Participants will gain a comprehensive understanding of UAE Tax and Compliance, focusing on the Executive Regulations and their implications for businesses. This is covered in our weekly webinar, held every Friday.

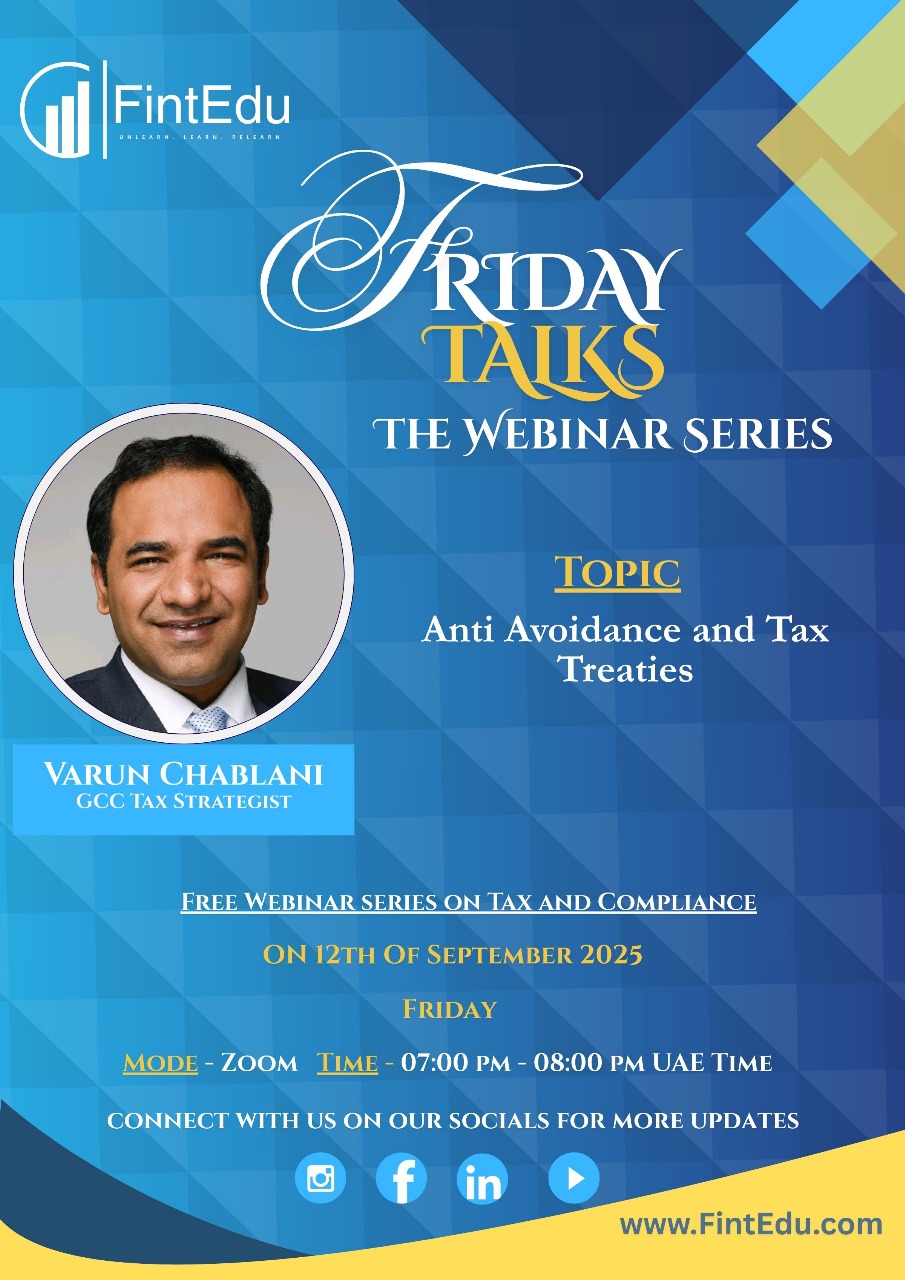

12th of September 2025 | Friday | 07:00 pm - 08:00 pm Dubai | ZOOM

Presentation: Anti Avoidance & Tax Treaties.

Topic

Anti Avoidance and Tax Treaties

Session Overview

In this session, Mr. Varun Chablani will shed light on the critical aspects of Anti-Avoidance Rules and Tax Treaties in the GCC and international context. The discussion will focus on how businesses can ensure compliance while optimizing cross-border tax positions within the framework of global best practices.

Key Highlights

-

Understanding General and Specific Anti-Avoidance Rules (GAAR & SAAR)

-

Role of Tax Treaties in preventing double taxation

-

Common strategies and pitfalls in treaty application

-

Impact of BEPS (Base Erosion and Profit Shifting) on GCC tax frameworks

-

Practical insights and case studies for compliance and planning

About the Trainer

Varun Chablani is a GCC Tax Strategist, specializing in Corporate Tax, International Tax, VAT, Transfer Pricing, and Customs. He holds an LLM in International Tax Law and the ADIT qualification.