Participants in the UAE Value Added Tax course will gain a comprehensive understanding of updated UAE VAT laws and compliance requirements. They will learn about supply rules, designated zones, and customs obligations, as well as practical skills for managing input tax and filing returns. The course also offers insights into VAT implications for various sectors and strategies for optimizing VAT obligations.

Including the latest updates on VAT Executive Regulations from the Federal Tax Authority (FTA).

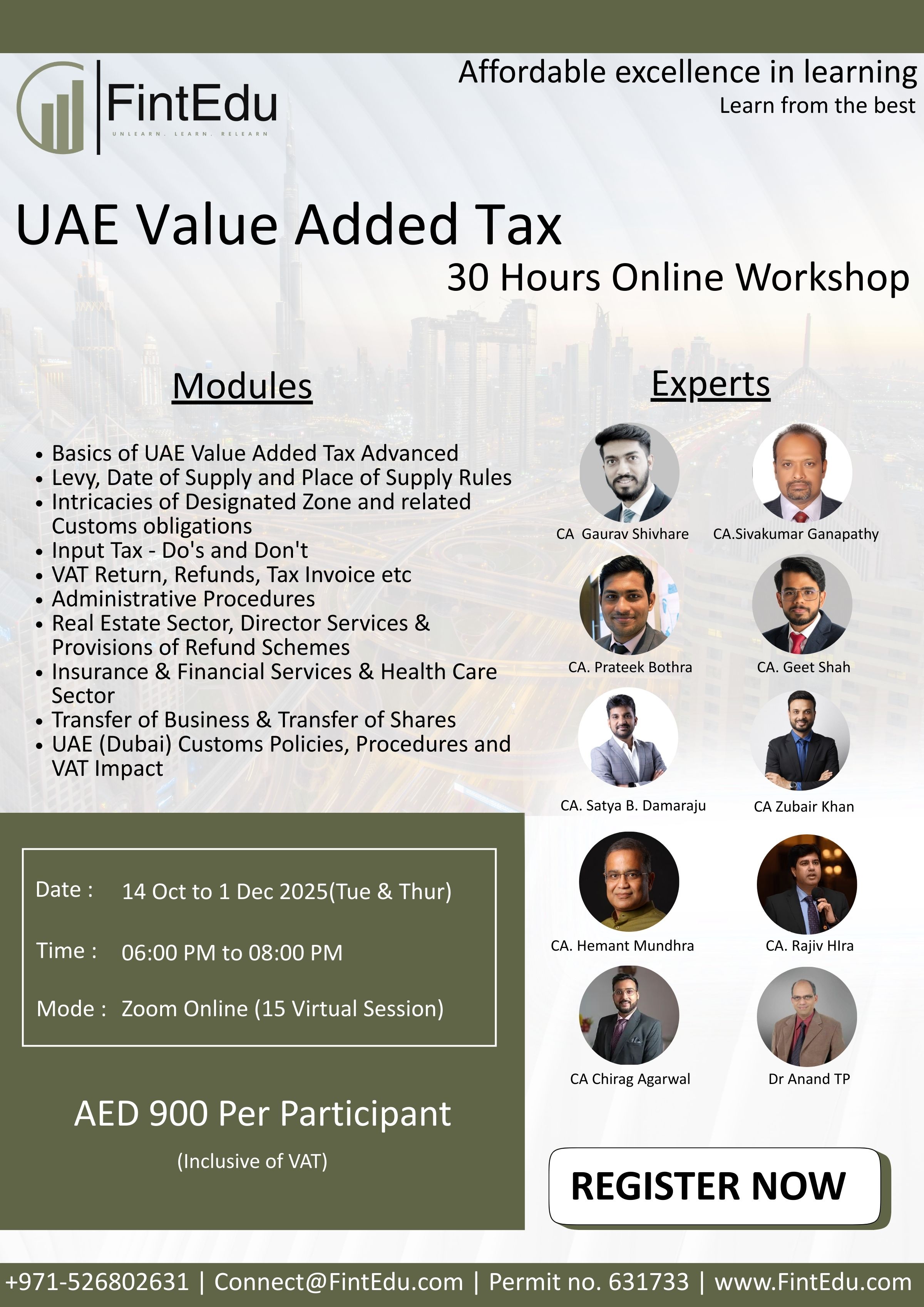

Course Features

- Expert Faculty: Learn from seasoned tax professionals and industry leaders.

- Practical Approach: Hands-on experience with real-world applications and case studies.

- Comprehensive Curriculum: Covers a wide range of topics from basic to advanced VAT principles.

- Sector-Specific Focus: Tailored modules for various sectors like real estate, insurance, and healthcare.

- Interactive Learning: Engaging discussions, polls, and virtual activities to enhance understanding.

- Certification: Certificate awarded upon completion, enhancing professional credentials.

- Networking Opportunities: Connect with peers and industry experts for valuable professional relationships.

Course Outline

Module 1 - Basics of UAE Value Added Tax Advanced

Module 2 - Levy, Date of Supply and Place of Supply Rules

Module 3 - Intricacies of Designated Zone and related Customs obligations

Module 4 - Input Tax - Do's and Don't

Module 5 - VAT Return, Refunds, Tax Invoice etc

Module 6 - Administrative Procedures

Module 7 - Real Estate Sector, Director Services & Provisions of Refund Schemes

Module 8 - Insurance & Financial Services & Health Care Sector

Module 9 - Transfer of Business & Transfer of Shares

Module 10 - UAE (Dubai) Customs Policies, Procedures and VAT Impact

Course Highlights:

- Duration : 30 hours (Tuesday & Thursday)

- Dates : 14 October 2025 to 01 December 2025

- Timings : 06:00 PM - 08:00 PM

- Fees : AED 900 per participant Including VAT

- Mode : Zoom Online 15 Session

- Format : This workshop combines engaging online lectures with interactive sessions via Zoom, offering a dynamic and collaborative virtual learning experience.

- Certification: Participants will receive an Attendance Certificate.

Who is it Designed For?

- Corporate Executives and Managers

- Finance and Accounting Professionals

- Tax Consultants and Advisors

- Business Owners and Entrepreneurs

- Legal Professionals

By the end of the course, participants will be well-equipped to navigate the complexities of UAE VAT confidently and with strategic foresight, making them valuable assets to their organizations in managing tax compliance and planning.

Course Mentors:

- Dr. Anand TP | Deputy Director | S P Jain School of Global Management

- CA. Hemanth Mundhra | Founder | The Total CFO

- CA Zubair Khan | Corporate Trainer

- CA. Rajiv Hira | Managing Partner | RHMC

- CA. Chirag Agarwal | Founder | Earningo Accounting and Tax Consultancy

- CA. Satya Bharat Damaraju | Founder | DSB Pro

- CA. Geet Shah | Associate Partner | WTS Dhruva Consultants

- CA. Prateek Bothra | Vice President Taxation | Gulf Islamic Investments

- CA.Sivakumar Ganapathy | Financial Business Controller | Danzas

- CA Gaurav Shivhare | Director Tax | Dhruva Consultants

By the end of the course, participants will be well-equipped to navigate the complexities of UAE VAT confidently and with strategic foresight, making them valuable assets to their organizations in managing tax compliance and planning.