LISTEN TO THIS ARTICLE

Leaving a tax group can have unforeseen tax consequences. One such consequence is a de-grouping charge, which can arise when a company transfers an asset within the group and then exits the group within two years. Let's break down what this means for business:

The De-grouping charge: when a charge is triggered, the General Rule

Generally, the event which triggers a degrouping charge is a company ceasing to be a member of a tax group either the transferor or transferee within two years from the date of the transfer.

A degrouping charge will arise only if the asset was within the charge to Corporate Tax on chargeable gains before and after the transfer.

The first main condition for the degrouping charge is that a company (referred to as `company A’) acquires an asset from another company in the same group (company B) and leaves that group within the following two years.

If the condition is met the result is a deemed disposal by the chargeable company as at the time immediately following the intra-group transfer, so reinstating the gain or loss that would have arisen but for the no gain/no loss rule.

Example

In year 1 company X transfers an asset to its subsidiary Y, and 1.5 years later X sells the shares in Y to an unconnected third party. A degrouping charge is triggered and Y is treated as if, immediately after its acquisition of the asset from X, it had sold and immediately reacquired the asset at its market value at that time.

The main conditions for a degrouping charge are satisfied. Y ceases to be a member of a group at a time when it owns an asset acquired from group company X within the previous two years. The charge is computed by reference to a deemed market value disposal of the asset immediately after it was acquired by the company leaving the group (that is, immediately after the acquisition by Y from M). The value to be used is not the market value of the asset at the time the chargeable company leaves the group but the market value at the earlier time when it was acquired by company Y.

The De-grouping charge: when a charge is triggered, Special Rules

Special rule 1: A Subsidiary is merged into the Parent Company

Example:

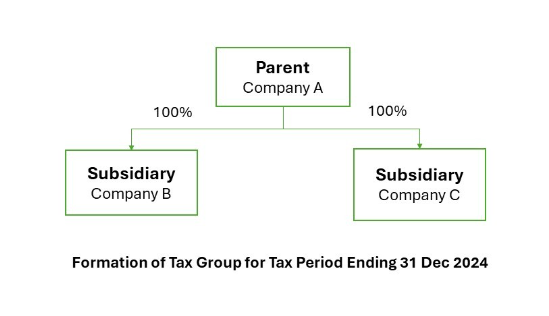

Co. A Co. B and Co C formed a Tax Group during the tax period ending 31 Dec 2024

On 1st March 2024, Co. B transfers an asset to Co. C in Exchange for Cash.

On 1st March 2025, Co. B merges into Co. A and ceases to Exist.

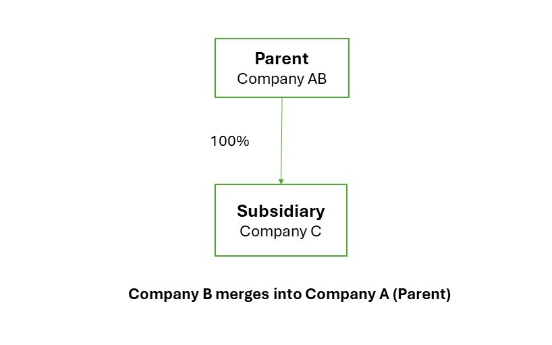

Transfer of assets and liabilities as part of legal merger

The degrouping charge does not apply where a subsidiary is merged into the Parent Company if the conditions of Business Restructuring Relief are met. No Gain/Loss would be taken into consideration.

Transfer of assets and liabilities as part of a legal merger is considered to have transferred within the Tax Group. So, no gain/loss will be recognized when Co. B ceases to exist and leaves the Tax Group.

Transfer of asset by Co. B to Co. C

A degrouping charge will be triggered because Co. B ceases to be part of a Qualifying Group within 2 years of the transfer of the asset. Therefore, the transfer of an asset shall be treated as taking place at its Market Value determined at the time of the asset transfer. The resulting gain or loss from the transfer of asset by Company B to Company C should be taken into account in the hands of Company B (transferor) on the date the transferor (Company B) leaves the Tax Group. However, as Company B ceases to exist, the relevant gain or loss must be taken into account in the hands of the Transferee, being the Tax Group.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

Virtual assets have moved from niche innovation to mainstream financial activity across the region. ...

Read More

The Federal Tax Authority (FTA) of the United Arab Emirates released its comprehensive guide on the ...

Read More

Background: Transfer pricing is often described as not an exact science. It involves a high deg...

Read More