Participants will gain a thorough understanding of transfer pricing fundamentals, including key concepts like the arm's length principle, BEPS implications, and value chain analysis. They will learn to apply traditional and transactional pricing methods, draft compliant documentation, and tackle real-life implementation challenges through practical exercises and case studies.

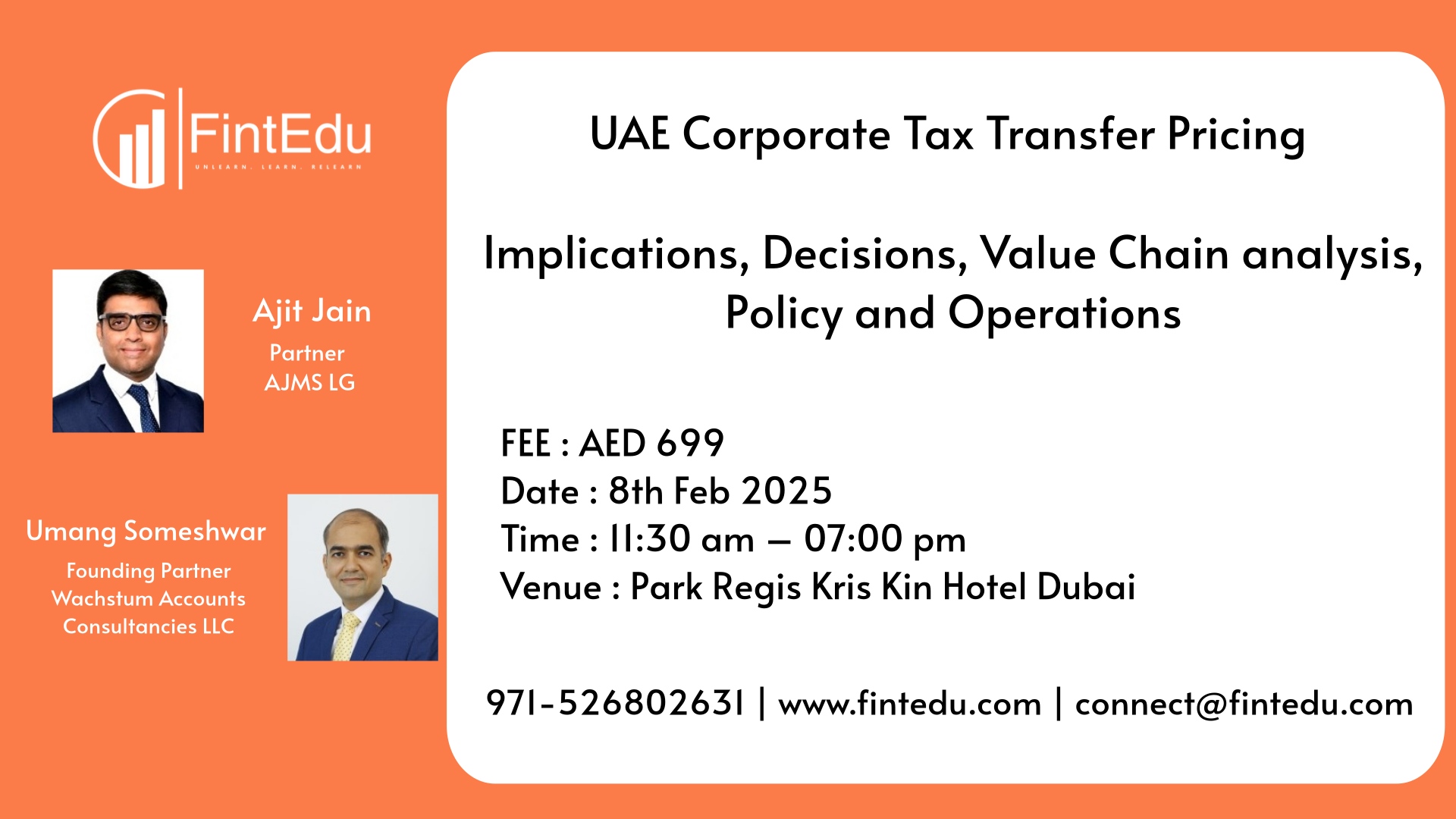

Dates : 8th February 2025, Saturday

Location : Park Regis Kris Kin Hotel, Burjuman , Dubai, UAE

Timings : 11:30 am - 07:00 pm

Register your interest here for a callback

COURSE MODULE

Fundamentals of Transfer Pricing

- Overview of Transfer Pricing: Importance and Global Impact

- Key Concepts: Arm's Length Principle and Profit Allocation

- BEPS Initiative: Impact on Multinational Enterprises

Value Chain Analysis in Transfer Pricing- Introduction to Value Chain Analysis (VCA)

- Primary vs. Support Activities in Value Creation

- Practical Applications: Aligning Transfer Pricing Policies with Value Creation

Transfer Pricing Methods Including Documentation

- Overview of Transfer Pricing Methods : Comparative analysis of traditional methods (CUP, Resale Price, Cost Plus) and transactional methods (TNMM, Profit Split). and other method

- Importance of Documentation: Understanding the necessity of maintaining transfer pricing documentation for compliance and risk management.

- Practical Exercise: Drafting transfer pricing documentation for hypothetical transactions.

Implementation of Transfer Pricing with Practical Cases

- Case Study Analysis: Examining real-life transfer pricing cases to understand implementation challenges and solutions.

- Transfer Pricing Planning: Strategies for effective transfer pricing planning to optimize tax outcomes while ensuring compliance.

- Group Exercise: Analyzing and resolving transfer pricing issues in simulated scenarios.

Learning Outcomes

By the end of the workshop, participants will be able to:

Understand Core Principles: Grasp the fundamentals of transfer pricing, including the arm's length principle, profit allocation, and the impact of the BEPS initiative.

Analyze and Align Value Chains: Apply Value Chain Analysis (VCA) to identify value-creating activities and align transfer pricing policies with actual operations.

Apply Transfer Pricing Methods: Effectively use traditional and transactional methods, such as CUP, Resale Price, TNMM, and Profit Split, in various scenarios.

Develop Documentation and Solutions: Draft robust transfer pricing documentation and address practical challenges through case studies and strategic planning exercises.

ABOUT THE TRAINERS

Ajit Jain

Ajit Jain is a seasoned Transfer Pricing professional with over a decade of experience in Value Chain Analysis and Tax Technology. Holding a Diploma in Tax Technology from CIOT, UK, and recognized with the FIT Fellowship Award in 2015, Ajit has worked at PwC Mumbai, PwC Middle East, and KPMG London. As the Head of Transfer Pricing at AJMS Global, Dubai, he leads the team in building the Transfer Pricing practice in the Middle East Region.

Umang Someshwar

Umang Someshwar

CA Umang Someshwar brings over 15 years of expertise in consulting and accounting, specializing in BEPS, international tax, global transfer pricing, and Indian taxation regulations. As a key leader at "Your CFO," Umang drives growth strategies, leveraging experience in managing Transfer Pricing practices in Saudi Arabia and initiating overseas expansions in Dubai, UAE. An All India Rank Holder in Chartered Accountancy and Company Secretary Examinations, Umang also holds ADIT certification from the Chartered Institute of Taxation, UK.