LISTEN TO THIS ARTICLE

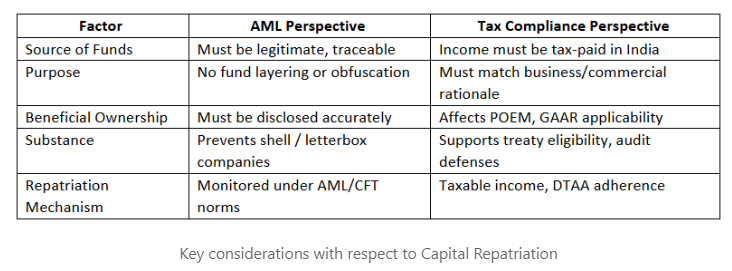

Anti-Money Laundering (AML) and tax compliance are two closely aligned domains in the global financial regulatory framework. With increased scrutiny over cross-border transactions, countries are tightening their regimes to prevent illicit fund flows, base erosion, and profit shifting. The India-UAE corridor is one of the most active in terms of trade, investment, and capital movement. This short article explores how AML and tax compliance intersect, with a specific focus on capital repatriation and profit earning between India and the UAE.

Both AML and tax regulations aim to foster financial integrity, transparency, and legality. Many jurisdictions, including India and the UAE, treat tax evasion as a predicate offense to money laundering. This alignment strengthens enforcement against illicit fund flows under both - domestic laws and international cooperation platforms such as the Financial Action Task Force (FATF) and Common Reporting Standards (CRS).

Regulatory Overview

India:

- AML: Prevention of Money Laundering Act (PMLA), 2002.

- Tax: Income Tax Act, 1961; Foreign Exchange Management Act (FEMA), 1999.

- Reporting: Liberalized Remittance Scheme (LRS), Overseas Direct Investment (ODI) regulations.

UAE:

- AML: Federal Decree-Law No. 20 of 2018.

- Tax: UAE Corporate Tax Law (effective 2023), Economic Substance Regulations.

- Reporting: Ultimate Beneficial Ownership (UBO) disclosure, AML-CFT reporting obligations.

India to UAE Capital Repatriation

Example: An Indian company invests $1 million in a UAE subsidiary to expand its logistics business.

Compliance Requirements:

- ODI filing under FEMA (ODI) Rules, 2022

- Tax-paid source of funds

- UBO disclosure under AML norms

- Economic Substance demonstration by UAE entity

India and the UAE are both signatories to the OECD's Common Reporting Standard (CRS), which facilitates the automatic exchange of financial account information between jurisdictions. This means:

- Financial institutions in India and the UAE are obligated to identify and report accounts held by non-resident individuals and entities.

- The reported data includes account balances, interest, dividends, and proceeds from the sale of financial assets.

- This exchange enables tax authorities to detect undeclared income and offshore assets, strengthening both AML enforcement and tax compliance.

In the globalized economy, AML and tax compliance are no longer separate silos. They converge sharply when capital moves across borders. In specific to India and UAE, both countries have enhanced scrutiny mechanisms to detect misuse of cross-border structures, and capital repatriation is a critical focus area. Businesses must ensure transparent, well-documented, and lawful transactions to avoid regulatory risks and build sustainable international operations.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

The Growing Importance of Corporate Service Providers Corporate Service Providers (CSPs) play a key ...

Read More

The UAE has introduced a new top-up tax regime as part of its commitment to global tax reforms und...

Read More

Qatar, 05 January, 2026: The General Tax Authority (GTA) has announced that the tax return f...

Read More