LISTEN TO THIS ARTICLE

Electronic invoicing is a topic that businesses in the UAE will soon be hearing much more about. Key announcements from the Ministry of Finance include:

e-invoicing legislation will be published in Q2 2025

It will become mandatory for business-to-business (B2B) and business-to-government (B2G) transactions.

The first go-live phase will be June 2026

The UAE intends to implement a "5-corner" model

This article introduces electronic invoicing in plain English and explains why it matters to businesses in the UAE.

Why e-invoicing?

e-invoicing benefits tax authorities and the broader economy. It helps governments improve revenue collection by reducing fraud and evasion. Having more data, and having it faster, helps governments plan and intervene in the market in more targeted ways.

For businesses, e-invoicing aims to simplify processes, promote transparency, and improve information quality within the organization.

Finally, it contributes to greener, more efficient business practices by reducing reliance on paper.

What is e-invoicing?

Traditional invoicing involves a seller providing a paper or PDF invoice to a buyer for purchased goods or services. The government might mandate specific information on the invoice, but the structure can vary. The invoice might be shared physically, by email, or even via WhatsApp.

E-invoices are different:

Structured: They use a specific format designed for software to read correctly (machine-readable vs. human-readable).

Transferred electronically: They are sent using a government-approved process, not ad-hoc methods like mail, WhatsApp, or email.

Shared with the government: They are transferred between buyer, seller, and the government.

It's important to note that a PDF is not an e-invoice.

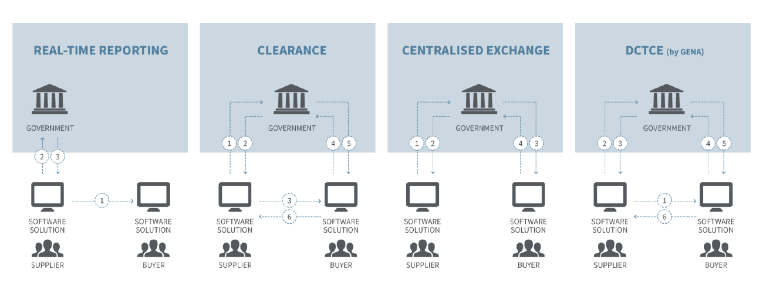

E-invoicing models

Several e-invoicing implementation models exist, each with pros and cons. Some models require government pre-approval of invoices; others don't. Some send invoices directly to buyers; others route them through the government.

The UAE model

The UAE's approach differs from others in the region. The UAE intends to adopt the DCTCE model, while notably, KSA has implemented a clearance model.

Most businesses will eventually need e-invoicing software. Be aware that a solution that works in KSA, Jordan, or Egypt might not be directly transferable to the UAE due to differences in the models and potential government certification requirements for software providers.

e-invoicing rollout

E-invoicing will become mandatory for B2B and B2G transactions. Whether a business faces the mandate starting in June 2026 or later depends on the phased rollout (e.g., by size, industry, or geography). More details will emerge over the next year, particularly after the legislation is released in Q2 2025. Currently, B2C transactions are not part of the e-invoicing plans.

Businesses may encourage their supply chain partners to adopt e-invoicing software, upstream or downstream, for smoother business processes. This means there could be drivers for adoption even before it becomes legally mandated.

Tax and e-invoicing

Tax is crucial due to mandates and penalties regarding:

Correct transaction taxation

Accurate invoice structure

Timely reporting

Businesses need to invest in ensuring correct data and processes, so invoices are automatically generated with accurate information, structure and tax coding. Tax-sensitive master data is vital, including customer information, intercompany details, and the nature of goods/services.

Currently, many businesses currently look to just get the right rate on the invoice and push the tax coding to the end of the month/quarter.

As part of the broader digitalisation drive, the FTA, amongst other, are working towards automated tax returns. A stated aim of e-invoicing will be to give businesses a pre-filled draft return for businesses to review and correct. So, whilst errors can be remedied, it will be more complicated, involving reconciling information with that of the tax authorities. In an e-invoicing regime, the tax authorities will have high volumes of up-to-date information. Retrospective audits may be less common, but with the volumes of data available to tax authorities, a raised risk profile from lots of inconsistencies could yield forensic scrutiny.

Getting ready

Who needs to be in the room?

E-invoicing is a mandate, requiring people to drive the transformation. Experience from other countries shows that this should not be solely IT-led, a common approach when it's viewed as purely a compliance exercise.

Successful e-invoicing implementation involves stakeholders from IT, Data (often separate from IT), Procurement, Finance, and Tax, with business leading it through a steering committee. An e-invoicing solution will likely be needed, requiring involvement from an application solution provider. With potentially numerous stakeholders, a dedicated project manager is strongly recommended.

Preparation is key, even though implementation may seem distant. Consider forming a task force to address critical questions:

Transaction Mapping: Outline all transaction scenarios to understand the full scope of technology, process, and personnel impacts.

Master Data Assessment: Evaluate the state of your master data— it likely resides across multiple systems or spreadsheets and may need cleansing.

- Build, Buy, or Outsource? Weigh the pros and cons of each approach to your e-invoicing software solution.

- Defining Success: Is compliance the sole aim, or are there broader efficiency and optimization goals this transformation can address?

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Related Articles

Technical and Process Challenges in E-invoicing

Basics of E-invoicing – Series 3

Basics of E-invoicing – Series 2

Contributor

Related Posts

Virtual assets have moved from niche innovation to mainstream financial activity across the region. ...

Read More

The Federal Tax Authority (FTA) of the United Arab Emirates released its comprehensive guide on the ...

Read More

Background: Transfer pricing is often described as not an exact science. It involves a high deg...

Read More