Author: Mustafa G Daudi

This is a short update on recent requirement of submitting Declaration of the eligibility of formation of Tax group. FTA has issued a format of declaration for submitting the declaration on below mentioned lines. (attached herewith).

Confirm Eligibility: Declare that all members of the group meet the conditions for being 'Related Parties' under Article 9 and the registration conditions under Article 10 of the VAT Executive Regulations. It specifically confirms that no member is a sole establishment, branch, or foreign company.

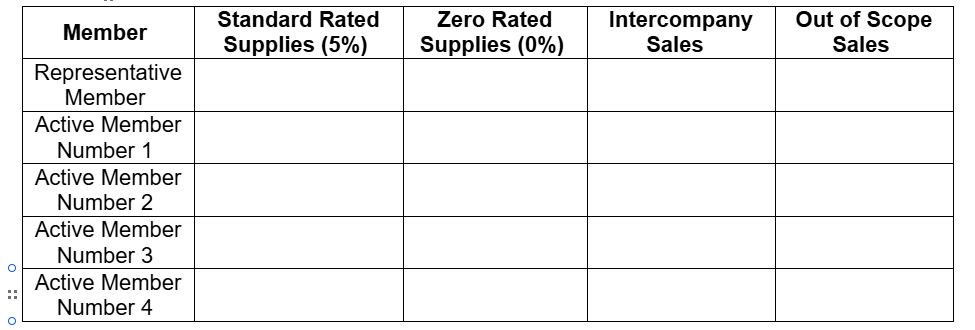

Declare Turnover: Provide a breakdown of the group members' turnover (Standard Rated, Zero Rated, Intercompany, Out of Scope) for the last 12 months

3. Attest Accuracy: Confirm the information is accurate and supported by evidence

Key updates inferred from this declaration are also provided herein below.:

Exclusion of certain entities: Declaration explicitly requires representative member to confirm that the members forming the tax group are not sole establishment, a branch, or a foreign company. Please note that article 9(1) of the Exec. Regulations refers to legal persons whereas Article 10(5)(c) of the Exec. Regulations provides that FTA can refuse to accept the tax group registration request if any member is not a legal member. Further Regulations didn’t explicitly list “sole establishment”, “branch or foreign company” as exclusions in these specific articles.

Declaration to be submitted requires representative member to provide turnover details of members for the previous 12 months period clearly bifurcated into Standard, Zero Rated, InterCompany and out of scope supplies.

Open points which requires clarification.

What about exempt supplies declaration?

What is the periodicity/ frequency of submitting this declaration??

Subject: Declaration of Tax Group Eligibility

I, the undersigned, in my capacity as the Authorized Representative Member [Name / TIN] of [Tax Group Name], hereby declare and confirm the following:

In accordance with the provisions of Article 9 – Related Parties and Article 10 – Registration as a Tax Group of the Executive Regulation of Federal Decree-Law No. 8 of 2017 on Value Added Tax, all members of the Tax Group duly meet the prescribed conditions for registration as a Tax Group.

I confirm that none of the members of the Tax Group is a sole establishment, a branch, or a foreign company.

Article 9 – Related Parties:

1. For the purposes of Tax Group provisions, the definition of Related Parties shall

relate to any two legal persons in instances such as:

a. One Person or more acting in a partnership and having any of the following:

1) Voting interests in each of those legal Persons of 50% or more;

2) Market value interest in each of those legal Persons of 50% or more;

3) Control of each of those legal Persons by any other means.

b. Each of Persons is a Related Party with a third Person.

2. Two or more Persons shall be considered Related Parties if they are associated in

economic, financial and regulatory aspects, taking into account the following:

a. Economic practices, which shall include at least one of the following:

1) Achieving a common commercial objective;

2) One Person’s Business benefiting another Person’s Business;

3) Supplying of Goods or Services by different Businesses to the same

customers.

b. Financial practices, which shall include at least one of the following:

1) Financial support given by one Person’s Business to another Person’s

Business.

2) One Person’s Business not being financially viable without another Person’s

Business.

3) Common financial interest in the proceeds.

c. Regulatory practices, which shall include any of the following:

1) Common management.

2) Common employees whether or not jointly employed.

3) Common shareholders or economic ownership.

Article 10 – Registration as a Tax Group:

8. The Authority may only register a Person as part of a Tax Group under Clause 7 of

this Article if the two following conditions are met:

a. The Person’s Business includes making Taxable Supplies or importing

Concerned Goods or Concerned Services.

b. If all the Taxable Supplies or imports of Concerned Goods or Concerned Services

of the Business by Persons carrying on the Business would have exceeded the

Mandatory Registration Threshold.

Turnover Declaration Letter for the Tax Group

In reference to the above-mentioned subject, kindly note that the "Tax Group Name" has the turnover shown below for the last 12 months:

I hereby declare that the information provided in this disclosure is complete and accurate, and none of the above information is false or misrepresented. This declaration is supported by documentary evidence, including signed and stamped monthly taxable supplies for the last 12 months by the authorized signatory, as well as supporting financial documents (e.g., invoices, LPOs, contracts, agreements…etc).

Authorized Signatory (Signature and Stamp)

Contributor

Related Posts

The Federal Tax Authority (FTA) of the United Arab Emirates released its comprehensive guide on the ...

Read More

The Fundamental Reform On January 1, 2026, the UAE implemented a comprehensive reform to ...

Read More

The UAE Federal Tax Authority (FTA) has announced a fundamental shift in how it taxes Sweetened Drin...

Read More