The course covers thin capitalization in the UAE, exploring its background, key issues flagged by the OECD, and strategies for global management. Participants will understand UAE's interest limitation approach, deduction limitations, and practical compliance strategies.

Overview

Topic 1: The Story Behind Thin Capitalization and its Adoption in the UAE

- Overview of thin capitalization: Definition and significance

- Historical context: Evolution of thin capitalization rules in the UAE

- Reasons for adopting thin capitalization rules in the UAE tax system

Topic 2: Key Issues in Thin Capitalization Highlighted by the OECD

- OECD's perspective on thin capitalization: Concerns and implications

- Identification of key issues in thin capitalization practices

- Case studies illustrating challenges and consequences

Topic 3: The OECD's Approach to Tackling Thin Capitalization

- Overview of OECD guidelines on thin capitalization

- Best practices recommended by the OECD

- Comparative analysis of OECD approaches with UAE regulations

Topic 4: UAE's Interest Limitation Approach: Understanding Fixed and Group Ratio Rules

- Introduction to UAE's interest limitation rules

- Explanation of fixed ratio and group ratio rules

- Calculation methodologies and practical examples

Topic 5: Understanding Interest Deduction Limitations under UAE CT Law

- Detailed exploration of interest deduction limitations under UAE Corporate Tax (CT) Law

- Exemptions and thresholds

- Implications for multinational corporations operating in the UAE

Topic 6: Key Takeaways on Thin Capitalization Norms in UAE Tax Law

- Recap of thin capitalization norms covered in the course

- Importance of compliance with UAE tax regulations

- Case studies illustrating successful compliance strategies

Topic 7: Thin Capitalization: Practical Considerations

- Implementation challenges faced by businesses

- Strategies for managing thin capitalization risks

- Practical tips for navigating thin capitalization rules in day-to-day operations

This course module will provide participants with the knowledge and tools necessary to understand, navigate, and comply with thin capitalization regulations in the UAE, ensuring effective tax planning and risk management for businesses operating in the region.

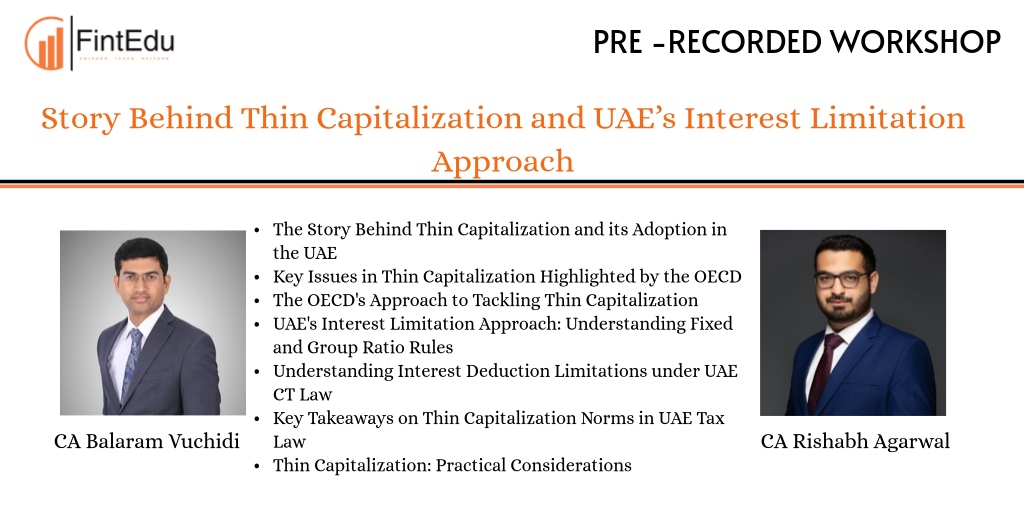

About the Trainers  CA Balaram Vuchidi

CA Balaram Vuchidi

CA Balaram Vuchidi, Founding Partner of Spectrum Auditing and SBC Tax Consulting LLC in the UAE, boasts 20 years of expertise in Audit, Tax, IFRS, and Technology. He leads corporate tax strategies and international tax structuring while overseeing audit, VAT, and IFRS services, drawing from his background in Big4 firms like Deloitte, KPMG, and PwC. A Fellow Chartered Accountant from ICAI, he actively contributes to industry knowledge.

CA Rishabh AgarwalCA Rishabh Agarwal, a Chartered Accountant and partner at SBC Tax Consulting LLC, specializes in Direct Taxes, International Taxation, and Transfer Pricing. With an LL.M in International Taxation from Vienna University of Economics and Business and extensive experience, he is recognized for his expertise and frequently lectures on these topics while providing expert advisory services as a practicing Chartered Accountant.

CA Rishabh AgarwalCA Rishabh Agarwal, a Chartered Accountant and partner at SBC Tax Consulting LLC, specializes in Direct Taxes, International Taxation, and Transfer Pricing. With an LL.M in International Taxation from Vienna University of Economics and Business and extensive experience, he is recognized for his expertise and frequently lectures on these topics while providing expert advisory services as a practicing Chartered Accountant.