Participants will gain a comprehensive understanding of UAE Tax and Compliance, focusing on the Executive Regulations and their implications for businesses. This is covered in our weekly webinar, held every Friday.

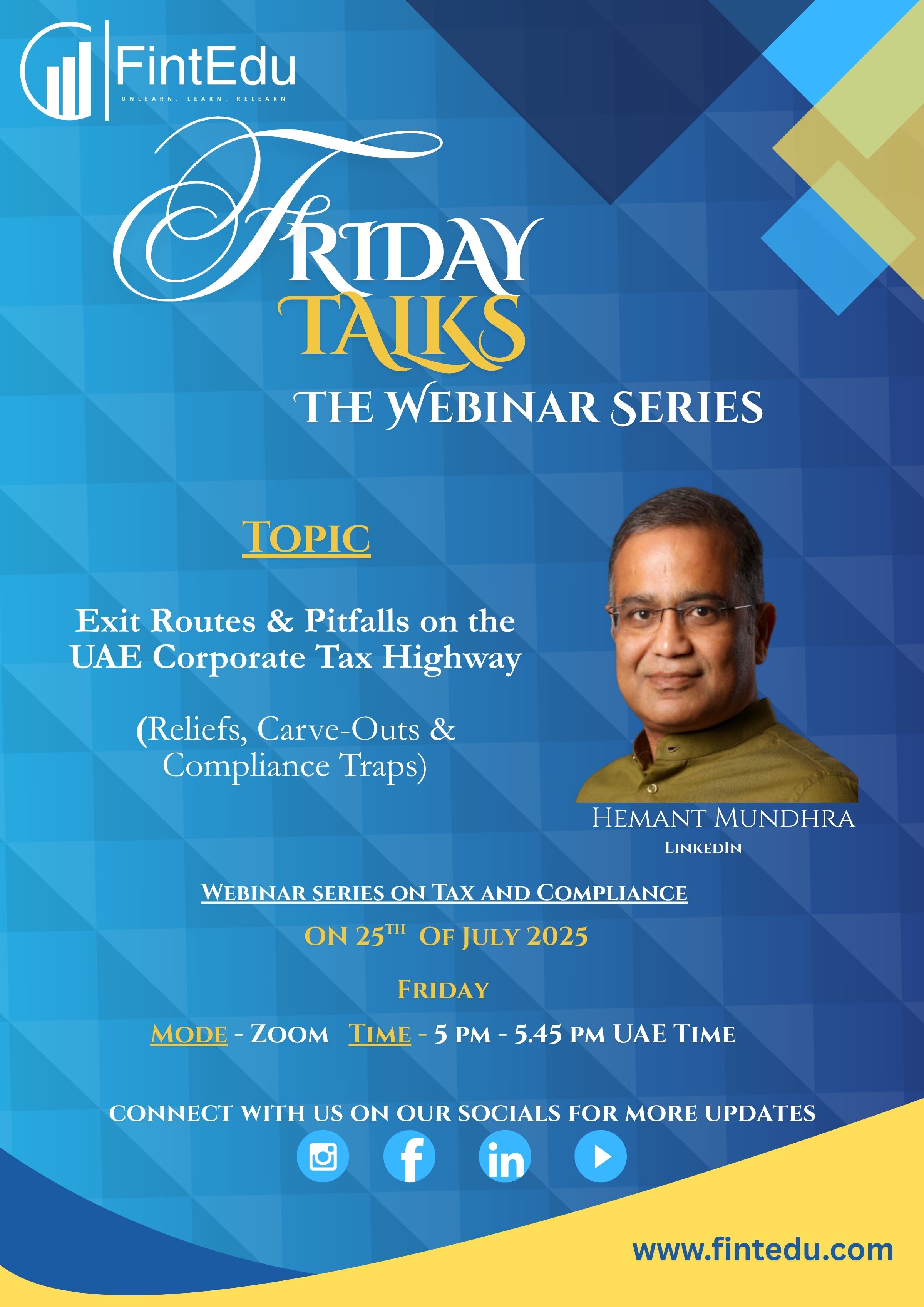

25th of July 2025 | Friday | 05:00 pm - 05:45 pm GST | ZOOM

Topic

Exit Routes & Pitfalls on the UAE Corporate Tax Highway

(Reliefs, Carve-Outs & Compliance Traps)

Session Overview:

As businesses gear up for their first UAE Corporate Tax filings, the real question arises: Are you aware of all the available exit routes—or are you heading straight into a dead end? This session dives deep into the obvious and hidden reliefs, carve-outs, and regulatory nuances that can drastically impact your tax liability and compliance burden. Discover how the right interpretations and timely planning can help you minimize risks and maximize exemptions—legally and strategically.

What You’ll Learn:

• Key Reliefs and Exemptions under UAE Corporate Tax

• Free Zone benefits: Conditions, traps & transition planning

• Understanding Participation Exemption & Restructuring Relief

• Carve-outs for Exempt Persons and Qualifying Activities

• Missteps to avoid: When reliefs turn into liabilities

• Practical case scenarios & interpretation pitfalls

About the Trainer

Hemant Mundhra is a Certified Independent Director and ESG Expert with 30+ years of experience in CFO services, tax advisory, and financial strategy. He is the Founder of The TotalCFO and a Corporate Tax Trainer based in Dubai.