Listen to This Article

1. What issue does this document address? The document addresses the transition of excise tax on sweetened drinks in the UAE from the current ad valorem model (percentage of price) to a tiered volumetric model (based on sugar/sweetener content per 100ml).

It clarifies:

❖ How sweetened drinks will be defined going forward.

❖ How tax will be calculated depending on sugar levels.

❖ Which drinks are excluded (e.g., 100% natural juices, milk products, baby formula, special dietary/medical drinks).

❖ The administrative requirements for businesses (lab testing, product registration, transitional stock rules).

❖ Effective date expected from 1 January 2026.

2. What was the status of excise tax before this clarification?

Before this change, all excise goods (including sweetened drinks) were taxed using an ad valorem method:❖ A fixed percentage (50%) of the “Excise Price” (retail price excluding VAT, or standard price list). EXTP012

❖ For example: a sweetened drink bottle with an excise price of AED 2 was taxed at 50% = AED 1 excise tax, regardless of whether it contained 3g or 15g sugar per 100ml.

❖ Carbonated drinks were a separate category subject to excise regardless of sugar content.

So the old system taxed based on price, not sugar content, and did not differentiate between high- and low-sugar products.

3. What problem is this document solving?

The current ad valorem method creates issues:❖ It does not encourage manufacturers to reduce sugar content, since tax is the same whether the drink is high or low in sugar.

❖ Drinks with identical sugar content but different retail prices end up taxed differently, which is inconsistent from a public health perspective.

❖ Some drinks with artificial sweeteners only were still subject to excise, even though they contained no sugar.

The new tiered volumetric model solves these by:

❖ Aligning tax with sugar content, incentivizing reformulation toward lower sugar products.

❖ Ensuring fairness: taxation reflects actual health impact, not retail pricing.

❖ Exempting zero-sugar artificially sweetened drinks from excise.

❖ Simplifying categories (removing carbonated drinks as a separate excise group).

In summary:

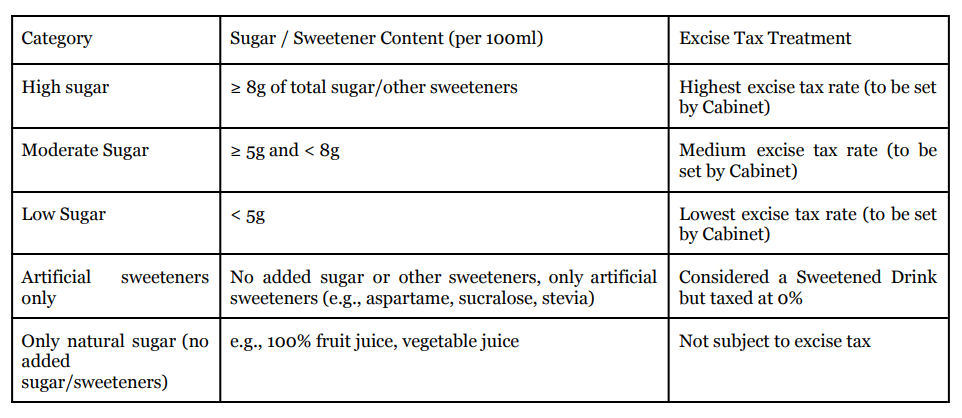

❖ Before: Excise tax = % of retail price (50%), regardless of sugar levels.❖ Now (from 2026): Excise tax = tiered system based on grams of sugar/sweetener per 100ml.

❖ Problem solved: The new model ensures healthier products are taxed less (or zero), and high-sugar drinks are taxed more, aligning with health policy and creating fairness.

Key points:

❖ Carbonated drinks will no longer be a separate category - their tax depends only on sugar content.❖ Lab certification will be required to confirm sugar content.

❖ If no lab report is available, the drink will automatically be treated as high sugar until proven otherwise.

Lets understand this with the help of an example

Excise Tax Example – 500ml Sweetened Drink

❖ Bottle size: 500ml

❖ Sugar content: 6g per 100ml (so total = 30g sugar per bottle)

❖ Excise Price: AED 2 per bottle

Before (Current system – ad valorem, 50%)

❖ Tax = 50% of Excise Price

❖ = 50% × AED 2 = AED 1 excise tax per bottle

Same rate whether the sugar was 3g/100ml or 15g/100ml.

After (From 1 Jan 2026 – tiered volumetric)

❖ Sugar content = 6g per 100ml

❖ Falls into Moderate sugar category (≥5g and <8g/100ml)

❖ Tax rate = To be set by Cabinet for moderate sugar drinks (not yet published).

Example outcome:

● If Cabinet sets Moderate sugar = 30%, then:

○ Tax = 30% × AED 2 = AED 0.60 excise tax per bottle

● If High sugar = 50% and Low sugar = 10%, then this drink would sit in the middle.

Impact

● Current system: Always AED 1 (50%), regardless of sugar.

● New system: Tax depends on sugar content.

○ Low-sugar drinks could be taxed less than AED 1.

○ High-sugar drinks could be taxed more than AED 1.

○ Zero-sugar artificially sweetened drinks = 0 tax.

● In summary: The new model introduces a health-based incentive — reformulating to reduce sugar can lower the tax burden.

Author: CA Mustafa G Daudi

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

The Federal Tax Authority (FTA) of the United Arab Emirates released its comprehensive guide on the ...

Read More

The Fundamental Reform On January 1, 2026, the UAE implemented a comprehensive reform to ...

Read More

The UAE Federal Tax Authority (FTA) has announced a fundamental shift in how it taxes Sweetened Drin...

Read More