Listen this Article

Scope: The rules for the Electronic Invoicing System apply to any person conducting business in the UAE for all of their business transactions, unless the person or the specific transaction is excluded as detailed in Article 4 of the Decision.Exclusions: The e-invoicing requirements do not apply to the following transactions:

● Sovereign business activities performed by Government Entities that do not compete with the private sector.

● International passenger and ancillary services provided by airlines when an Electronic Ticket or Miscellaneous Document is issued.

● International air cargo services for which an Airway Bill is issued; this exclusion is temporary and lasts for only 24 months.

● Financial services that are exempt from VAT or zero-rated.

● Any other transaction that the Minister may exclude in the future.

Note: Excluded persons can voluntarily adopt the e-invoicing system. If they do, they must follow all the rules but will be exempt from administrative penalties for violations.

Appointment of Accredited Service Provider

● Both the issuer and the recipient of electronic invoices are required to appoint an Accredited Service Provider

● The Ministry of Finance will publish an official list of these Accredited Service Providers

● If there are any changes to the data registered with the Federal Tax Authority, both the issuer and recipient must notify their service provider in writing within five business days of the authority confirming the amendment.

Procedural Requirements for Electronic Invoices and Credit Notes

● Issuers must send electronic invoices and credit notes, which Recipients must process.

● The general deadline for issuance is 14 days from the transaction date, but VAT registrants must follow the timeline in the VAT Law. ● Both parties must report the electronic documents to the Authority.

● All these obligations must be fulfilled through an Accredited Service Provider.

Invoicing by Agent on behalf of Principal

If an agent is acting on behalf of a principal, the agent is permitted to issue and transmit Electronic Invoices or Electronic Credit Notes on the principal's behalf through the Electronic Invoicing System.

Self Billing

A Recipient is allowed to issue an Electronic Invoice or Credit Note on behalf of the Issuer for a supply of goods or services. This is permitted only under the condition that both the Recipient and the Issuer are registered for VAT, and they must adhere to the conditions laid out in the VAT Executive Regulation or as otherwise specified by the Minister

Access to Records and sharing

The Federal Tax Authority is granted full access to and use of any data within the Electronic Invoicing System. The Authority may also share this data with other domestic Government Entities or foreign government bodies, subject to the conditions of the Tax Procedures Law and for the implementation of the State's obligations under international agreements.

Other Procedural Aspects:

· Data Storage: All electronic invoices, credit notes, and associated data must be stored within the State (UAE) for the duration specified in the Tax Procedures Law.

· System Failure: In case of a system failure, both the Issuer and the Recipient must notify the Federal Tax Authority within two business days of the event occurring.

· Implementation: The electronic invoicing system will be rolled out in phases that will be determined by the Minister.

· Legal Precedence: Any previous legal provisions that are inconsistent with this Decision are now repealed.

· Enforcement: The Decision becomes effective once it is published in the Official Gazette

The Pilot Programme

The Pilot Programme is a program established by the Ministry of Finance and the Federal Tax Authority to test and implement the new Electronic Invoicing System.

Key aspects of the program include:

● It involves a "Taxpayer Working Group," which is a group of people selected to participate in the pilot.

● The Ministry notifies a person of their potential inclusion, but they are only included after providing written agreement to participate.

● Participants in the Taxpayer Working Group must comply with all technical requirements for the e-invoicing system established by the Ministry and the Authority.

● The Pilot Programme is scheduled to begin on July 1, 2026.

Voluntary Implementation

Any person is permitted to implement the Electronic Invoicing System on a voluntary basis starting from July 1, 2026. Should a person choose to do so, they are mandated to comply with all technical requirements for the system's use as established by the Ministry and the Authority.

Mandatory Implementation

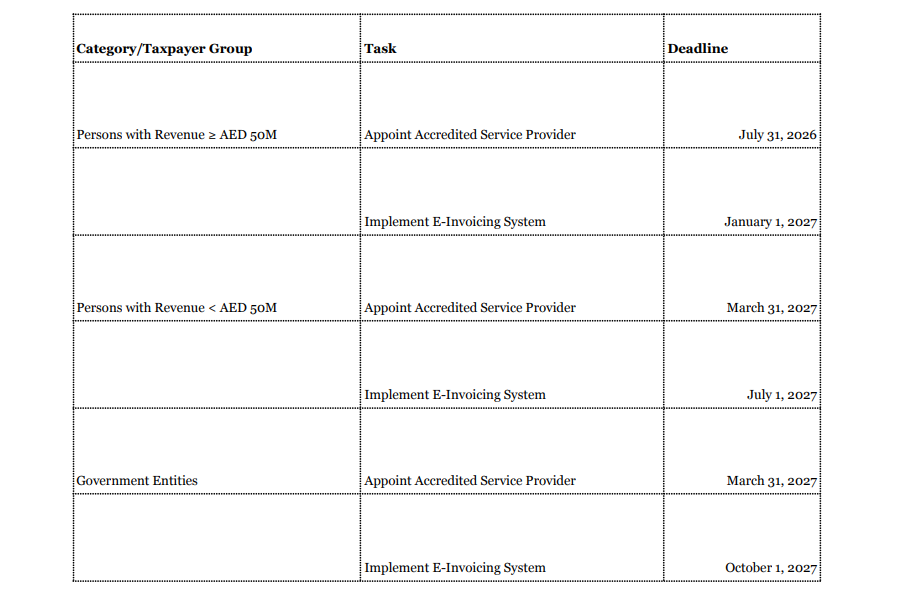

Based on the provided text, the mandatory implementation of the Electronic Invoicing System is outlined as follows:

The system will be implemented in phases determined by the taxpayer's revenue and entity type:

● Phase 1: Persons with revenue equal to or exceeding AED 50,000,000 must appoint an Accredited Service Provider by July 31, 2026, and implement the system by January 1, 2027.

● Phase 2: Persons with revenue less than AED 50,000,000 are required to appoint an Accredited Service Provider by March 31, 2027, and implement the system by July 1, 2027.

● Phase 3: Government Entities must appoint an Accredited Service Provider by March 31, 2027, and implement the system by October 1, 2027.

There are two key provisions to note:

● B2C Exclusion: Business-to-Consumer (B2C) transactions are not subject to the e-invoicing system. Consequently, persons engaged exclusively in such transactions are also not subject to the system until a future date is determined by the Minister.

● Compliance: All entities required to implement the system must comply with the onboarding process and all technical requirements established by the Ministry and the Authority.

Disclaimer

This guide has been prepared by the author for general informational and educational purposes only. The views and opinions expressed herein are personal to the author and do not represent the official position or policy of any firm, company, or organization.

The information provided is not intended to be a substitute for the official text of any federal decree-law, executive regulation, or other ministerial decisions. Readers should always refer to the primary legal sources for definitive guidance. The author makes no representation or warranty regarding the accuracy, completeness, or reliability of the content.

Tax laws and their interpretation by the Federal Tax Authority (FTA) are subject to change and may differ based on specific facts and circumstances. Therefore, the author expressly disclaims all liability for any actions taken or not taken based on the contents of this guide.

This document does not constitute professional tax or legal advice. You must consult with a qualified professional advisor for advice tailored to your specific situation before making any decisions.

Author: Mustafa G Daudi

Disclaimer: Content posted is for informational and knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. The view/interpretation of the publisher is based on the available Law, guidelines and information. Each reader should take due professional care before you act after reading the contents of that article/post. No warranty whatsoever is made that any of the articles are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.

Contributor

Related Posts

The Federal Tax Authority (FTA) of the United Arab Emirates released its comprehensive guide on the ...

Read More

The Fundamental Reform On January 1, 2026, the UAE implemented a comprehensive reform to ...

Read More

The UAE Federal Tax Authority (FTA) has announced a fundamental shift in how it taxes Sweetened Drin...

Read More