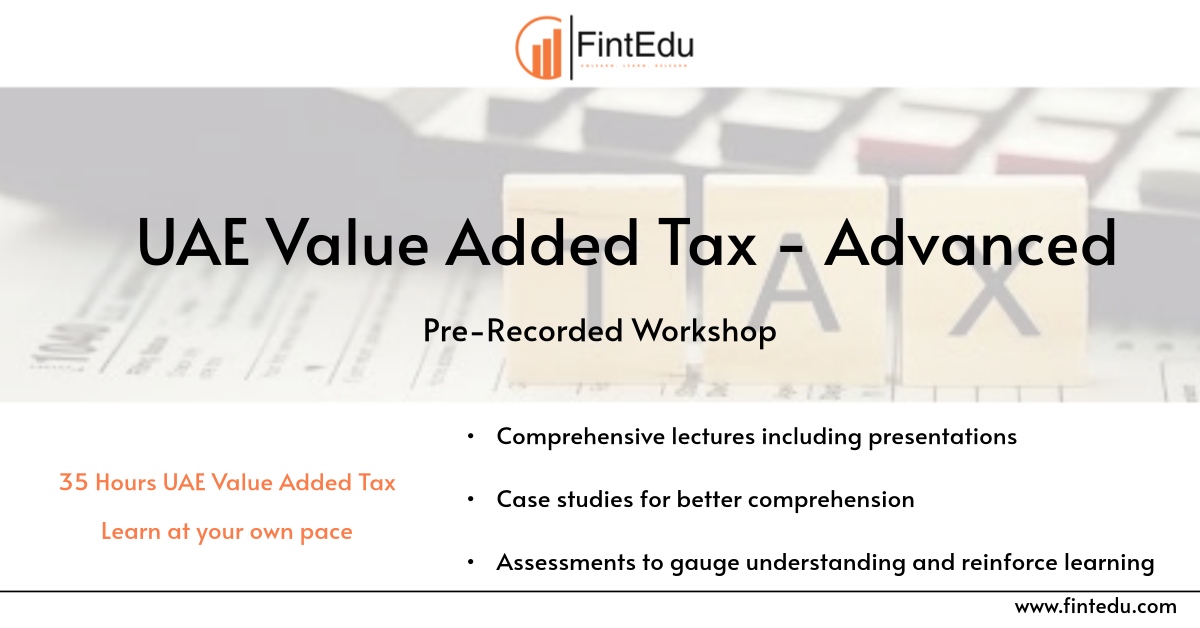

The UAE Value Added Tax Course is designed to provide a detailed understanding of the UAE's Value Added Tax regime, introduced to diversify the economy and align with international standards.

This course offers a thorough examination of the tax framework, ensuring that participants are well-prepared to meet compliance requirements and capitalize on tax planning opportunities. With a focus on practical applications and real-world scenarios, this course is essential for professionals seeking to enhance their tax strategy and compliance capabilities in the UAE.

Register your interest here for a callback.

Course Outline

Module 1 - Basics of UAE Value Added Tax Advanced

Module 2 - Levy, Date of Supply and Place of Supply Rules

Module 3 - Intricacies of Designated Zone and related Customs obligations

Module 4 - Input Tax - Do's and Don't

Module 5 - VAT Return, Refunds, Tax Invoice etc

Module 6 - Administrative Procedures

Module 7 - Real Estate Sector, Director Services & Provisions of Refund Schemes.

Module 8 - Insurance & Financial Services & Health Care Sector.

Module 9 - Transfer of Business & Transfer of Shares

Module 10 - Holding Companies and Funds

Module 11 - UAE (Dubai) Customs Policies, Procedures and VAT Impact

Module 12 - UAE Excise and VAT impact on Retail sector

Module 13 - VAT in Hospitality, Hotel & Food and Beverage Sector

Module 14 - IFRS for SME