Participants will gain a comprehensive understanding of UAE Tax and Compliance, focusing on the Executive Regulations and their implications for businesses. This is covered in our weekly webinar, held every Friday.

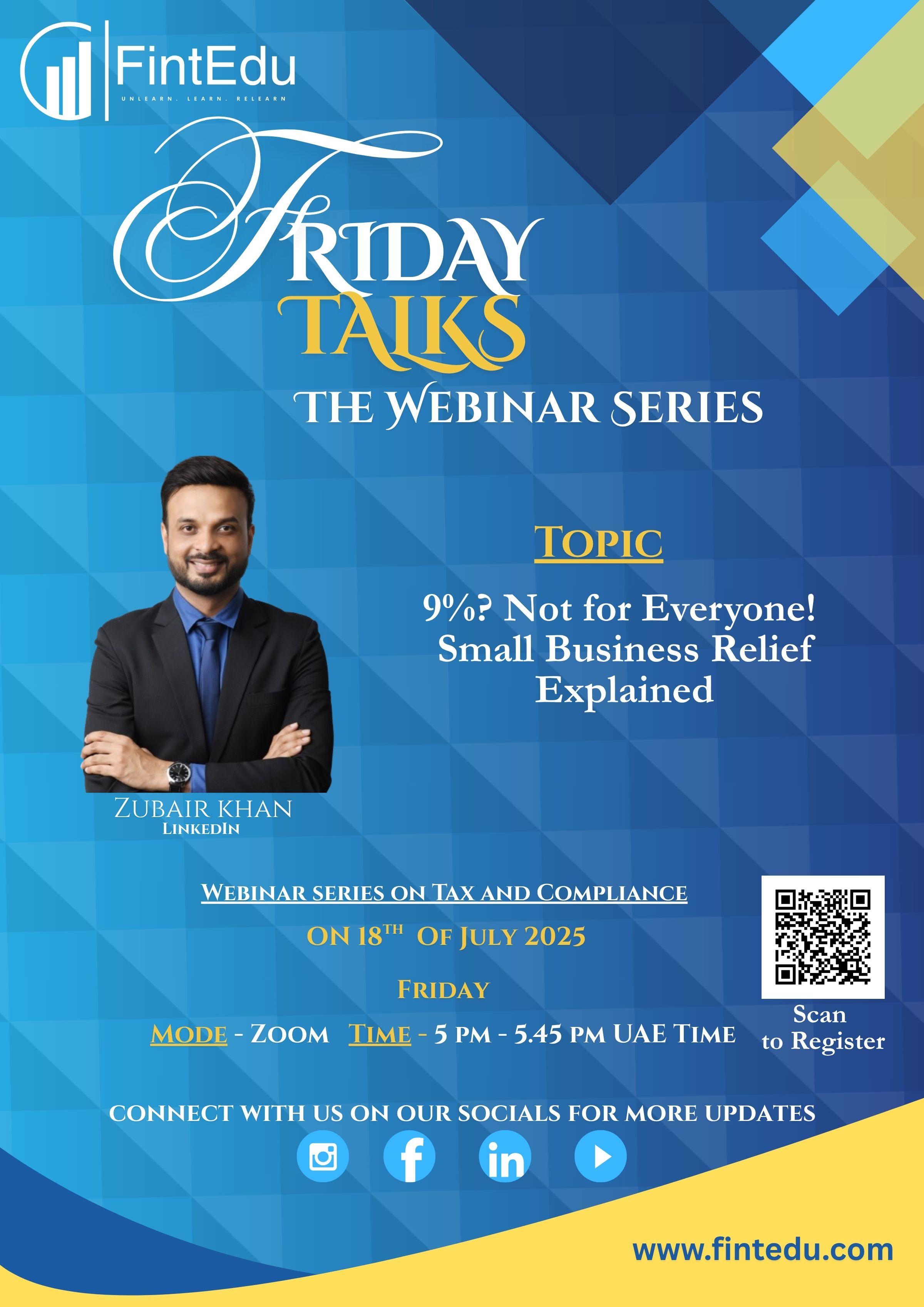

18th of July 2025 | Friday | 05:00 pm - 05:45 pm GST | ZOOM

Topic

9%? Not for Everyone! Small Business Relief Explained

Under the UAE Corporate Tax regime, not every business is subject to the standard 9% tax rate. This session explores the

Small Business Relief provision, designed to support micro and small enterprises. We explain who is eligible, the AED 3 million revenue threshold, key conditions for claiming relief, and important compliance requirements. Whether you're a startup or a growing small business, understanding this relief can help you reduce your tax burden and stay compliant with UAE regulations.

About the Trainer

CA Zubair Khan is a Chartered Accountant and expert corporate trainer in IFRS, UAE Corporate Tax, and VAT with 14+ years of experience. He has trained professionals across top global companies and institutions in the UAE and India.