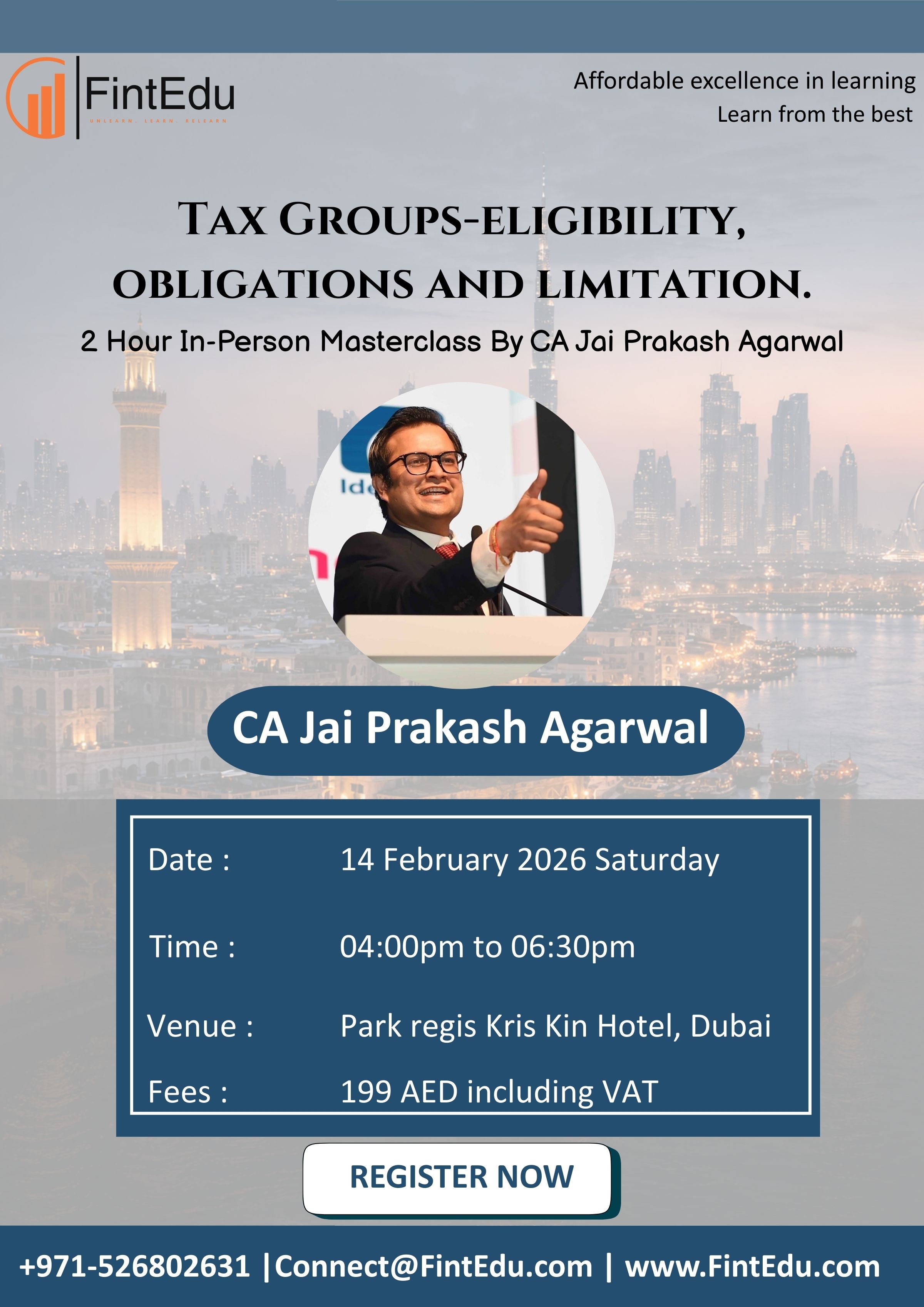

UAE Corporate Tax – Tax Groups

Eligibility, Obligations, and Limitations

2.5 Hours In-Person Masterclass

Gain a practical understanding of UAE Corporate Tax Tax Group provisions, including eligibility criteria, compliance obligations, and key limitations. This focused 2.5-hour live in-person masterclass is designed for tax professionals, finance teams, and business owners seeking clarity on forming and managing Tax Groups under UAE Corporate Tax law.

Course Schedule

📅 Date: 14th February 2026 (Saturday)

⏰ Time: 04:00 PM to 06:30 PM (UAE Time)

📍 Venue: Park Regis Kris Kin Hotel, Burjuman, Dubai

💵 Fees: AED 199 per participant

🤝 Networking Break included

Topics Covered

• Overview of UAE Corporate Tax Groups

• Eligibility Criteria for forming a Tax Group

• Obligations and compliance requirements

• Limitations and restrictions under Tax Grouping

• Impact on tax filing and reporting

• Practical challenges and case-based discussion

Trainer

CA Jai Parkash Agarwal

Why Attend

✔ Understand who can form a UAE Corporate Tax Group

✔ Learn compliance obligations and reporting requirements

✔ Identify limitations and risks under Tax Group provisions

✔ Gain practical insights for real-world application

Contact Us

📞 Phone: +971 52 680 2631

📧 Email: connect@fintedu.com

🌐 Website: www.fintedu.com