LISTEN TO THIS ARTICLE

IFRS Accounting for Property Development

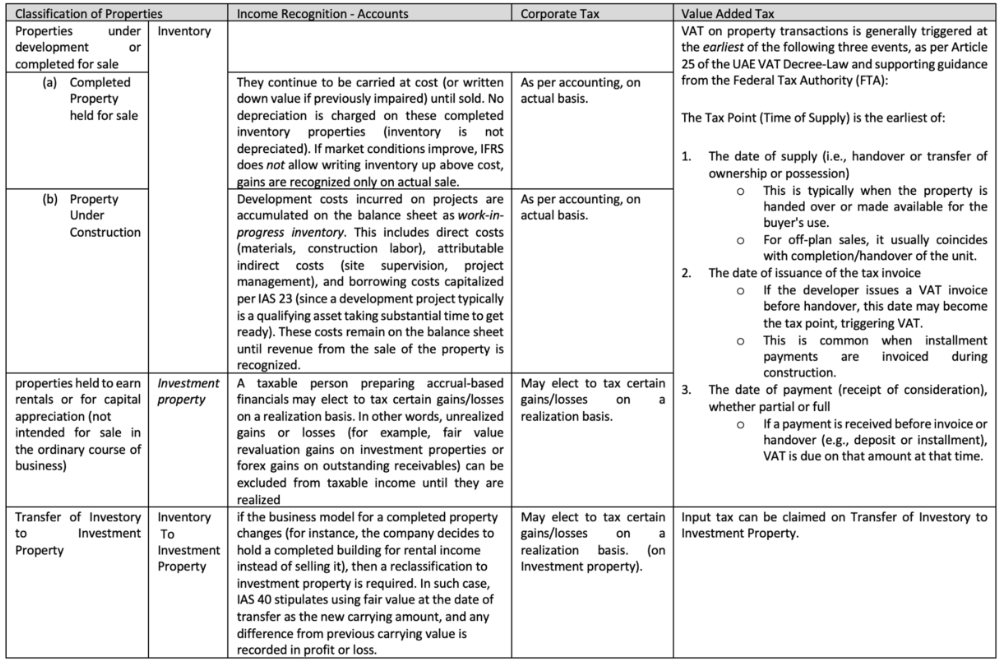

Classification of Properties: Under IFRS, a property development company must distinguish between properties held for sale and those held for long-term investment.

Properties under development or completed for sale (whether residential or commercial units) are treated as inventory under IAS 2. These are recorded at cost during construction (including land, development costs, and eligible borrowing costs) and carried at the lower of cost or net realizable value.

In contrast, properties held to earn rentals or for capital appreciation (not intended for sale in the ordinary course of business) are classified as investment property under IAS 40. For example, if the company decides to retain a completed retail unit for leasing rather than sale, that unit would be transferred from inventory to investment property at fair value, with any resulting gain or loss recognized in profit or loss (since IFRS requires using fair value as deemed cost on transfer to investment property).

Property Under Construction (Inventory): Development costs incurred on projects are accumulated on the balance sheet as work-in-progress inventory. This includes direct costs (materials, construction labor), attributable indirect costs (site supervision, project management), and borrowing costs capitalized per IAS 23 (since a development project typically is a qualifying asset taking substantial time to get ready). These costs remain on the balance sheet until revenue from the sale of the property is recognized. Selling and marketing costs (e.g. sales commission) are not capitalized into inventory; instead, if they are incremental costs to obtain a sales contract, IFRS 15 allows capitalizing them as a contract cost asset to be amortized upon revenue recognition, otherwise they are expensed as incurred. All general administrative or overhead costs not directly related to a specific project are expensed in the period. The company should also test work-in-progress inventory for impairment – if the expected selling price (minus selling costs) of a development falls below its carrying cost, the inventory is written down to that net realizable value under IAS 2.

Completed Properties (Held for Sale): Once construction is finished, any unsold units remain as inventory (finished goods). They continue to be carried at cost (or written down value if previously impaired) until sold. No depreciation is charged on these completed inventory properties (inventory is not depreciated). If market conditions improve, IFRS does not allow writing inventory up above cost, gains are recognized only on actual sale. However, if the business model for a completed property changes (for instance, the company decides to hold a completed building for rental income instead of selling it), then a reclassification to investment property is required. In such case, IAS 40 stipulates using fair value at the date of transfer as the new carrying amount, and any difference from previous carrying value is recorded in profit or loss. For example, if a completed office building (initially held as inventory at cost AED 50M) is now to be leased out, and its fair value is AED 60M, the company would reclassify it as investment property and recognize a gain of AED 10M in income at the date of change in use.

Revenue Recognition (Income) and Expense Matching: A property developer’s main income is from selling units. Under IFRS 15 – Revenue from Contracts with Customers, revenue is recognized when the developer satisfies its performance obligation by transferring control of the property to the buyer. In Dubai’s typical off-plan sales, this transfer of control usually occurs at handover/completion (when the unit is delivered and title is transferred), meaning revenue is recognized at a point in time (not progressively), unless specific criteria for over-time recognition are met. IFRS outlines that revenue can be recognized over time (similar to a percentage-of-completion method) only if the buyer controls the asset as it is created or if the developer has an enforceable right to payment for performance to-date with no alternative use of the asset (per IFRS 15.35). In many Dubai off-plan contracts, the developer retains ownership and the buyer typically cannot dictate changes to the construction; furthermore, if the buyer defaults the developer often only keeps a penalty rather than payment for work done. As a result, the IFRS Interpretations Committee concluded that such real estate contracts generally do not meet the criteria in IFRS 15.35, so revenue is taken at a point in time (handover). For instance, if a customer signed an off-plan sale contract in 2024 and made progress payments, but the unit is delivered in 2025, the developer would record no revenue in 2024 (all payments received are carried as contract liabilities/deposits) and then recognize the full sale revenue in 2025 when the unit is completed and handed over.

Matching of Costs to Revenue: All the accumulated costs of a unit (land allocation, construction, etc.) are expensed as cost of sales in the same period when the related revenue is recognized. This matches income and expense, reflecting true project profit. Using the previous example, the costs incurred in 2024 for the unit remain in inventory at year-end 2024. In 2025, when the revenue of (say) AED 2 million is recorded at handover, the corresponding cost of the unit, suppose AED 1.5 million, is released from inventory to cost of sales. The gross profit of AED 0.5 million is thus reflected in 2025. Until sale, any unsold completed units continue to sit in inventory. Income from rentals or other services (if the company temporarily leases some units or provides property management services) would be recognized under IFRS 15 or IFRS 16 as appropriate (rental income from operating leases is recognized on a straight-line basis over the lease term, separate from the sale revenue). Additionally, if any impairment or Net Realizable Value (NRV) write-down was recorded previously (due to market value dropping below cost), that expense would be reversed in the income statement if conditions recover (to the extent permitted by IAS 2) when the unit is sold at a higher price than its written-down value.

UAE Corporate Tax Considerations

Overview and Tax Rate: The UAE’s Federal Corporate Tax (CT) came into effect for financial years starting on or after 1 June 2023 under Federal Decree-Law No. 47 of 2022. A UAE LLC that is not a Qualifying Free Zone Person is subject to the standard corporate tax regime, i.e. 0% tax on the first AED 375,000 of taxable profit, and 9% on taxable profit above that threshold. (Free zone companies that qualify enjoy 0% on certain income, but this does not apply here.) The property developer must register and file returns for corporate tax and ensure compliance from the first taxable period. It’s important to note that taxable profit is based on the accounting profit per IFRS with certain adjustments as specified by the law. Below we address specific aspects of income recognition and timing that affect a developer:

Accrual vs. Realization Basis of Accounting: The UAE CT law mandates use of the accrual basis for computing taxable income, meaning profits are taxed based on earned revenue and incurred expenses per the financial statements, not just cash flows. However, the law provides an important exception for unrealized gains or losses.

A taxable person preparing accrual-based financials may elect to tax certain gains/losses on a realization basis. In other words, unrealized gains or losses (for example, fair value revaluation gains on "investment properties") can be excluded from taxable income until they are realized.The Corporate Tax law explicitly states that unrealized profits or losses reported in the income statement shall not be taken into account in taxable income calculation. For a developer, this means if you have, say, an investment property measured at fair value with an unrealized gain of AED 2 million in IFRS profit, that gain can be excluded from the tax computation until the property is actually sold (realized). By default, the accounting profit is the starting point for tax, so most revenues/expenses recognized under IFRS (on an accrual basis) will be included in taxable income in that period. The company should make the relevant elections (as per Article 20 of the law) in its tax return to defer taxation of unrealized items. Note that revenue from property sales will generally be taxed on an accrual basis in line with IFRS recognition, there is no cash-basis deferral for realized sale proceeds except for the unrealized accounting adjustments described.

Properties Sold in a Previous Year: If a property sale was recognized in the previous financial year under IFRS, that profit would have been taxable in that prior period’s corporate tax return (assuming the period was within the CT effective timeline). There is no double taxation on receipt of cash in a later year. For example, if a unit’s sale was completed and accounted for in December 2024, it will be included in taxable income for the 2024 tax period, even if some payments from the buyer are collected in 2025. The developer does not wait to pay tax until cash is fully received; tax is aligned with the accrual recognition of revenue. Conversely, if an off-plan unit was sold (contract signed and perhaps partly paid) in 2023 but did not meet IFRS revenue recognition criteria until completion in 2024, then the profit is not reflected in the 2023 accounts and thus not in 2023 taxable income. Only in 2024, when the revenue is recorded in the books, will it become taxable. UAE CT has no retroactive taxation for deals that closed before the law’s start date, for instance, profits from sales completed in 2022 (before CT) remain outside the scope of CT. The main point is that taxable income follows the accounting period of revenue recognition, so any sale recognized “last year” is taxed last year, and amounts recognized this year are taxed this year. The company should ensure proper cut-off: if, say, a building finished in Jan 2025 but contracts were signed in 2024, the revenue (and taxable profit) will likely fall in 2025 when control transfers under IFRS. (If any doubt, the FTA would expect consistency with accounting unless a specific provision applies.)

Income Recognition for Ongoing vs. Completed Projects: A key scenario for developers is projects spanning multiple years. Under IFRS (and thus initially for tax), a project might not generate any revenue until completion, even though significant costs are incurred in earlier periods. This can lead to accounting losses in early years (due to administrative expenses or interest that cannot be capitalized) and a large profit in the completion year. UAE CT allows carry-forward of tax losses (generally up to 75% utilization per year, with no expiry, subject to continuity of ownership conditions), which helps smooth the taxable impact. For instance, if in 2024 the developer reports a accounting/tax loss of AED 5 million (perhaps from overheads with no revenue yet), that loss can be carried forward to offset future taxable profits. In 2025, when a project completes and generates, say, AED 15 million profit, the company can use the brought-forward loss (AED 5M) to reduce the taxable amount to AED 10 million for 2025 (subject to the 75% limit and other conditions). There is no requirement under UAE CT to use percentage-of-completion accounting for long-term projects, the tax follows the accounting treatment, which for most Dubai developments is point-in-time recognition. The law does not force developers to accelerate income for tax purposes before IFRS would recognize it. However, the company should be mindful of the realization principle when it does use IFRS estimates: if, hypothetically, a developer met IFRS criteria to recognize revenue over time (and so included partially completed project profits in its books), those profits would be taxed in the year recognized. On the flip side, if IFRS defers revenue entirely to project completion, the tax will likewise be deferred.

In summary, the UAE CT regime is intended to align closely with IFRS profits, with notable adjustments such as excluding unrealized gains and allowing loss offsets. The developer should maintain proper documentation for any timing differences (e.g. elections to defer unrealized gains under Article 20). All accounting policies (revenue recognition, expense capitalization, etc.) should be applied consistently to avoid any risk of the FTA challenging the timing of income. It’s also worth noting that interest and certain other expenses have deductibility limits (e.g. net interest expense is deductible only up to 30% of EBITDA in some cases), and transactions with related parties must meet arm’s-length standards (transfer pricing), these could be relevant if the LLC is funded by shareholder loans or transacts with related entities.

VAT Implications for Property Developers

Value Added Tax (VAT) in the UAE (implemented via Federal Decree-Law No. 8 of 2017 and its Executive Regulations) has specific rules for real estate developers. The VAT treatment depends on the type of property (residential vs commercial) and the nature of the supply (sale vs lease), as well as timing (first supply vs subsequent). Key considerations include output VAT on sales/leases and input VAT recovery on construction costs:

VAT on property transactions is generally triggered at the earliest of the following three events, as per Article 25 of the UAE VAT Decree-Law and supporting guidance from the Federal Tax Authority (FTA):

The Tax Point (Time of Supply) is the earliest of:

- The date of supply (i.e., handover or transfer of ownership or possession)This is typically when the property is handed over or made available for the buyer's use.For off-plan sales, it usually coincides with completion/handover of the unit.

- The date of issuance of the tax invoiceIf the developer issues a VAT invoice before handover, this date may become the tax point, triggering VAT.This is common when installment payments are invoiced during construction.

- The date of payment (receipt of consideration), whether partial or fullIf a payment is received before invoice or handover (e.g., deposit or installment), VAT is due on that amount at that time.

VAT on Residential vs. Commercial Units: The sale or lease of residential property is treated differently from commercial property:

- Residential Property: First supply of a new residential building (e.g. the first sale of an apartment or villa, or the first lease to a tenant) within 3 years of its completion is zero-rated (0% VAT). “First supply” covers the first time the property is sold or rented after construction, provided this happens within 3 years of the building’s completion date. Because it is zero-rated, the developer does not charge VAT to the buyer/tenant on that first sale/lease, but critically, is entitled to full input VAT recovery on related costs. For example, if the company completes a residential tower in 2025 and sells units to end-users in 2025-2026 (within three years of completion), it will issue invoices with 0% VAT, effectively no VAT collected from customers, but all the VAT incurred on construction (5% on contractor bills, materials, etc.) is recoverable in its VAT returns. After the first supply, any subsequent supplies of the residential property are exempt from VAT. This means if the first buyer later resells the home, those transactions have no VAT charged but also correspondingly no input VAT recovery on costs associated with those supplies (since they are exempt).

- Commercial Property: All sales and leases of commercial properties (shops, offices, warehouses, etc.) are subject to 5% VAT (standard rate) regardless of first or subsequent supply. The developer must charge 5% output VAT on the selling price or rent. In return, input VAT on expenses related to commercial supplies is fully recoverable. For instance, if the company develops a retail center or office building, all the VAT on construction costs can be reclaimed, and when it sells the units or rents them out, it will add 5% VAT on those invoices. Buyers of commercial property who are VAT-registered can typically also recover the VAT they pay (e.g. a buyer of a shop unit for business use reclaims the 5% as input). Bare land (undeveloped land) is an exempt supply, whereas partially developed or serviced land is treated as commercial (taxable at 5%) per the VAT rules for land.

VAT liability varies by property type: new residential property is 0% (zero-rated) for the first supply, existing residential (subsequent sale) is exempt, and commercial property is standard-rated 5%.

Input VAT Recovery and Mixed-Use Developments: A property developer incurs significant VAT on construction and development costs (5% on contractor payments, materials, consultancy, etc.).

Recovering this input VAT depends on the nature of the output supplies:

- If a project is wholly commercial, or the first supplies of all units are taxable (including zero-rated), then essentially all input VAT is recoverable. For a purely residential development, the first transfer is zero-rated, so the developer can recover all input VAT on construction. There is no need for apportionment during the initial sale phase because zero-rated supplies are considered taxable supplies (at 0%). For example, building a residential compound and selling each villa first-hand to buyers will allow the developer to claim back the VAT on build costs in full, since those sales are zero-rated supplies.

- If a developer holds residential units beyond the first supply or engages in exempt rentals, input VAT apportionment comes into play. After the first supply, any ongoing expenses related to exempt supplies (like maintenance of rented apartments where the rent is exempt) would have non-recoverable VAT. If the company has a mix of taxable and exempt outputs, it must use the standard input tax apportionment formula as per UAE VAT law (recoverable proportion based on ratio of taxable supplies to total supplies, or any other method approved by FTA). Mixed-use developments (e.g. a tower with retail shops at ground floor and apartments above) require careful tracking of costs and their attribution. VAT on costs directly attributable to taxable portions (commercial units or the zero-rated first supply of residential units) is fully recoverable, while VAT on costs solely for exempt portions (e.g. building amenities that will only be used in exempt residential rentals) would be blocked. Common costs that affect both can be prorated. The FTA’s Real Estate Guide provides that input VAT on developing a residential building is initially recoverable in full if it relates to the zero-rated first supply. If the developer later makes exempt supplies of that building (say it retains some units as rentals after selling others), there is generally no claw-back on the originally recovered input VAT for the zero-rated first supply. (The UAE does not apply a capital goods scheme adjustment for a change of use from zero-rated first supply to exempt subsequent use in the case of residential property, the initial recovery stands because it was correct based on the first supply being taxable.) However, any new costs incurred after the first supply in relation to exempt rents or maintenance would have non-recoverable VAT.

- Example: Suppose the company develops a mixed-use building with a shopping area (commercial) and apartments (residential). It incurs AED 10M+VAT in construction costs for the commercial part and AED 20M+VAT for the residential part. It sells the new apartments to buyers (zero-rated) and leases the retail space to businesses (standard-rated). The developer can claim all input VAT on the whole AED 30M project costs. It will charge 5% VAT on the retail rents and 0% on the apartment sales. Now, assume 2 years later it is still holding a couple of unsold apartments and decides to rent them out to tenants. Those rental incomes are exempt (since they occur after the first supply period). The company will not charge VAT on that rent, and going forward, it cannot recover VAT on expenses related to those rented apartments (e.g. a repair in those units) because those expenses now relate to an exempt supply. But the VAT it paid on the original construction remains fully claimed (no adjustment) because at the time of first supply (the initial sale which was zero-rated) the input VAT was rightfully recovered.

In summary, VAT for developers in UAE is structured to support development of new residential properties (via zero-rating) and to tax commercial real estate transactions normally. The developer should ensure VAT compliance in invoicing (charging the correct VAT rate on each sale/lease) and in VAT reporting (apportioning input tax correctly).

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

The Growing Importance of Corporate Service Providers Corporate Service Providers (CSPs) play a key ...

Read More

The UAE has introduced a new top-up tax regime as part of its commitment to global tax reforms und...

Read More

Qatar, 05 January, 2026: The General Tax Authority (GTA) has announced that the tax return f...

Read More