LISTEN TO THIS ARTICLE

The facts

The Group set up a company in the Kingdom of Saudi Arabia with a Regional Headquarter (RHQ) License. This RHQ conducts Eligible Activity and applies the 0% Income Tax Rate to income generated by this activity.

The Parent Company operates in the UAE mainland and owns 100% of the RHQ. The RHQ pays dividends to its Parent.

The question

Does the Participation Exemption in the UAE cover these dividends?

The summary

After considering the facts and the analysis below, we opine as follows:

- The Participation Exemption is allowed.

- The risk exists that the FTA will disagree.

- Transferring the shares of the KSA RHQ from the UAE Mainland Parent to a Free Zone Company may rule out the above risk.

The analysis

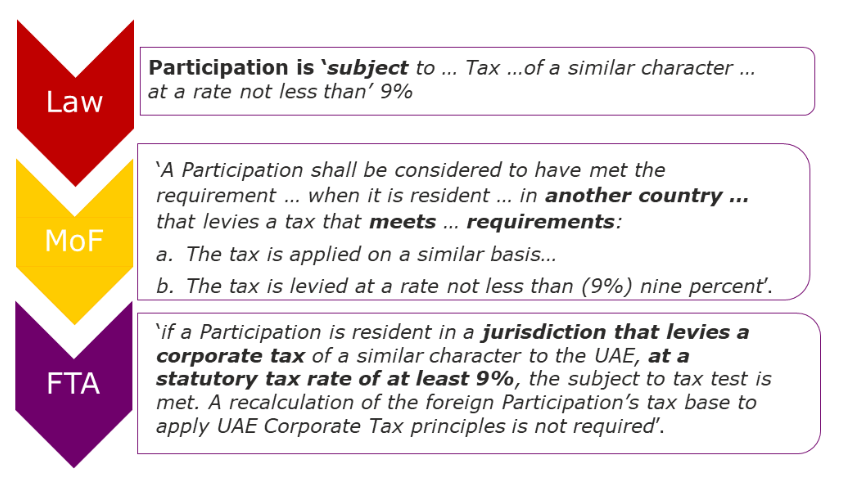

1. Generally, the UAE company that holds the stake in the RHQ in the KSA is entitled to the Participation Exemption. The latter exempts dividends and capital gains, in particular. However, this exemption works only if the Participation is ‘subject to Corporate Tax or any other tax imposed under the applicable legislation of the country … in which the juridical person is resident which is of a similar character to Corporate Tax at a rate not less than’ 9%.

The Standard Income Tax rate in the KSA is 20%. However, Article 3 (A) of the RHQ Tax Rules grants 0% income tax on Eligible Income, i.e. ‘income from the Eligible Activities derived by the Regional Headquarters’. ( зArticle 1(A)(8) of the Tax Rules. ) This incentive is effective ‘for a period of thirty (30) years subject to renewal’.

So, may the UAE parent of RHQ keep the Participation Exemption for distributed income?

2. Clause 1 of Article 6 of the UAE MoF’s Decision No. 116 of 10 May 2023 sets forth that the ‘Subject to 9% Tax Test is met ‘when it is resident … in another country or foreign territory that levies a tax that meets all of the following requirements:

- ‘The tax is applied on a similar basis to Corporate Tax, taking into account the conditions set out in Clauses (2), (3), (4) and (5) of this Article.

- The tax is levied at a rate not less than (9%) nine percent’.

Thus, the Subject to Tax Test is transferred from the requirements for Participation to the requirements for the jurisdiction where the Participation resides.

3. Clause 3(c) of this Article stipulates that ‘targeted incentives or exemptions of a temporary nature’ shall not disqualify foreign tax (from being treated as tax of a different character). This is especially fair for the headquarter income which is also subject to the 0% Corporate Tax rate in the UAE free zones. ( Article 2(1)(i) of Ministerial Decision No. 265. )

The FTA emphasizes this in Section 5.5.1 of the Exempt Income Guide ( Corporate Tax Guide Exempt Income: Dividends and Participation Exemption No. CTGEXI1) : ‘… targeted incentives …, e.g. moving headquarter functions to a foreign country … granted for a certain period’ ‘do not imply that the jurisdiction does not have a similar tax to Corporate Tax’.

Hence, KSA Income Tax remains a tax of a nature similar to that of UAE Corporate Tax.

4. The second part of the test is the rate. The FTA instructs ( Section 5.5.2 of the Exempt Income Guide. ) us that:

- ‘if a Participation is resident in a jurisdiction that levies a corporate tax of a similar character to the UAE, at a statutory tax rate of at least 9%, the subject to tax test is met. A recalculation of the foreign Participation’s tax base to apply UAE Corporate Tax principles is not required’.

- ‘However, if the statutory corporate tax rate in the foreign jurisdiction is below 9%, the subject to tax test can be met if the Participation’s effective tax rate is at least 9%’.

This wording makes an additional shift of the Subject to Tax test from the Participation to the jurisdiction.

You can see how this wording changes on its way from the Decree-Law through the Ministerial Decision to the Guide:

Thus, the statutory rate in the jurisdiction shall be compared with the 9% rate in the UAE.

5. Neither the Law nor bylaws provide for a definition of the term “statutory rate”.

As per the OECD ( Corporate Tax Statistics, Fourth Edition, OECD 2022. )

, ‘statutory CIT rates show the headline tax rate faced by corporations and can be used to compare the standard tax rate on corporations across jurisdictions and over time. As statutory tax rates measure the marginal tax that would be paid on an additional unit of income, in the absence of other provisions in the tax code, they are often used in studies of BEPS to measure the incentive that firms have to shift income between jurisdictions. Standard statutory CIT rates, however, do not give a full picture of the tax rates faced by corporations in a given jurisdiction. The standard CIT rate does not reflect any special regimes or rates targeted to certain industries or income types, nor does it take into account the breadth of the corporate base to which the rate applies. Further information, such as the data on effective corporate tax rates and intellectual property (IP) regimes in the Corporate Tax Statistics database, is needed to form a more complete picture of the tax burden on corporations across jurisdictions’.

The UAE Subject to Tax test has been boiled down from an individual burden of the Participation to the statutory tax rate in the jurisdiction. Hence, a statutory rate in the KSA, deemed as:

- ‘the headline tax rate’,

- ‘the standard tax rate’,

- a rate ‘that measure[s] the marginal tax that would be paid on an additional unit of income, in the absence of other provisions in the tax code’,

- a rate that does ‘not give a full picture of the tax rates faced by corporations in a given jurisdiction’ and

- ‘does not reflect any special regimes or rates targeted to certain industries or income types’.

shall be applied to pass the test. As per the OECD, ( https://stats.oecd.org/Index.aspx?DataSetCode=CTS_CIT ) the Saudi Arabia Statutory Corporate Income Tax Rate is 20%. Hence, the test is passed.

6. This is not certain, however, as the FTA explains that ‘the purpose of the Participation Exemption is to prevent double taxation where a Participation that distributes a profit or whose shares or other ownership interests are being sold may have already been taxed on its profits. Accordingly, and to prevent income from being shifted to foreign jurisdictions to inappropriately benefit from the Participation Exemption, income derived from subsidiaries that are resident in no or low-tax jurisdictions would generally not benefit from the Participation Exemption regime’.

This is said in Section 5.5 of the above Guide prior to the instruction to test the jurisdiction with the statutory rate. The wording accompanied with “generally” and a reference to “no or low-tax jurisdictions” still allows for a denial of a contradiction between this explanation of the purpose of the rule and the content of the rule.

Related articles covering the same subject matter

- Tax Incentives for Regional Headquarters in Saudi Arabia

Saudi Arabia – Tax Measures to Boost Investments and Economy

Establishing a Regional Headquarters in Saudi Arabia

All About KSA’s RHQ Program

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

@@PLUGINFILE@@/RD%20Principles%20in%20Identifying%20Core%20Attributes%20in%20Innovation.mp3&nb...

Read More

@@PLUGINFILE@@/Overview%20of%20the%20Corporate%20Tax%20Returns%20Guide%20No.%20CTGTXR1.mp3 ...

Read More

A company established and residing in the UAE (referred to as UAE Co.) is planning to distribute app...

Read More