE subsidiary which is limited to creating a commercial market for semiconductor chip in the UAE. The Taiwanese parent, on the other hand, creates relatively more value through continuous R&D functions which generate patents and enable premium pricing for its products and by undertaking highly complex and capital-intensive chip manufacturing.

Who is required to prepare a Master and Local Files?

Master and Local Files are only required when the revenues of the UAE entities exceed AED 200 million or the wider MNE Group revenues exceed AED 3.15 billion.

For purely domestic UAE groups that are not considered to be a Multinational Enterprise, there is no requirement for a Master File – only a Local File. This makes sense because the global context of a purely local group is largely irrelevant.3

The revenue thresholds for Master and Locals Files are high – and only a small fraction of the UAE companies will fall into these requirements. This clemency exists because Master and Local Files are highly cumbersome (and expensive) to prepare and tax authorities do not want to burden small and medium sized businesses with such an onerous compliance burden.

However, even if the Master and Local File requirements to not apply, you are still required to maintain standard transfer pricing documentation

Transfer pricing documentation is not required to be submitted as part of the corporate tax filing (as of now). But the requirements may change. It is typical for tax authorities to grant 30 days to the tax payer to provide the transfer pricing documentation upon request.

Transfer Pricing Disclosure Forms

There is also a third leg of the transfer pricing requirement which involves disclosing intercompany transaction amounts as part of the Corporate Tax Return. This is referred to as the Transfer Pricing Disclosure Form (TPDF)

The FTA more recently provided thresholds for the submission of the TPDF. The TPDF only needs to be prepared when:

- The transactions between a UAE subsidiary and their related parties exceeds AED 40 million and

- The value of the specific transaction exceeds AED 4 million. These thresholds were the clarified in FTA’s Tax Guide released a few weeks ago (November 2024).

- The value of salaries to Connected Persons exceeds AED 500,000

The first two thresholds are quite high (compared to similar requirements of other tax authorities), which is good news for most companies as only a small section of the UAE taxpayers will need to disclose Related Party Transactions. However, the Connected Persons threshold is low, which means a lot more taxpayers will need to provide information on compensation to Connected Persons (Shareholders)

This should give us some clue to the type of transactions that the FTA will target.

Exhibit 5 – TP Compliance Components

FY2024 Transfer Pricing Documentation Plan

So what does this all mean for your company when it comes to meeting the transfer pricing requirements for FY2024.

Here is a simple checklist:

➔ Understand the overall transfer pricing exposure of your company.

If your business is entirely based in the UAE and also does not have any presence in freezones with preferential tax rates, the risk of a transfer pricing challenge is generally not high.

The risk is lowest for companies that do not cross the AED 200 million threshold to prepare a Local File and have related party transaction amounts below AED 40 million and will not need to be disclosed in the TPDF.

The logic should be straightforward. The less visibility that the FTA has over your intercompany dealings, the less likely it will be for you to be selected for a transfer pricing audit.

➔ Understand the transactions that pose the greatest individual risk and focus efforts to develop good support.

Transactions with a value of less than AED 4 million (which do not need to be disclosed on the TPDF) carry a low risk of challenge.

➔ However, given the generally low threshold of AED 500,000 of compensation to Connected Persons, a large number of taxpayers will need to disclose these transactions on the TPDF.

Given that UAE has no personal income taxes, a keen area of interest for the FTA will be around the compensation paid to Connected Persons, especially if they happen to be shareholders. Every penny paid out as a salary to a shareholder will directly reduce the taxable income of the UAE company which would otherwise be subject to corporate income tax (barring free zones).

A trend we have seen with some clients is for shareholders to start paying themselves a salary for “executive functions” although their functions are primarily related to them being a shareholder and not an executive.

We would advise against this strategy because it creates unwarranted exposure. Executive functions align with but differ from those of shareholders because executives must undertake fiduciary duties and answer the company board. Understandably, this distinction becomes murky for privately held businesses, without a board structure, and the shareholders are actively involved in day-to-day decision making of the business.

➔ Have some level of support for all intercompany transactions. Even if a transaction doesn’t need to be disclosed in the TPDF, it does not mean that it doesn’t need to analyzed to ensure that it is arm’s length. If you don’t undertake this exercise, you may end up closing your books with inaccurate amounts, creating tax exposure that will surface during a financial due diligence exercise if the company is sold.

------------------------------------------------------------------------------------------

1. 140+ pages of the FTA Transfer Pricing Guide and 660+ pages of the OECD Transfer Pricing Guidelines referenced by the FTA as additional guidance

2. Tax Authority Benefit = (Probaility of a Successfull Transfer Pricing Adjustment × Tax Revenue Gain) − Adminsitrative Cost of Audits

3. Except in cases where the Group is purely export-oriented with all sales outside of the UAE.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice

Contributor

Related Posts

The Fundamental Reform On January 1, 2026, the UAE implemented a comprehensive reform to ...

Read More

Insurance plays a vital role in financial stability across the region by protecting individuals busi...

Read More

The real estate sector plays a central role in the UAE economy, and VAT continues to be a critical c...

Read More