Listen this Article

During a recent discussion, a colleague raised an interesting point:

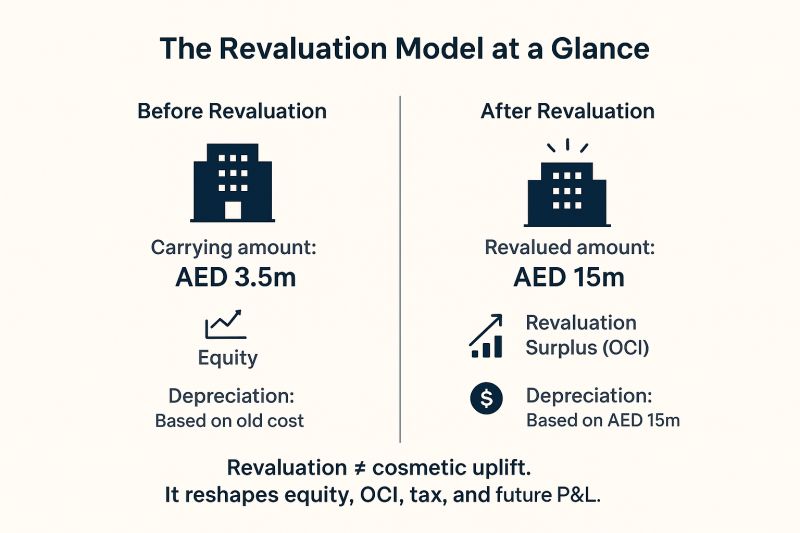

“Our office building was purchased for AED 5 million in 2008. Today, the market value is around AED 15 million, yet our balance sheet still reflects a depreciated carrying amount of only AED 3.5 million. Does this not create a weaker impression for investors?”This is where the Revaluation Model under IAS 16 becomes highly relevant. Unlike the cost model, the revaluation model allows companies to present assets at fair value, reflecting a closer alignment with market realities. However, the implications extend far beyond simply adjusting the carrying amount of an asset.

Key considerations include:

-

Upward Revaluation

-

Any increase in value is recognised in Other Comprehensive Income (OCI) and accumulated in a Revaluation Surplus under equity.

-

Future depreciation is recalculated based on the revalued amount, resulting in higher depreciation charges going forward.

-

-

Downward Revaluation

-

Any decrease in value is charged directly to the Profit and Loss account, unless a previous surplus for that asset exists. In such cases, the reduction is first applied against the surplus.

-

-

Deferred Tax Implications

-

Revaluations create temporary differences between accounting and tax bases.

-

A Deferred Tax Liability (DTL) must be recognised against OCI, reducing the net revaluation surplus reported in equity.

-

The broader impact

While revaluation can make the balance sheet appear stronger by reflecting a higher asset base, it also alters key financial indicators. Equity increases, gearing ratios may improve, and the company appears more robust to investors or lenders. However, the trade-off comes in the form of increased depreciation expenses in future years, which reduce reported profitability.

Conclusion

Revaluation under IAS 16 is not merely a cosmetic exercise. It influences equity, OCI, deferred tax positions, and future profitability. For this reason, CFOs often approach revaluation as a strategic decision. It can be used to enhance the company’s financial presentation to stakeholders, but it must always be weighed against the longer-term implications for earnings and financial performance.

Question for reflection: Should companies regularly revalue their assets to reflect fair market value, or should they adhere to historical cost for the sake of stability and comparability?

Author: CA Ramesh Jha

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

@@PLUGINFILE@@/ttsmaker-file-2025-10-24-12-6-22.mp3Listen to this ArticleIt was the first quarter af...

Read More

@@PLUGINFILE@@/ttsmaker-file-2025-9-1-14-27-36.mp3Listen This ArticleWhen the UAE Corporate Tax...

Read More

Executive Summary As global tax environments evolve and regulatory scrutiny intensifies...

Read More