Participants will gain a comprehensive understanding of UAE Tax and Compliance, focusing on the Executive Regulations and their implications for businesses. This is covered in our weekly webinar, held every Friday.

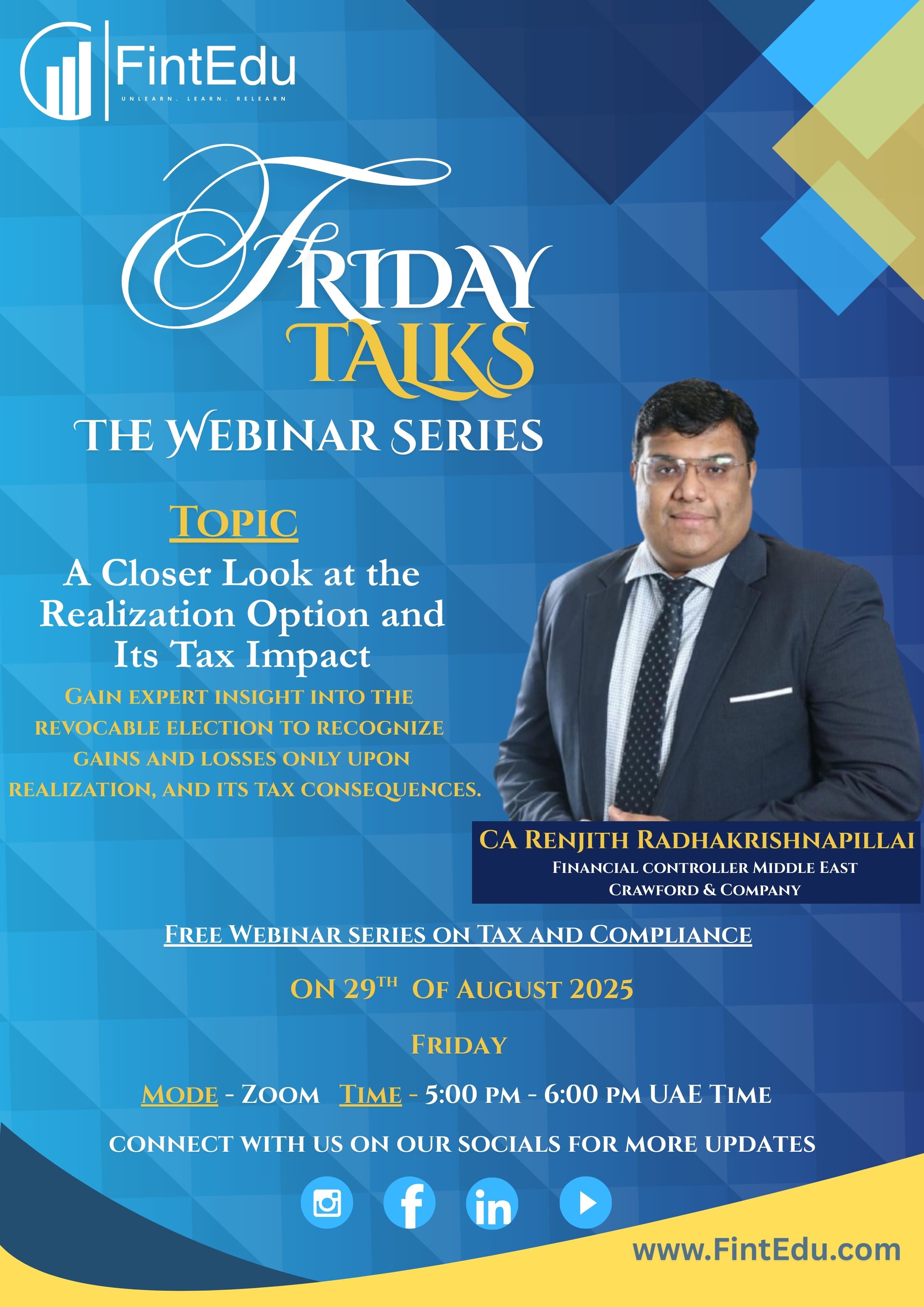

29th of August 2025 | Friday | 05:00 pm - 06:00 pm Dubai | ZOOM

Topic

A Closer Look at the Realization Option and Its Tax Impact, Gain expert insight into the revocable election to recognize gains and losses only upon realization, and its tax consequences.

Session Overview

This session will take a closer look at the Realization Option under the UAE Corporate Tax framework. Participants will gain a clear understanding of what the realization method entails, how it differs from the accrual approach, and the potential tax implications of electing to recognize gains and losses only upon realization. The discussion will also cover the conditions for making this election, its revocable nature, and practical considerations for businesses evaluating whether this option aligns with their tax and financial strategy.

Key Highlights

-

Understanding the Realization Option under UAE Corporate Tax Law

-

Difference between realization vs. accrual basis of recognizing gains/losses

-

Tax consequences of adopting the realization method

-

Conditions and procedures for electing this option

-

Revocability: when and how the election can be changed

-

Strategic considerations for businesses and investors

-

Compliance and record-keeping requirements

About the Trainer

CA Renjith Radhakrishnapillai is a Chartered Accountant with 20+ years of experience. He is expert trainer in UAE Corporate Tax, VAT, IFRS, and compliance. He currently serves as Financial Controller – Middle East at Crawford & Company.