Click here to access the PPT part 1 Click here to access the PPT part 2

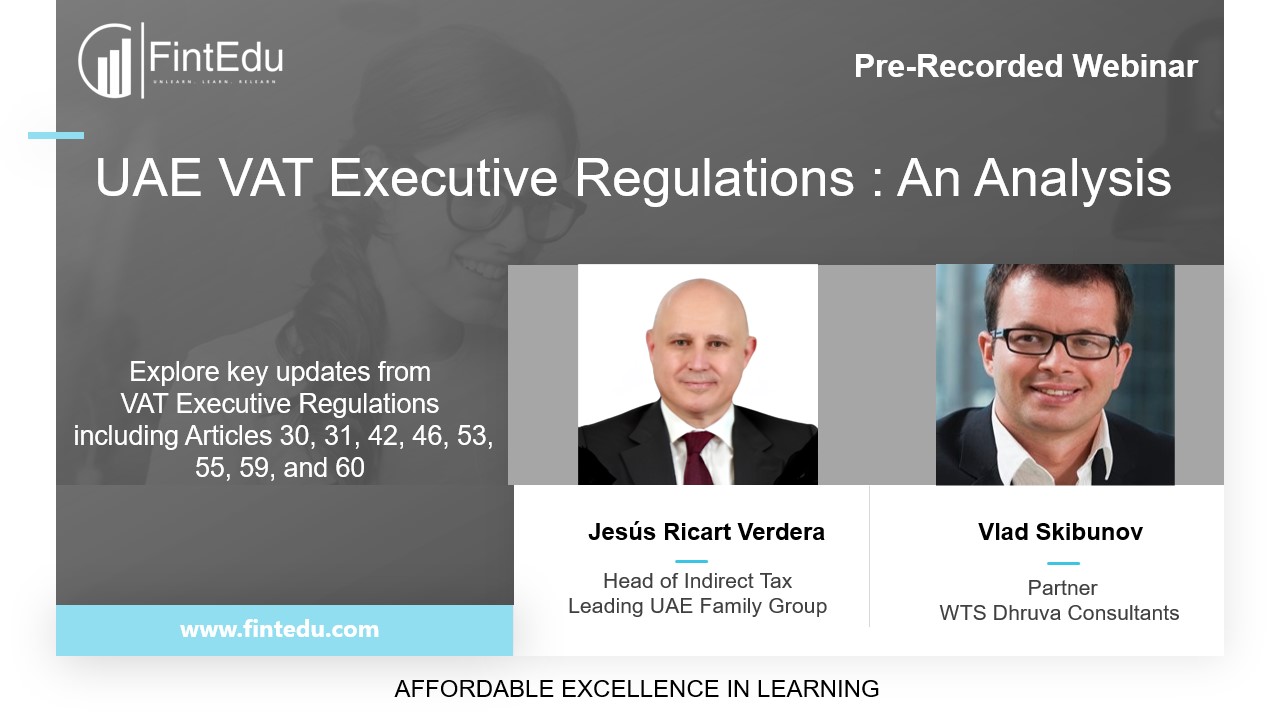

Exploring key updates from VAT Executive Regulations including Articles 30, 31, 42, 46, 53, 55, 59, and 60

Overview

Article 30

Article 31

Article 42

Article 46

Article 53

Article 55

Article 59

Article 60 About the Trainers  Jesús Ricart Verdera

Jesús Ricart Verdera Jesús Ricart Verdera is the Head of Indirect Tax at Leading UAE Family Group with over 29 years of experience in indirect taxes and tax technology. He has led VAT implementation and tax restructuring projects globally. Previously, he worked at Yusuf bin Ahmed Kanoo Group, Deloitte, Ryan, and KPMG. Jesús holds an M.B.A. from Esade and a Bachelor of Laws from the University of Navarra.

Vlad Skibunov

Vlad SkibunovVlad Skibunov is a VAT and indirect taxes specialist with over 17 years of experience in the UAE, UK, and New Zealand. Since 2016, he has advised GCC governments on tax reforms and guided major clients on VAT management and compliance. Previously, he worked with Deloitte and the New Zealand Revenue Department. Vlad holds a Master of Laws from The University of Auckland and is currently a Partner at WTS Dhruva Consultants in Dubai.