Combo Offer: UAE VAT & Corporate Taxation Certification Courses

Enhance your expertise in taxation with FintEdu’s exclusive combo package that combines two of our most sought-after certification programs:

-

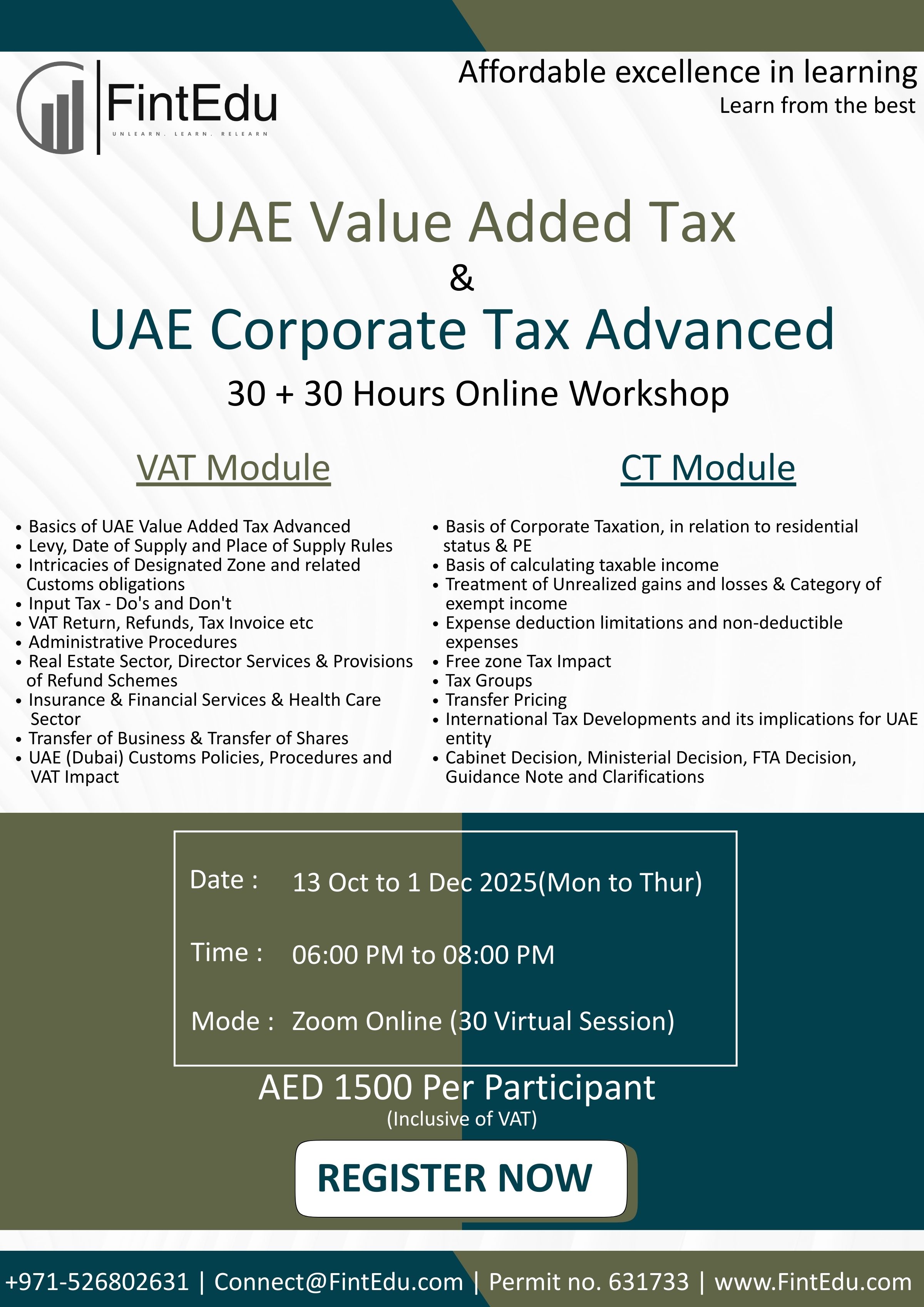

UAE Value Added Tax (VAT) Certification Course

-

UAE Corporate Taxation Certification Course

By enrolling in this combo, participants gain a comprehensive 60-hour learning experience covering both Indirect Tax (VAT) and Direct Tax (Corporate Tax) in the UAE.

Why Choose the Combo?

- Learn from renowned industry experts and corporate trainers.

- Get practical, case-based insights into real-world tax scenarios.

- Build a complete understanding of UAE taxation from VAT compliance to corporate tax strategies.

- Obtain two attendance certificates, enhancing your professional profile.

- Save on fees with our special bundled offer.

Course Features (Combined)

-

Expert Faculty: Delivered by leading tax professionals, consultants, and corporate trainers.

-

Practical Approach: Case studies, real-life examples, and interactive exercises.

-

Comprehensive Curriculum: 20 modules covering VAT & Corporate Tax in depth.

-

Interactive Learning: Engaging online sessions, polls, and discussions.

-

Sector-Specific Focus: Insights into real estate, insurance, healthcare, free zones, and international tax.

-

Networking: Opportunities to connect with peers and industry experts.

-

Extended Access: Access to course materials and recordings (Corporate Tax course includes 3-month access).

-

Certification: Separate Attendance Certificates for both VAT & Corporate Tax courses.

Course Highlights (Combo Package)

-

Total Duration: 60 Hours (30 hours VAT + 30 hours Corporate Tax)

-

Dates: 13 Oct 2025 – 01 December 2025

Time: 06:00 PM – 08:00 PM Monday to Thursday

-

Mode: Online (Zoom)

-

Format: Online lectures + interactive sessions

-

Fees: AED 1,500 (combo price, inclusive of VAT) – save AED 300

-

Certification: Two Attendance Certificates (one for each course)

Who Should Attend?

-

Finance and Accounting Professionals

-

Tax Consultants and Advisors

-

Corporate Executives and Managers

-

Business Owners & Entrepreneurs

-

Legal Professionals dealing with tax matters

Mentors Include:

-

Dr. Anand TP | Deputy Director | S P Jain School of Global Management

-

CA. Hemanth Mundhra | Founder | The Total CFO

-

CA. Zubair Khan | Corporate Trainer

-

CA. Rajiv Hira | Managing Partner | RHMC

-

CA. Chirag Agarwal | Founder | Earningo Accounting and Tax Consultancy

-

CA. Satya Bharat Damaraju | Founder | DSB Pro

-

CA. Geet Shah | Associate Partner | WTS Dhruva Consultants

-

CA. Prateek Bothra | VP Taxation | Gulf Islamic Investments

-

CA. Sivakumar Ganapathy | Financial Business Controller | Danzas

-

CA. Gaurav Shivhare | Director Tax | Dhruva Consultants

-

CA. Janak Panjuani | Director | Puthran Chartered Accountants

-

CA. Umang Someshwar | Partner | YourCFO

-

CA. Aashna Mulgaonkar | Partner | Transprice GDT

Outcome

By the end of this combined learning journey, you will be fully equipped with dual expertise in UAE VAT and Corporate Tax, positioning yourself as a strategic professional capable of managing compliance, optimizing tax structures, and advising organizations on both direct and indirect tax regimes.

Enroll now and take the next step in advancing your career in corporate taxation!