LISTEN TO THIS ARTICLE

Introduction to Pillar Two and DMTT in Bahrain

The global tax landscape underwent a fundamental transformation with the OECD's introduction of the Two-Pillar Solution to address tax challenges arising from digitalization. As a member of the OECD's Inclusive Framework, Bahrain has implemented Pillar Two through Decree-Law No. 11 of 2024 (the DMTT Law) and its Executive Regulations (Decision No. 172 of 2024), which take effect from January 1, 2025.

The DMTT represents Bahrain's implementation of the GloBE Rules through a Qualified Domestic Minimum Top-up Tax (QDMTT) regime, ensuring Bahrain retains primary taxing rights over any top-up tax due from in-scope entities operating within its jurisdiction. The framework introduces a comprehensive system designed to ensure that the effective tax rate (ETR) on the income of in-scope MNE Groups meets the global minimum rate of 15%.

Revenue Test

The applicability of DMTT is primarily determined by the Revenue Test - a key threshold requiring MNE Groups to have annual consolidated revenue of €750 million or more in at least two of the four preceding fiscal years.

Example 1: Basic Revenue Test Application Consider an MNE Group with the following consolidated revenues:

- FY2021: €740 million

- FY2022: €760 million

- FY2023: €780 million

- FY2024: €730 million

For FY2025, this group would be in scope as it exceeded the €750 million threshold in two of the preceding four years (FY2022 and FY2023).

For fiscal years shorter than 12 months, the €750M revenue threshold must be proportionally reduced based on the number of months in the fiscal year (e.g., for a 6-month fiscal year, the threshold would be €375M). Conversely, for fiscal years longer than 12 months, the threshold must be proportionally increased (e.g., for a 15-month fiscal year, the threshold would be €937.5M).

Key Considerations for Revenue Test:

Consolidated Revenue Calculation:

- Revenue is determined from the Ultimate Parent Entity's Consolidated Financial Statements

- Includes inflows from ordinary activities including goods, services and investments

- Net gains from investments reflected in the profit and loss statements are included

- Intra-group transactions eliminated on consolidation are excluded

Special Scenarios:

- For newly created groups without four years of consolidated statements, missing years are deemed not to meet the threshold

- For mergers, the combined revenue of merging groups is considered

- For demergers, special rules apply for the first four fiscal years following the demerger

For the Revenue Test, amounts must be converted to Euros using the average monthly foreign exchange rate for December in the calendar year immediately preceding each fiscal year. This ensures consistent application across different jurisdictions and currencies.

Entities in Scope

The DMTT applies to Constituent Entities of qualifying MNE Groups located in Bahrain. A Constituent Entity includes:

1.Any entity in a group whose assets, liabilities, income, expenses, and cash flows are consolidated in the Ultimate Parent Entity's financial statements

2.Any permanent establishment of such entities, which includes fixed places of business like branches that meet specific criteria under tax treaties or local law

3.Entities excluded from consolidation solely due to size or materiality grounds

An important feature of the regulations is the treatment of Joint Ventures and Joint Venture Subsidiaries. These entities, while not technically Constituent Entities, are brought within scope if:

- The Joint Venture's financial results are reported under the equity method in the Ultimate Parent Entity's financial statements

- The MNE Group holds at least 50% ownership interest

- They are not themselves Ultimate Parent Entities of MNE Groups meeting the Revenue Test or Excluded Entities

For DMTT calculations, Joint Ventures and their subsidiaries are treated as if they were Constituent Entities of a separate MNE Group, with the Joint Venture considered the Ultimate Parent Entity.

Excluded Entities

The regulations provide for specific categories of excluded entities that, while considered for revenue threshold purposes, are not subject to the DMTT's operative provisions:

1.Government Bodies: Entities that are part of or wholly owned by government, fulfilling government functions

2.International Organizations: Intergovernmental bodies with headquarters agreements

3.Non-profit Organizations: Entities established for charitable, religious, or similar purposes

4.Pension Funds: Entities exclusively administering retirement benefits

5.Investment Funds that are Ultimate Parent Entities

6.Real Estate Investment Vehicles meeting specific criteria

Location Determination

The location of entities for DMTT purposes follows specific rules that may differ from traditional corporate residency concepts. For standard entities, location is determined by tax residency. However, where an entity is resident in multiple jurisdictions, tie-breaker rules apply:

Standard Determination by Tax Residency: For most entities, their location is determined based on tax residency in a particular jurisdiction.

Tie-Breaker Rules:

If a Tax Treaty Exists: The entity's location is determined according to the treaty's residence rules, consistent with the tax treaty provisions.

If No Tax Treaty Exists:

- The jurisdiction where the entity pays more tax is prioritized.

- If the amount of tax paid is equal, the jurisdiction with the greater substance-based income exclusion is considered.

- If there is still no resolution, the jurisdiction of creation is used as a final determinant, specifically for Ultimate Parent Entities.

Permanent Establishment

The regulations provide comprehensive guidance on permanent establishment (PE) determination, aligned with international standards but adapted for Bahrain's context. A PE may arise through:

1.Fixed place of business

2.Dependent agent arrangements

3.Construction sites lasting more than 12 months

4.Other forms as determined by ministerial decision

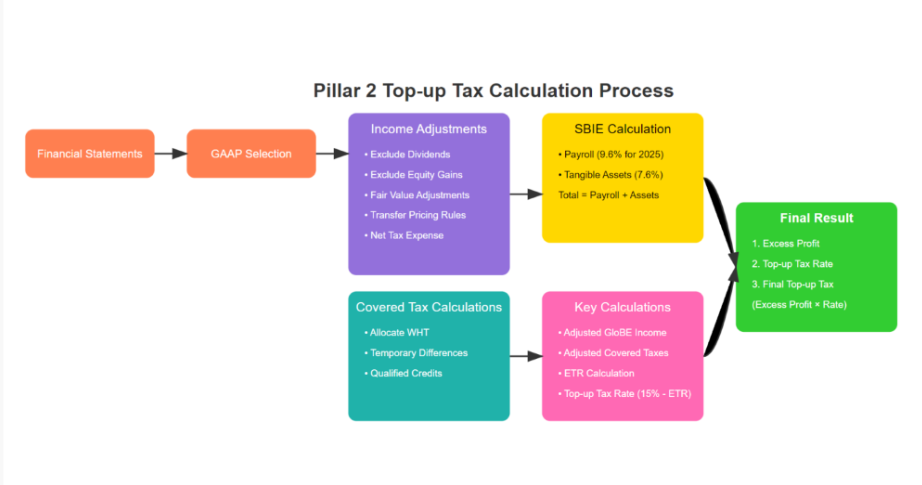

Financial Accounting - IFRS/GAAP

The DMTT regulations place significant emphasis on financial accounting standards as the foundation for tax calculations. The regulations recognize International Financial Reporting Standards (IFRS) as an Acceptable Financial Accounting Standard, along with various other Generally Accepted Accounting Principles (GAAP) from specified jurisdictions.

For Bahrain-located Constituent Entities, financial accounts can be prepared using:

1.Local Financial Accounting Standards, provided:

- All Constituent Entities in Bahrain use the same standard

- The accounting period aligns with the Group's fiscal year

- The accounts are subject to external audit or used for tax/regulatory purposes

2.The Ultimate Parent Entity's accounting standard if local standards requirements aren't met

Example: A Bahrain subsidiary of a US-based MNE Group prepares its local accounts under IFRS. If these accounts meet the above conditions, they can be used for DMTT purposes. Otherwise, the entity would need to use US GAAP (the Ultimate Parent Entity's standard) with appropriate adjustments.

A key feature is the treatment of Material Competitive Distortions - where specific accounting principles result in material variations compared to IFRS treatment. In such cases, adjustments are required to align with IFRS principles.

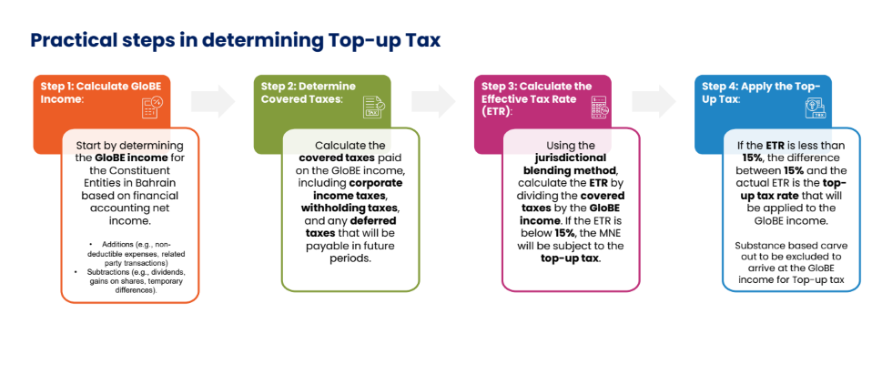

Effective Tax Rate Calculation

The Effective Tax Rate (ETR) calculation forms the core of the DMTT framework and comprises three key elements:

Adjusted Income:

1.Based on financial accounting net income/loss

2. Subject to specific adjustments including:

- Excluded dividends and equity gains/losses

- Stock-based compensation

- Fair value adjustments

- Pension expenses

- Foreign exchange gains/losses

Adjusted Covered Taxes:

1.Includes current and deferred taxes

2.Excludes certain items such as:

- Qualified Domestic Minimum Top-up Tax

- Taxes related to excluded income

- Disqualified refundable imputation tax

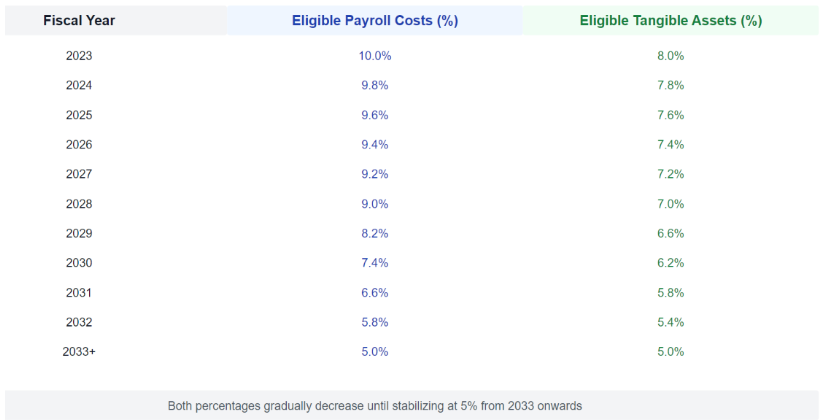

Substance-based Income Exclusion:

1.Comprises payroll and tangible asset components

2.Calculated using declining percentages:

- Payroll: Starting at 9.6% in 2025, reducing to 5% by 2033

- Tangible Assets: Starting at 7.6% % in 2023, reducing to 5% by 2033

Bahrain's Domestic Minimum Top-up Tax (DMTT) Regulations: An overview

Other Significant Provisions

The Bahrain DMTT regulations incorporate several important provisions designed to manage compliance burden while ensuring effective implementation of the global minimum tax framework. These provisions include various exclusions and safe harbors that can significantly impact an MNE Group's tax position in Bahrain.

De Minimis Exclusion

The regulations provide for a De Minimis Exclusion which offers relief for MNE Groups with relatively small operations in Bahrain. This exclusion operates on an annual basis and requires an explicit election by the Filing Constituent Entity. Under this provision, if the average annual revenue of Bahrain-located Constituent Entities falls below €10 million and their average income is less than €1 million (or they are in a loss position), the DMTT liability can be reduced to zero.

For example, consider a Bahrain subsidiary of an MNE Group with average annual revenue of €8 million and average income of €800,000 over the relevant period. Despite being part of a large MNE Group meeting the €750 million threshold, this entity could qualify for the De Minimis Exclusion, effectively reducing its DMTT liability to zero for that fiscal year.

Safe Harbor Provisions

The regulations introduce two types of safe harbor provisions. The first is the Transitional Country-by-Country Reporting Safe Harbor, available until June 2028. This provision leverages existing Country-by-Country reporting data to simplify compliance during the initial implementation phase. To qualify, entities must meet specific criteria related to revenue, profitability, and effective tax rates as reported in their Country-by-Country reports.

Article 56 of the DMTT Executive Regulations makes reference to a Simplified Computation Safe Harbor. However, the rules, conditions and controls required to apply this safe harbor will be set out in a future ministerial decision after Cabinet approval. Until such decision is issued and the detailed rules are published, this safe harbor cannot be applied by Multinational Enterprise Groups. Therefore, MNE Groups should currently rely on the standard DMTT computation rules and other available exclusions/safe harbors (such as the Transitional CbCR Safe Harbor or De Minimis Exclusion) where applicable."

Initial Phase Exclusion

Recognizing the unique challenges faced by businesses in their early stages of international expansion, the regulations provide for an Initial Phase Exclusion. This exclusion is available for the first five years of an MNE Group's international activities, provided certain conditions are met. The group must operate in no more than six jurisdictions, and its tangible assets outside the reference jurisdiction must not exceed €50 million. This provision particularly benefits growing businesses that are just beginning to establish their international presence.

Transfer Pricing Considerations

The regulations incorporate comprehensive transfer pricing provisions aligned with international standards. These requirements go beyond mere compliance with the arm's length principle, establishing a robust framework for documenting and analyzing related-party transactions.

Key aspects of the transfer pricing requirements include:

- Preparation and maintenance of local and master files

- Documentation of the transfer pricing methodology used

- Analysis of the functions, assets, and risks involved in controlled transactions

The regulations require entities to maintain contemporaneous documentation supporting their transfer pricing positions. This documentation must be sufficient to demonstrate that their transfer prices are arm's length and that any adjustments required for DMTT purposes have been properly calculated and applied.

Registration and Compliance Framework

The regulations establish a comprehensive compliance framework that balances the need for effective administration with practical business considerations. Filing Constituent Entities must register within 120 days of their transition year beginning and submit annual tax returns within 15 months of their fiscal year-end. The regulations also require maintenance of detailed records, with a standard retention period of five years, extended to ten years for real estate and capital assets.

Advance payments of tax are required on a quarterly basis, calculated either using a prior year method or a current year method, providing some flexibility in managing cash flow implications. The regulations include a proportionate penalty regime designed to encourage compliance while recognizing that some non-compliance may be inadvertent or due to reasonable cause.

This comprehensive framework reflects Bahrain's commitment to implementing the global minimum tax while providing businesses with practical mechanisms to manage their compliance obligations effectively.

Registration and Compliance Framework

The regulations establish a comprehensive compliance framework with specific timing requirements for registration. For most entities, registration must be completed within 120 days from the first day of their Transition Year. However, there is an important exception - where an MNE Group meets the Revenue Test for at least two of the four Fiscal Years immediately preceding the DMTT Law's effective date (January 1, 2025), the Filing Constituent Entity must submit its registration application within 30 days of this date. This accelerated timeline ensures early compliance from groups that clearly fall within the scope of the regulations from day one.

For example, if an MNE Group's consolidated revenue exceeded €750 million in both 2022 and 2023, its Bahrain Filing Constituent Entity would need to register by January 30, 2025, rather than waiting for the standard 120-day period.

The regulations also require ongoing monitoring and updating of registration information. Any changes to the information provided in the registration application (except for financial information) must be notified to the National Bureau for Revenue within 30 days of the change occurring. This ensures that the tax authority maintains current and accurate information about in-scope entities.

Post-registration, entities must navigate various compliance obligations:

- Annual tax returns must be filed within 15 months of fiscal year-end

- Records must be maintained for five years (extended to ten years for real estate and capital assets)

- Quarterly advance tax payments are required, calculated using either prior year or current year methods

- Specific documentation requirements apply for transfer pricing, elections, and other aspects of the DMTT

The penalty regime supports this framework with graduated penalties for various types of non-compliance, including late registration, late filing, incorrect returns, and record-keeping violations. These penalties are designed to encourage timely compliance while recognizing that some non-compliance may be inadvertent or due to reasonable cause.

Tax Return Filing Requirements

The DMTT regulations establish a comprehensive tax return filing system. The Filing Constituent Entity must submit a tax return within 15 months from the last day of the reporting fiscal year. The tax return comprises two key components:

1.Tax Computation Schedule: This includes a self-assessment of tax due to the National Bureau for Revenue (NBR) for the fiscal year, incorporating detailed calculations of Effective Tax Rate and any applicable adjustments.

2.Information Schedule: This contains data about all Constituent Entities, Joint Ventures, and Joint Venture Subsidiaries within the MNE Group, including those located outside Bahrain.

Interestingly, the regulations provide flexibility in filing requirements. A Filing Constituent Entity may submit a tax return containing only the Tax Computation Schedule if another entity in the group has submitted a compliant Information Schedule in a jurisdiction that has a Qualifying Competent Authority Agreement with Bahrain. However, the NBR retains the right to request supplementary information if needed.

Documentation Requirements

The regulations mandate comprehensive record-keeping, including:

Financial Records:

- Balance sheets and profit/loss accounts

- Records of wages and salaries

- Fixed asset registers

- Inventory records

Supporting Documentation:

- Correspondence and contracts

- Calculation methodologies and supporting workpapers

- Transfer pricing documentation (local and master files)

- Evidence supporting any elections made

These records must be maintained in either Arabic or English. Where documents exist in other languages, the NBR may request certified translations.

Election Framework

The DMTT regulations provide for various elections that can significantly impact tax outcomes. These elections fall into two categories:

Five-Year Elections:

- Stock-based compensation treatment

- Foreign exchange hedge elections

- Fair value accounting elections

- Consolidation adjustments

Annual Elections:

- De minimis exclusion

- Debt release treatment

- Loss elections

- Safe harbor applications

Each election must be made within specified timeframes and in the prescribed manner. Once made, five-year elections cannot be revoked during the five-year period except in specific circumstances.

Penalty Framework

The regulations incorporate a structured penalty regime designed to ensure compliance:

Administrative Penalties:

- Late registration: Up to BHD 10,000

- Failure to submit tax returns: Up to BHD 20,000

- Incorrect information: Up to BHD 15,000

- Record-keeping violations: Up to BHD 5,000

Tax Evasion Penalties: More severe penalties apply for deliberate non-compliance or tax evasion, including potential criminal proceedings in serious cases.

Payment and Collection

The regulations establish a structured payment system including:

1.Advance Payments: Quarterly installments based on either:

- Prior Year Method: Based on previous year's tax liability

- Current Year Method: Based on estimated current year liability

2.Final Settlement: Any remaining tax must be paid within 15 months of the fiscal year-end

3.Refund Mechanism: Where excess tax has been paid, entities can:

- Request a refund

- Carry forward the credit against future liabilities

The NBR must process valid refund claims within 30 days of approval, though it may offset refunds against other outstanding tax liabilities.

Appeals and Dispute Resolution

The regulations provide a structured dispute resolution mechanism:

1.Initial Review: Taxpayers can request a review of NBR decisions within 30 days

2.Tax Objections Committee:

- Independent committee to hear appeals

- Must issue decisions within specified timeframes

- Decisions binding unless appealed to courts

3.Judicial Appeal: Right to appeal committee decisions to competent courts within 60 days

This comprehensive framework aims to provide certainty while ensuring fairness in the application of the DMTT regime. The clear procedural requirements, coupled with robust appeal mechanisms, reflect Bahrain's commitment to implementing a sophisticated tax system aligned with international standards.

The operational challenges associated with Bahrain's DMTT implementation reflect the need for enhanced processes, tools, and expertise to address complexities such as cross-jurisdictional data integration, compliance with Bahrain-specific adjustments, and system limitations for top-up tax calculations. Rigorous monitoring and reporting requirements further underscore the importance of robust internal controls to meet these regulatory demands effectively. Addressing these challenges requires a focus on accuracy and adaptability in managing GloBE income, Covered Taxes, and compliance documentation.

Looking ahead, businesses can strengthen their preparedness by investing in internal controls and reporting frameworks, upskilling tax teams to navigate Bahrain's DMTT-specific requirements, and engaging proactively with updates from the National Bureau for Revenue. Conducting dry-run calculations and audits will be crucial in identifying gaps and ensuring compliance before full implementation. By adopting these measures, organizations can align with global tax standards while maintaining operational efficiency in Bahrain's evolving tax landscape.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice

Contributor

Related Posts

@@PLUGINFILE@@/Transfer%20Pricing%20in%20the%20Cryptocurrency%20Space%20Global%20Perspectives%...

Read More

@@PLUGINFILE@@/Navigating%20the%20Complex%20Web%20of%20Transfer%20Pricing%2C%20Customs%20%20VA...

Read More