LISTEN TO THIS ARTICLE

In the UAE, VAT regulations differentiate between Reimbursement and Disbursement, which impacts the VAT treatment of salary reimbursements between group companies. This study examines the implications of salary reimbursements in cases where an employee of one company (Company A) works for another company (Company B) within the same corporate group but outside a VAT tax group, particularly for cross-border transactions.

- Reimbursement is a taxable supply, where one entity incurs costs and later recovers them from another party, affecting VAT obligations.

- Disbursement is a non-taxable transaction where a company pays an expense on behalf of another entity, acting as an agent.

For salary reimbursements, the distinction depends on:

1. Who is the employer of record?

2. Who has control and supervision over the employee?

3. Is there a profit element added to the reimbursement?

When an employee works for another group company:

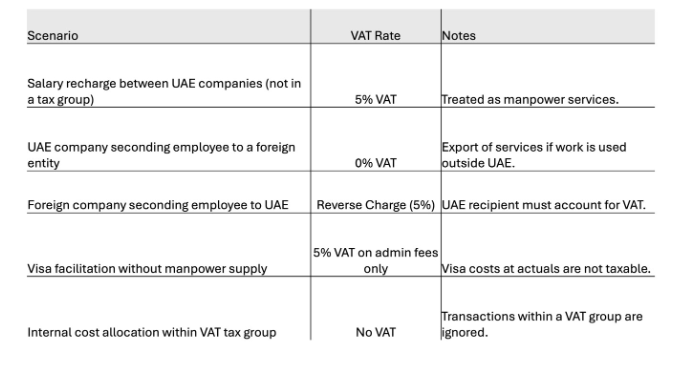

If the employer (Company A) incurs salary expenses and recharges these costs to Company B, it is generally classified as a supply of manpower services, subject to VAT.

As an exception to the above, a supply would not be regarded as a supply of manpower services but rather as a supply of visa facilitation services if ALL of the requirements set out below are met.

1. The employment visa holder (“Facilitator”) and the Customer are part of the same corporate group, but are not part of the same tax group.

2. The Facilitator’s business activities do not include the supply of manpower.

3. The Facilitator is not responsible for any of the obligations related to the employee.

4. The Facilitator sponsors these employees to exclusively work for, and under the supervision and control, of the Customer.

If Company A only facilitates the visa sponsorship but does not control or assign work, this may qualify as visa facilitation services, which have different VAT treatment.

- If Company A is recharging salaries and employment costs without markup, it may be treated as a reimbursement but may still attract VAT and is taxable at 5% VAT.

- If Company A is supplying employees to Company B (i.e., secondment or outsourcing), this constitutes manpower services and is taxable at 5% VAT.

- If Company A is merely facilitating visa-related matters without assigning or controlling employees, it is considered visa facilitation services, where VAT is applicable only on administrative fees.

Cross Border Implications:

When salary reimbursements involve entities outside the UAE:

- UAE-Based Employer Seconding Employees to a Foreign Entity:If the salary reimbursement is considered manpower services, it may qualify as an export of services and be subject to 0% VAT if the foreign recipient has no presence in the UAE. If the services are used within the UAE, VAT at 5% applies.

- Foreign Entity Seconding Employees to UAE-Based Company:The reverse charge mechanism (RCM) applies, meaning the UAE company (recipient of services) must account for VAT on behalf of the foreign supplier. VAT input tax recovery is possible if the company is making taxable supplies.

VAT treatment depends on whether companies are part of a VAT Tax Group:

- Part of VAT Tax Group: Transactions between members are ignored for VAT purposes.

- Outside a VAT Tax Group: Salary recharges may be considered for taxability as per details provided above.

Summary of Key VAT Treatments

What are important actions to be undertaken for the decision/ evaluation:

- Review Contracts – Define whether the transaction is manpower supply or mere cost recovery.

- Analyze Work Locations – Essential for applying zero-rating on exports.

- Review VAT Grouping – to evaluate VAT on intra-group transactions.

- Apply Reverse Charge Mechanism – When receiving foreign seconded employees.

- Evaluate the Agent Principe relationship - Link provided for an important element to look at related to Article (9) i.e. Supply via Agent The Supply of Goods and Services through an agent acting in the name of and on behalf of a principal is considered to be a supply by the principal and for his benefit. The Supply of Goods and Services through an agent acting in his name is considered to be a direct supply by the agent and for his benefit.

6. Seek Advance Rulings – If uncertainty exists, apply for FTA clarifications.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

The Growing Importance of Corporate Service Providers Corporate Service Providers (CSPs) play a key ...

Read More

The UAE has introduced a new top-up tax regime as part of its commitment to global tax reforms und...

Read More

Qatar, 05 January, 2026: The General Tax Authority (GTA) has announced that the tax return f...

Read More