Participants will gain a comprehensive understanding of UAE Tax and Compliance, focusing on the Executive Regulations and their implications for businesses. This is covered in our weekly webinar, held every Friday.

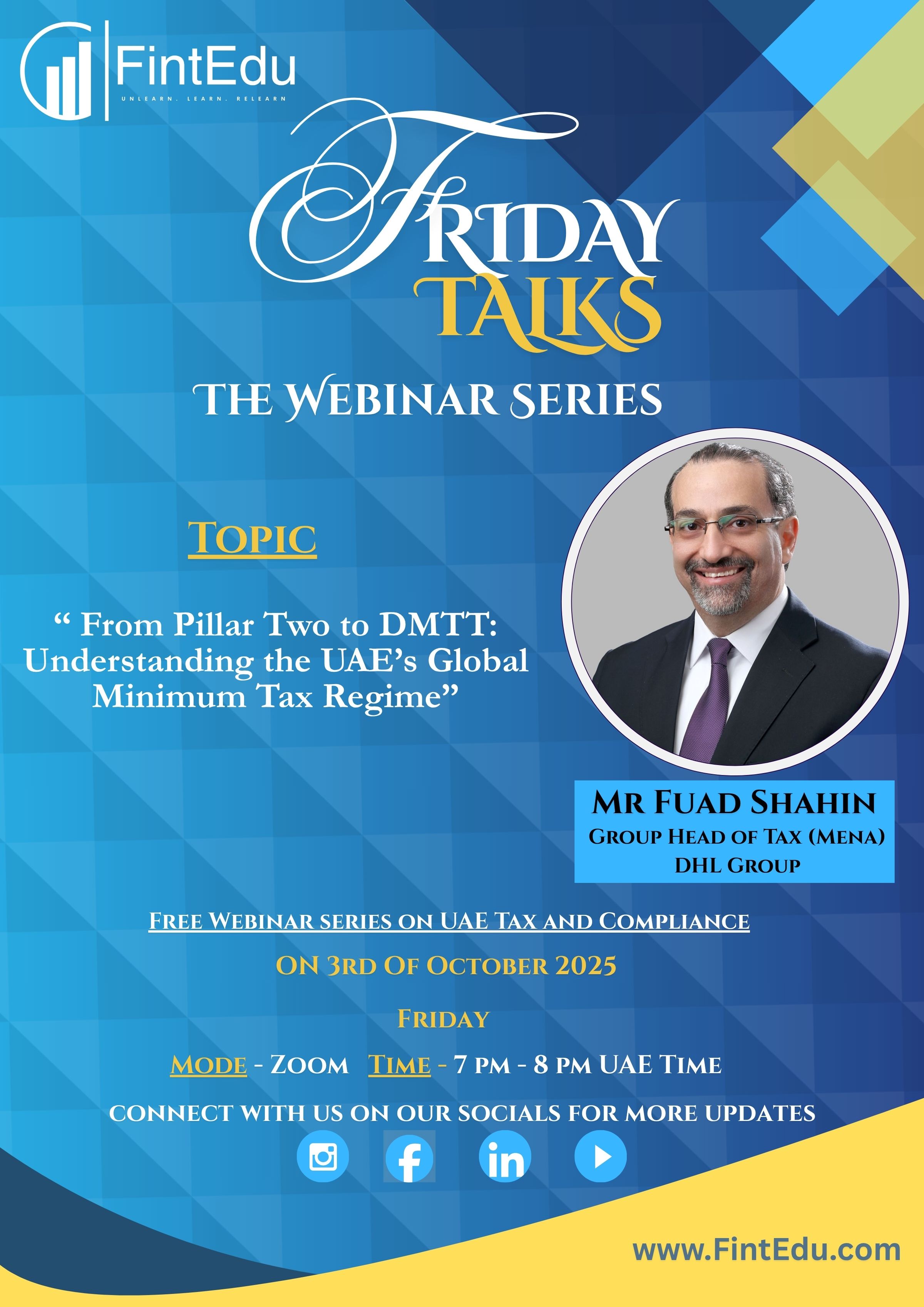

📅 3rd of October 2025 | Friday | 07:00 pm - 08:00 pm Dubai | ZOOM

Topic

“From Pillar Two to DMTT: Understanding the UAE’s Global Minimum Tax Regime”

A deep dive into how the UAE is aligning with the OECD’s global minimum tax framework and what this means for multinational groups operating in the region.

Session Overview

The introduction of the Global Minimum Tax (GMT) under OECD’s Pillar Two marks one of the most significant international tax reforms in decades. The UAE, as part of its commitment to global transparency and fair taxation, has introduced the Domestic Minimum Top-Up Tax (DMTT) to ensure compliance with the 15% minimum effective tax rate for large multinational groups.

This session will demystify the concepts of Pillar Two and DMTT, explaining their mechanics, relevance, and practical implications for UAE-based entities. It will equip finance professionals, tax advisors, and corporate leaders with the knowledge needed to assess their exposure, compliance requirements, and reporting obligations under this new regime.

Key Highlights

-

Understanding Pillar Two: Overview of the OECD’s global tax reform and the 15% minimum tax principle.

-

Introduction to DMTT: How the UAE’s Domestic Minimum Top-Up Tax aligns with Pillar Two requirements.

-

Scope & Applicability: Identifying which groups fall within the global minimum tax threshold.

-

Calculation Mechanics: Understanding effective tax rate (ETR), top-up tax, and key computational steps.

-

Compliance & Reporting: Disclosure obligations, documentation standards, and UAE Ministry of Finance guidelines.

-

Impact on Multinationals: Implications for global groups headquartered or operating in the UAE.

-

Strategic Considerations: How CFOs and tax leaders can prepare, restructure, or optimize to stay compliant.

About the Trainer

Fuad Shahin is a seasoned tax and finance leader with 20+ years of international experience. As Group Head of Tax – MENA at DHL Group, he specializes in corporate tax, VAT, transfer pricing, and Pillar 2 implementation. A CPA, ACCA Fellow, and MBA graduate, he has a strong track record in tax strategy, compliance, and financial leadership across global markets.