LISTEN TO THIS ARTICLE

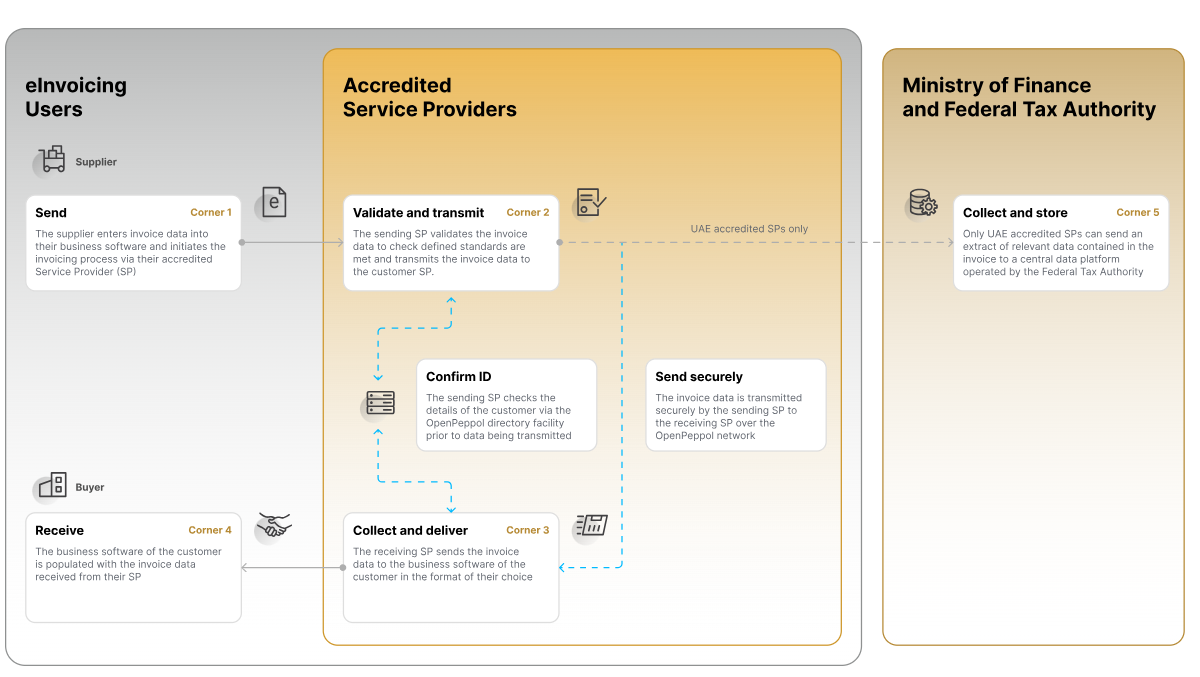

The UAE’s new e-invoicing model, the Decentralized Continuous Transaction Control and Exchange (DCTCE), is designed to streamline and secure the invoicing process between businesses and the Federal Tax Authority (FTA).

Let’s break down the steps of this model -

Step-by-Step Process of UAE’s e-Invoicing Model

Supplier Sends e-Invoice Data to Their Service Provider (Corner 1 → Corner 2)

The process begins with the supplier (referred to as Corner 1) sending their e-invoice data in a specific format to a UAE-accredited Service Provider (Corner 2). This accredited service provider is authorized by the FTA to handle and process e-invoices on behalf of the supplier.Service Provider Validates and Converts the Invoice Data (Corner 2)

The service provider (C2) receives the e-invoice data from the supplier and validates it, checking it meets the FTA’s standards. If the invoice data is in a different format than the UAE’s standard XML format, C2 converts it to the required XML format to ensure compatibility.Service Provider Sends the e-Invoice to Buyer’s Service Provider (Corner 2 → Corner 3)

Once the e-invoice data is validated and in the correct format, C2 sends it to the buyer’s accredited service provider (Corner 3). This service provider acts as a secure channel to facilitate the e-invoice exchange with the buyer.Acknowledgment and Delivery of the e-Invoice to the Buyer (Corner 3 → Corner 4)

The buyer’s service provider (C3) sends an acknowledgment back to the supplier’s service provider (C2), confirming that the e-invoice has been received successfully. C3 then transmits the e-invoice to the buyer (Corner 4), completing the invoice exchange between the supplier and the buyer.Reporting to the Federal Tax Authority (Corner 2 → Corner 5)

Once the invoice has been shared with the buyer, the supplier’s service provider (C2) reports the tax-related information to the FTA’s central data platform (Corner 5). This step ensures that the FTA has up-to-date tax information for compliance and audit purposes.Final Acknowledgments from FTA and Back to Supplier (Corner 5 → Corner 1)

The FTA (Corner 5) sends an acknowledgment back to C2, confirming that the e-invoice data has been successfully reported. C2 then forwards both the FTA acknowledgment and the buyer’s service provider acknowledgment to the supplier (C1), providing confirmation that the invoice has been successfully processed and recorded.

The UAE’s e-invoicing model is built to ensure transparency, security and efficiency. Through this six-step process, e-invoices are validated, securely exchanged and reported to the FTA, helping businesses stay compliant with tax regulations and facilitating seamless invoicing across the UAE.

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice