Participants will gain a comprehensive understanding of financial reporting, including recognition, measurement, presentation, and disclosure under various accounting standards. Address complexities in financial reporting through practical insights and case studies. This workshop will enhance their skills in applying financial reporting principles to ensure accuracy and compliance with global standards.

COURSE MODULES

Analysis of the International Financial Reporting Standards

- Overview of IFRS Framework and Key Principles

- Key Differences Between IFRS and Local Accounting Standards

- Global Trends in IFRS Adoption and Impact on Financial Reporting

Initial Recognition

- Criteria for Recognizing Assets and Liabilities

- Timing and Methodology for Initial Recognition

- Practical Challenges in Initial Recognition of Complex Transactions

Measurement

- Measurement Bases: Historical Cost vs. Fair Value

- Valuation Techniques and Methods for Financial Assets and Liabilities

- Impairment and Revaluation of Assets under Financial Reporting Standards

Complexities

- Dealing with Complex Financial Instruments and Derivatives

- Accounting for Leases and Revenue Recognition Complexities

- Challenges in Multi-currency Transactions and Consolidations

Presentation and Disclosure under Various Accounting Standards

- Financial Statement Structure and Presentation Requirements

- Disclosure Requirements for Financial Instruments and Off-Balance Sheet Items

- Specific Disclosures for Key Areas like Segment Reporting and Related Party Transactions

Participants will gain the ability to apply IFRS principles, recognize assets and liabilities, and address complexities in financial reporting. They will learn measurement techniques for financial assets and liabilities, handle challenges with financial instruments and leases, and ensure compliance with presentation and disclosure requirements. This workshop will enhance their skills in producing accurate, compliant financial statements.

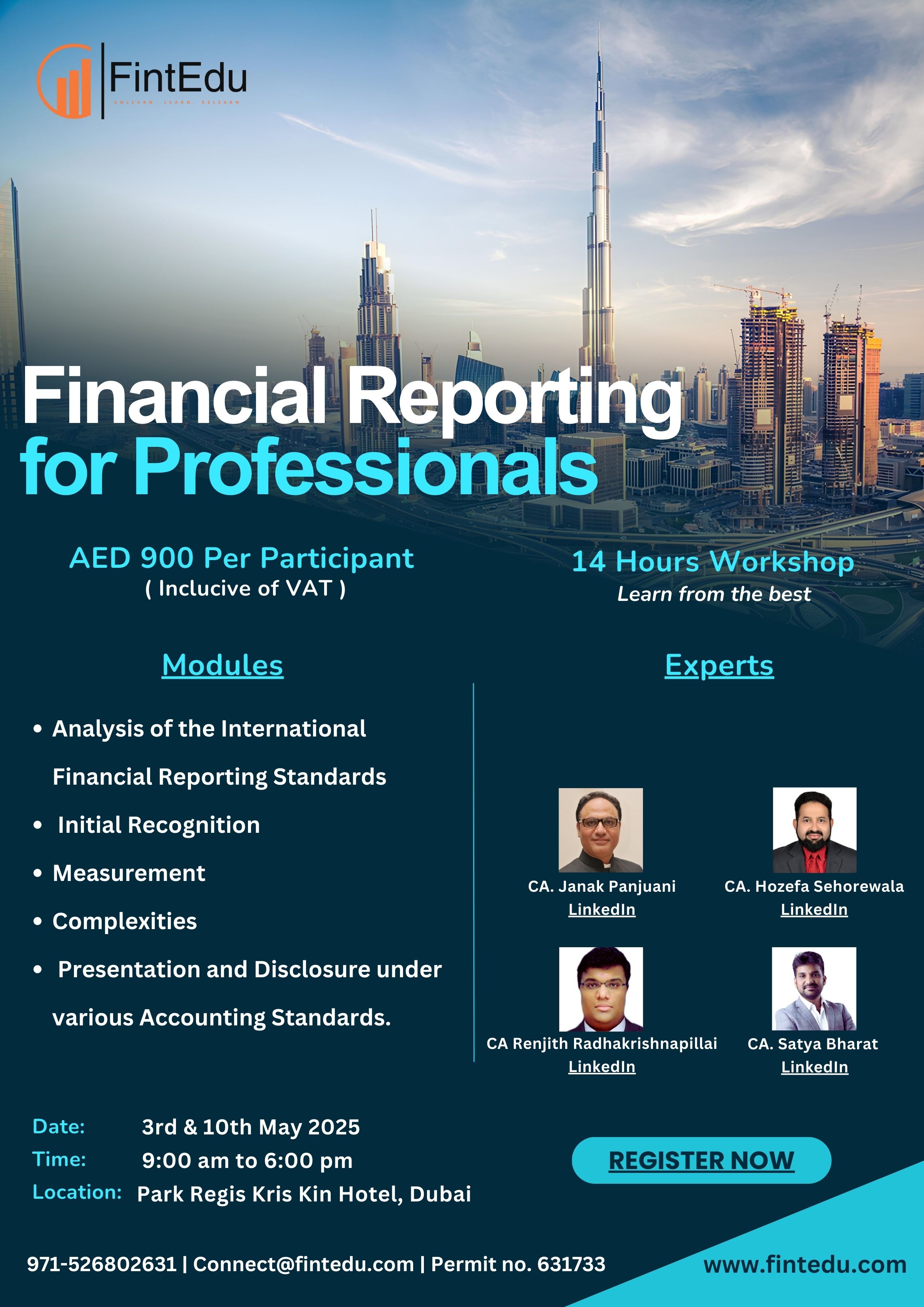

Course Highlights:

- Duration : 14 hours

- Dates : Saturdays - 3rd & 10th May 2025

- Timings : 9 am - 6:00 pm

- Fees : AED 900 per participant

- Venue : Park Regis Kris Kin Hotel, Burjuman , Dubai, UAE

- Format : In-person interactive sessions

- Certification: Participants will receive an Attendance Certificate

Who Should Attend:

- Finance and accounting professionals

- Tax practitioners and consultants

- Business owners and managers

- Legal professionals involved in corporate taxation

Register your interest here for a callback

Course Mentors:

- CA. Janak Panjuani | Director | Puthran Chartered Accountants

- CA. Satya Bharat Damaraju | Founder | DSB Pro

- CA. Hozefa A. Sehorewala |

- CA Renjith Radhakrishnapillai | Financial controller Middle East | Crawford & Company