UAE, 14 April, 2025 : The UAE Federal Tax Authority (FTA) has issued a new clarification (VATP041) on the VAT implications of SWIFT messages used in financial transactions.

Please be informed that Public Clarification VATP041 replaces Public Clarification VATP036.

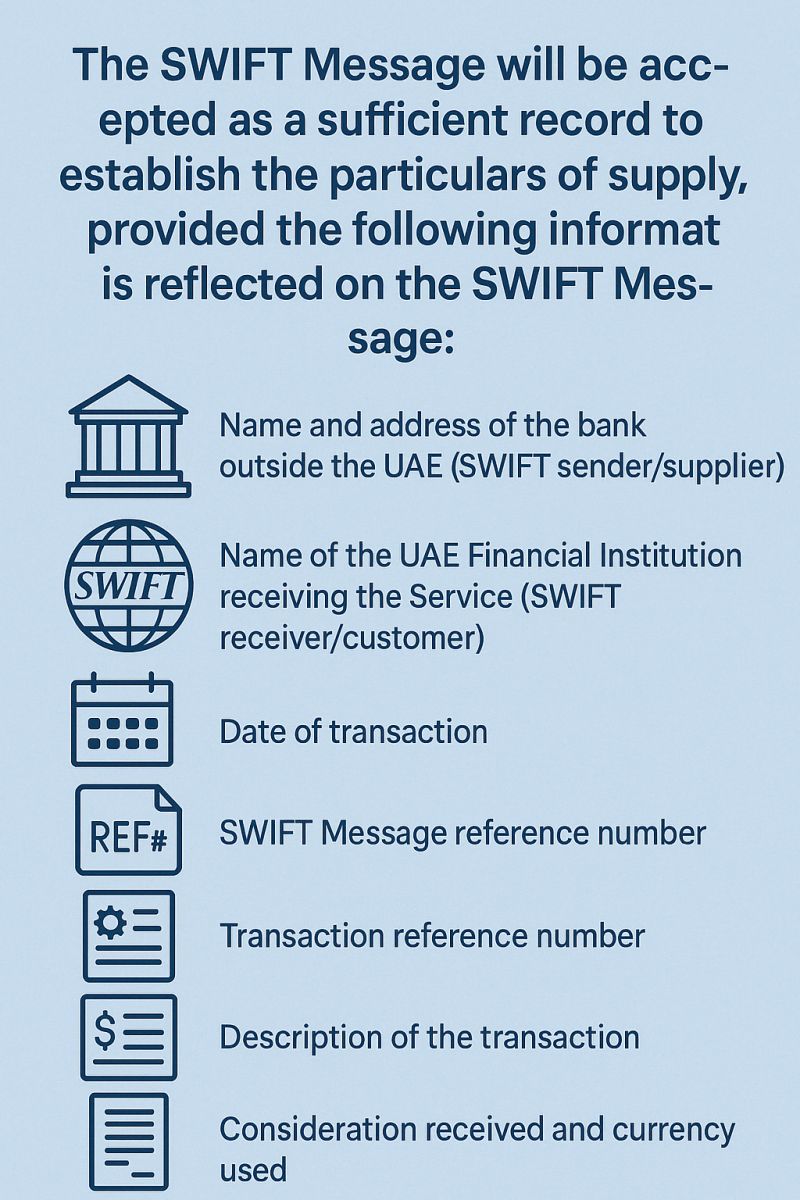

Released on 11 April 2025, the clarification confirms that fees for SWIFT messaging services are considered taxable under UAE VAT law, whether provided locally or cross-border.

The FTA urges financial institutions to review their VAT compliance in line with this guidance, as part of its broader efforts to ensure consistent VAT application in the financial sector.

Source : www.tax.gov.aeRelated Posts

Anti-Money Laundering (AML) in the UAE is a core component of the country’s financial and economic...

Read More

In an era where financial transactions occur at the speed of light, the role of an Anti-Money Launde...

Read More

@@PLUGINFILE@@/ttsmaker-file-2025-11-13-12-36-37.mp3Listen to this ArticleIn today’s business envi...

Read More